Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

3 Jun, 2021

The District of Columbia claimed Amazon.com Inc. engaged in anticompetitive conduct, but analysts believe courts will require a rigorous standard of proof for the case in the absence of any U.S. precedent on the matter.

In a lawsuit filed May 25 in Washington, D.C., Superior Court, Washington, D.C.'s Attorney General Karl Racine claimed Amazon artificially inflated prices across the entire online retail market by prohibiting merchants that sell on Amazon's site from charging lower prices for the same products elsewhere. The lawsuit seeks to stop Amazon’s use of the price agreements, recover damages and impose penalties to discourage similar conduct by Amazon and other companies.

A container being unloaded in an Amazon seller's warehouse. Net Health Shops LLC |

But experts say the suit is limited in scope because any judgment would apply to the district alone. A lack of successfully litigated cases focused on this issue could also pose an obstacle.

"There isn't a body of litigation that has looked at this in detail, in this setting, in trial proceedings," said former Federal Trade Commission Chair William Kovacic. "Without the benefit of cases that have said 'this practice is anti-competitive,' you have to explore some new terrain. The burden is always on the plaintiff to show anti-competitive effects."

Meanwhile, Amazon will likely bring an expert forward who argues that the company's pricing practices are pro-competitive or have no competitive effect, said Kovacic, who currently serves as a law professor at George Washington University. "Amazon will say 'this hasn't been condemned in the United States before,'" Kovacic said.

In an email statement to S&P Global Market Intelligence June 1, an Amazon spokesperson said sellers set their own prices for the products they offer in its store.

"Amazon takes pride in the fact that we offer low prices across the broadest selection, and like any store, we reserve the right not to highlight offers to customers that are not priced competitively," the spokesperson said. "The relief the AG seeks would force Amazon to feature higher prices to customers, oddly going against core objectives of antitrust law."

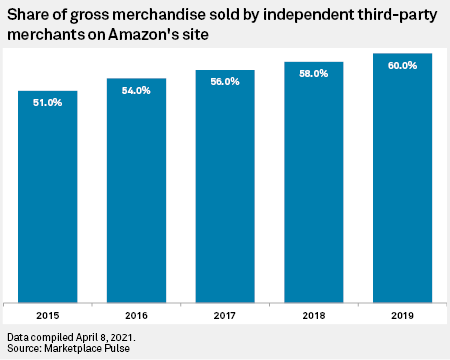

The suit takes on extra significance given that independent third-party merchants account for a majority of physical gross merchandise sales on Amazon's site, at 60% as of 2019, according to data from Marketplace Pulse, a firm that collects data on e-commerce companies, including Amazon.

Many Amazon sellers are increasingly diversifying to online platforms run by Walmart Inc., eBay Inc., Target Corp. and others to reach new consumers in the wake of the pandemic. Despite this, Amazon remains the dominant source for many of these sales.

"The perception is that they have almost zero negotiating leverage" when it comes to price, said Tuna Amobi, media and entertainment analyst with CFRA Research.

The suit rekindles some antitrust concerns with Amazon's price parity provision under its "most favored nation" agreements in which the company previously prohibited sellers from offering products at lower prices on competing platforms, Amobi said.

Amazon replaced the provision in 2019 with a "fair pricing policy," which has the same effect of blocking sellers from offering lower prices to consumers on other retail sites, Amobi said.

"The argument now is that Amazon really didn't follow through with the spirit of [removing the price parity provision] and kept enforcing it indirectly," Amobi said.

Under Amazon's fair pricing policy, third-party sellers can be sanctioned or removed from Amazon if they offer their products for lower prices or under better terms on a competing platform, according to the Washington, D.C., suit.

The lawsuit adds to increasing scrutiny over Amazon's relationship with its third-party sellers, including a probe launched by the FTC in concert with the attorneys general in New York and California.

But the district lawsuit's relatively limited scope, coupled with a high bar to prove fault, means little near-term material risk, Amobi said.

"It just seems to be a high bar to prove that these merchants had actually suffered direct losses," Amobi said. "Amazon has said merchants had the discretion to set their own prices. They are just requiring them to not offer lower prices elsewhere."

Kovacic said the plaintiff can, however, point to substantial academic literature that supports the theory of the district's case along with cases in Europe, where competition authorities in the United Kingdom and Germany launched investigations into whether Amazon’s price parity provision is anti-competitive.

According to the suit, Amazon informed European regulators in 2013 that it would abandon the provision across the European Union, but the provision "remained in place for years longer in the United States and elsewhere."