Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

30 Mar, 2021

By Sanne Wass and Rehan Ahmad

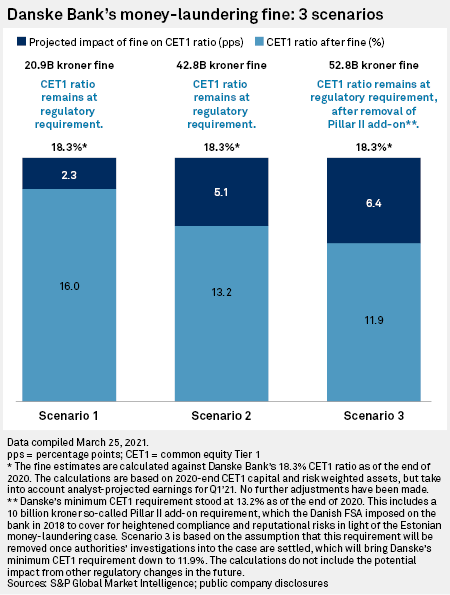

Danske Bank A/S' capital levels and projected first-quarter earnings imply that it could withstand a money-laundering fine of 20.9 billion kroner, or $3.3 billion, today and still achieve its management common equity Tier 1 ratio target of 16%, according to S&P Global Market Intelligence estimates.

Even a penalty of more than double that size would still leave Denmark's largest lender above its current regulatory requirement, the analysis found. "There is a long way to go before the fine becomes an issue for the bank's capital ratio," said Jyske Bank equity analyst Anders Vollesen in an interview.

Danske's material capital buffer is driving down risk associated with the outcome of its Baltic dirty money scandal, according to analysts, with some even seeing scope for distribution of excess capital to shareholders through generous dividends or share buybacks once the case is settled.

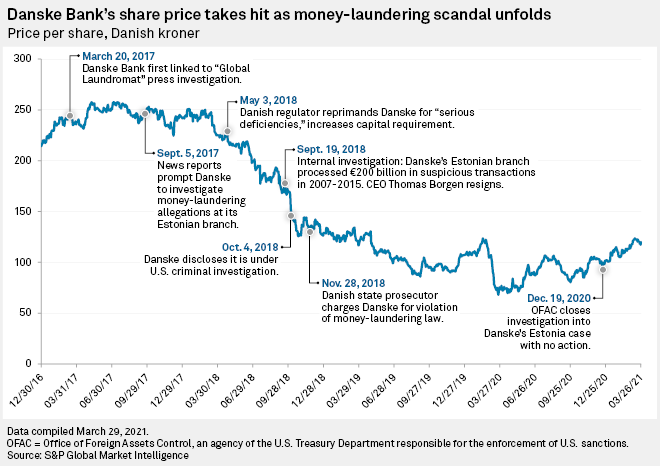

Authorities in Estonia, Denmark, France and the U.S. are investigating the Danish lender for its involvement in a money-laundering scandal in which €200 billion of nonresident money flowed through the bank's Estonian branch from 2007 to 2015, of which a "significant" part was found to be suspicious, according to an internal probe in 2018. Fine estimates made by analysts in recent months range from 4 billion kroner to 20 billion kroner.

A fine could be imminent, with the bank having finalized its second internal investigation and CEO Chris Vogelzang saying Danske is now in "waiting mode."

Fine fear 'disappearing' from market

Assessing how large a penalty Danske Bank will face for its Baltic wrongdoing is to a large degree still speculation, but according to Mads Thinggaard, an equity analyst at ABG Sundal Collier, "the fear of a large fine is slowly disappearing from the market."

Danske's share price dropped from an all-time high of 257 kroner per share in the summer of 2017 to a low of 68 kroner in March 2020, but has rebounded in recent months, partly because of declining risk in relation to the scandal, Thinggaard said in an interview. It closed at 118.75 kroner on March 29.

Thinggaard's fine estimate is on the lower end of the spectrum of analyst forecasts. He foresees that Danske will have to pay just 4 billion kroner, approximately $640 million, in a global settlement, similar to that of Dutch bank ING Groep NV in 2018, where U.S. authorities closed investigations into a money-laundering case without enforcement after the bank paid €775 million to Dutch authorities.

