Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

31 May, 2022

By Ben Dyson, Hailey Ross, and Yuzo Yamaguchi

Insurance companies may struggle to access the information they need to underwrite policies for cars with autonomous driving capabilities.

For vehicles that can drive themselves in specific situations but hand back control to a human driver in others, data will be essential to determine whether the human driver or the vehicle manufacturer was liable for an accident when settling claims.

"Given this dual-mode design and ability to transition driving responsibility, observing and recording the responsible party is critical," Jeremy Carlson, principal analyst and manager at S&P Global Mobility, said via email.

When accidents happen, insurers will need to tap into information held by vehicle manufacturers, which could be an arduous process.

"If the only way to get the data is after it's been squirted back to the motor manufacturer, who then sends it somewhere else to be translated, who then sends it on for a fee sometime in the future, that's going to be a real issue," said David Williams, former managing director of underwriting and technical services at AXA SA's U.K. operations and currently the chair of the Association of British Insurers' Autonomous Driving Insurance Group.

Information war

In some cases, auto manufacturers may be unwilling to send the data at all. Williams said vehicle manufacturers are trying to minimize the data they share because of privacy and cyberrisk worries. But aside from those concerns, manufacturers may also be reluctant to part with vehicle location data because they think they can monetize it, according to Williams.

"That is going to be a lengthy debate, I think," Williams said.

Moreover, vehicles' onboard systems may not record the information insurers need. Automated lane keeping systems, or ALKS, will likely be the U.K.'s first taste of automation in consumer vehicles. Cars with these systems will be able to drive themselves in a single lane on motorways at speeds up to 37 miles per hour.

Under a United Nations regulation, certain data for such vehicles must be recorded in onboard storage systems. But under the current rules, vehicles will only record data for a "detectable collision," which would typically be when an airbag is deployed.

Such accidents only account for roughly one in 10 crashes, according to Matthew Avery, head of insurance research at Thatcham Research, an insurer-funded vehicle safety center. That means data will not be recorded and available for the vast majority of crashes, which presents insurers with a big problem, Avery said in an interview.

Data access will be key to insuring automated vehicles in other markets. The U.S. legal and insurance systems will be able to adapt to automated vehicles provided that they can access information from vehicles to determine how accidents happened, Bob Passmore, department vice-president, personal lines at APCIA, said in an interview. Passmore said there is an existing framework at federal level will allow insurers to access information on event data recorders fitted to current vehicles for claims purposes.

"We think that, expanded and adapted for a vehicle that's more technologically advanced, is the right framework to follow," Passmore said.

Insurers will also need to identify the type of automated or driver assist technology on board a given vehicle, which is not always easy, said Passmore. It was once possible to determine a car's features from the vehicle identification number, but this is not possible with features such as automatic emergency braking or adaptive cruise control.

Insurance companies have time to prepare for the advent of autonomous vehicles as liability may alter the course of driverless car development. Some vehicle manufacturers, including Volvo and Mercedes-Benz, have accepted liability when certain vehicles are in driverless mode, Carlson said. Other automakers may follow suit, which could actually discourage some from developing such Level 3 automation capabilities.

"This is one reason that some automakers are deploying even more advanced automated features, even those that resemble [Level 4] behaviors, while requiring the driver to remain engaged and supervising," Carlson said.

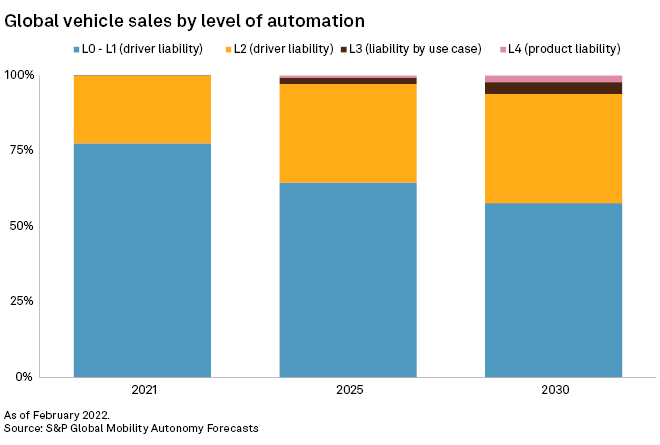

While autonomous vehicles currently make up a negligible percentage of the overall global market, this is set to change over the coming decade. Vehicles with Level 3 automation will make up 4.0% of global car sales by 2030, S&P Global Mobility projects, but accounted for just 0.004% of sales in 2021. Cars with Level 4 automation, which allows them to essentially drive themselves though a human driver can take over, are projected to account for 2.2% of global sales by 2030. No such vehicles were sold in 2021.

Give and take

Despite the challenges ahead, insurers say they are keen for more cars to have automated features as they will reduce accidents and claims.

"Broadly speaking, we're very, very supportive of automated driving technologies," Jonathan Fong, a policy adviser at the Association of British Insurers, said in an interview.

A side effect of lower claims, however, may be reduced prices for coverage and fewer premiums. In Japan, where vehicles with ALKS-like systems are already being sold, insurers have started turning their minds to how they can make up the difference elsewhere in that market. On average, Japanese insurers derive roughly half of their revenue from motor insurance.

"Obviously, the insurance market will shrink following the advancement of self-driving system," said a spokesperson at MS&AD Insurance Group Holdings. "We need to go beyond an insurance to a technology field."

Tokio Marine Holdings Inc. in January took an undisclosed minority stake in U.S. startup May Mobility, which specializes in developing automated vehicle software. A month later, Sompo Holdings Inc. launched an insurance product for companies developing software for commercial automated vehicles. Sompo's first customer is Tier IV, in which it holds an 18% stake. The insurer plans to offer the product to other software firms in the future.