S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

18 Jan, 2023

By Muhammad Hammad Asif and Darakhshan Nazir

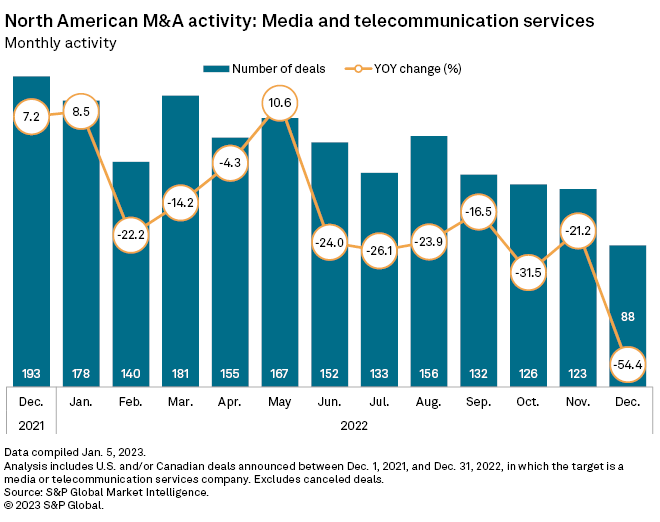

Deal volume among U.S. and Canadian media and telecom companies declined 54.4% year over year in December to reach its lowest monthly total in 2022, according to data compiled by S&P Global Market Intelligence.

There were 88 deals struck in December, compared to 193 transactions during the same month in 2021. Total M&A deal volume was also down on a sequential basis, decreasing by 28.5 % from 123 transactions in November.

|

* Review terms of December's largest U.S. media or telecom deal * Use our Transactions Statistics page to run a custom screen of M&A |

BC Partners Advisors LP's acquisition of a majority stake in Madison Logic Inc. from Clarion Capital Partners LLC for $750 million was the largest transaction for the sector in December. LUMA Partners LLC and William Blair & Co. LLC were financial advisers to BC Partners and Caliron Capital, respectively. The parties did not disclose associated advisory fees.

The second-largest deal in December was Animoca Brands Corp. Ltd.'s acquisition of a majority stake in Pixelynx Inc. for $500 million.

None of the transactions announced in the sector during the last four months of 2022 crossed the $1 billion mark. The rankings for the year's top 10 media and telecom deals by gross transaction value have remained unchanged since September.

Microsoft Corp.'s pending purchase of Activision Blizzard Inc. for $79.59 billion was the largest deal in 2022 for media and telecom companies.