Since the U.S. Office for Foreign Assets Control, a Treasury enforcement agency, in December closed its investigation into potential sanctions breaches by Danske, Thinggaard said U.S. authorities have limited motive to fine the bank in relation to the scandal, given it does not have a U.S. license.

Other analysts see a risk of a larger charge, with Vollesen estimating that fines from various authorities will add up to 10 billion kroner, while Bloomberg Intelligence in a July analysis said Danske could face a $1 billion fine from the U.S., equivalent to 6.3 billion kroner, Børsen reported. Citi's Maria Semikhatova, meanwhile, assumed that Danske will have to pay penalties of up to 20 billion kroner, the newspaper reported.

Danske is well-placed to cope with a fine of any of those sizes were one to be issued today, according to an S&P Global Market Intelligence analysis of Danske's 2020-end capital levels and projected earnings for the first quarter of 2021.

The analysis found that the bank could absorb a fine of at least 20.9 billion kroner before going below its own 16% CET1 ratio target, and could withstand a penalty of up to 42.8 billion kroner, or $6.9 billion, while staying above its current minimum regulatory requirement, as illustrated in scenarios 1 and 2.

Danske's CET1 ratio has, among other things, been boosted by the cancelation of 2019 dividends during the coronavirus pandemic.

S&P Global Market Intelligence arrived at the estimates by adding analyst first-quarter consensus earnings estimates to 2020-end CET1 capital, deducting a range of fine amounts from that figure, and expressing them as a percentage of 2020-end risk-weighted assets. No tax effects have been applied on the assumption that a fine would be recorded as an after-tax special item. The analysis does not take into account retained earnings beyond the first quarter.

Pillar 2 'AML' add-on

Another element that could work in Danske's favor is the fact that its regulatory capital requirement may be lowered once the case is closed. The Danish financial regulator in 2018 imposed a so-called Pillar II add-on requirement of 10 billion kroner on Danske to cover for heightened compliance and reputational risks in light of the scandal, meaning the bank has already set aside that amount to deal with the fallout.

Once the money-laundering investigations are settled, this requirement is likely to be removed, said Vollesen. Pierre-Brice Béguinet-Hellsing, associate director at S&P Global Ratings, thinks this is likely, too.

This essentially means that the first 10 billion kroner hit to its CET1 capital from a fine will be "free of charge" for Danske's capital buffer, and that any fine below this amount will leave the bank "just as well off," Vollesen said.

It leaves Danske with potentially even more capital before driving its CET1 ratio down to the minimum requirement. Assuming the regulator removes the Pillar II AML add-on, which would bring the bank's capital requirement down to 11.9% from 13.2%, Danske could withstand a 52.8 billion kroner fine, or $8.5 billion, before breaching its regulatory minimum, as per scenario 3. That said, a bank whose capital fell to near this minimum would likely be viewed as troubled and compelled by the market to raise extra funds.

Whether the Danish financial regulator will ax the full anti-money-laundering, or AML, add-on requirement immediately after investigations are settled is still uncertain, Thinggaard said. He, for one, expects the supervisor to maintain at least 3 billion kroner of the requirement to cover for reputational risks, which may only be removed further down the line.

Dividends and buybacks

Other moving parts are likely to impact Danske's capital buffer levels in the next few years, including the reintroduction of the countercyclical buffer requirement from 2022 as well as the implementation of Basel IV rules from 2023.

Even so, if the low-end fine estimates hold true, Danske Bank will likely still end up with excess capital above its management target. Thinggaard said that once the money-laundering investigations are settled and Danske has been "politically forgiven" for the scandal, there will be "plenty of room" for capital distributions in the form of share buybacks, and he expects the bank will consider this option.

Vollesen, meanwhile, sees it as more likely that Danske will seek to distribute excess capital through its normal dividend payments in the future by aiming for the upper end of its 40% to 60% payout target.

As of March 29, US$1 was equivalent to 6.31 Danish kroner.

Theme

Products & Offerings

Segment