Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

8 Jun, 2023

By Adrian Jimenea and Mohammad Taqi

|

Danske Bank A/S' new 2026 financial targets are more ambitious than expected, according to analysts.

The Copenhagen-based bank's targets — a return on equity of at least 13%, a common equity Tier 1 ratio of above 16% and a cost-to-income ratio of roughly 45% — were well ahead of what consensus had been looking for, UBS analysts said in a June 7 research note. Danske Bank is also targeting at least 50 billion Danish kroner in total dividends over the next three years, which JPMorgan analysts said was attractive.

Mid-single-digit upgrades are expected for the bank, along with a "favorable" share performance, the JPMorgan analysts said. The shares would "modestly outperform," according to UBS.

The bank's shares jumped following the announcement of the targets and a strategy update, where it will also sell its personal banking business in Norway to focus more on other segments.

"We are changing gears and substantially increasing our strategic and financial ambitions," Danske Bank CEO Carsten Egeriis said in a statement.

Renewed focus

Danske Bank can now fully focus on running its core business following the resolution of US and Danish investigations into its alleged role in a money laundering scandal in Estonia, Maria Parra, vice president at the European financial institutions team at DBRS Morningstar, told S&P Global Market Intelligence.

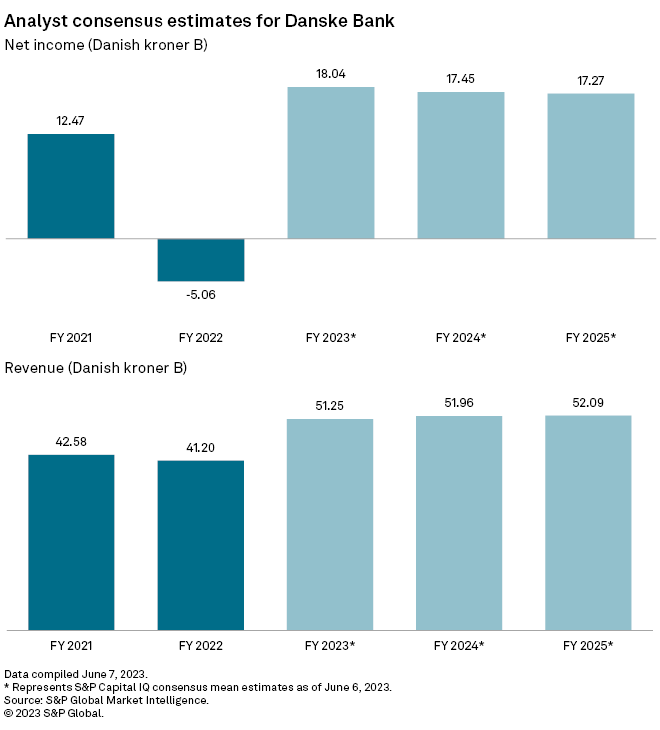

Provisions related to the Estonia matter pushed Danske Bank to a net loss of about 5 billion kroner in 2022. The bank is expected to generate a net income of 18.04 billion kroner in 2023, according to Market Intelligence analyst consensus estimates. By 2025, the bank's net income is projected at around 17.27 billion kroner.

Danske Bank did not respond to a request for comment.

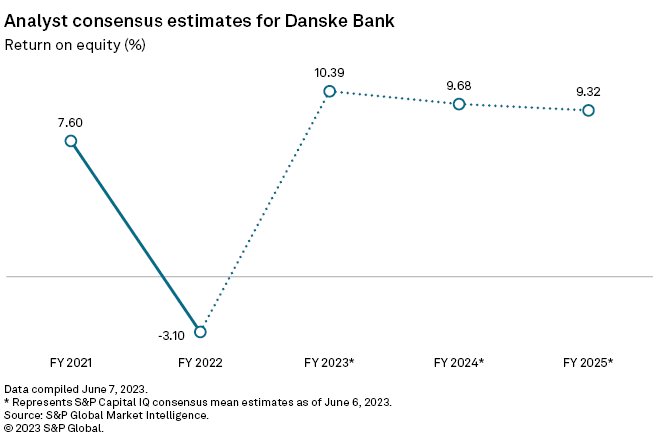

The bank is well-placed to rebuild market confidence following the settlements, Citi analysts said in a note before the announcement of the targets. Citi expected an ROE target of 10% only, a level they said would arguably deserve a stock rerating.

Analyst consensus estimates suggest Danske Bank's ROE will rebound to 10.39% in 2023 from negative 3.10% in 2022 and be 9.32% in 2025.

The bank's assumption on lending growth is achievable if economies begin growing again, according to Parra at DBRS Morningstar. The labor market in Denmark is very strong and is even resilient in Sweden, which has faced economic pressure from commercial real estate, Parra said. Danske Bank expects lending margins to trend higher through 2023 as repricing for business customers gradually kicks in, CEO Egeriis said at an earnings call in April.

Caution

JPMorgan analysts cautioned that revenue targets could be too ambitious considering a potential decline in interest rates and the impact of the Norway business exit. Danske Bank expects revenues of 56 billion kroner in 2026. Analyst consensus estimates suggest revenues will reach 52.90 billion kroner by 2025; data for 2026 was not available.

Yet, Danske Bank has some levers. It is mainly exposed to its home market, where the economy is performing better than expected, according to DBRS Morningstar's Parra. With interest rates returning to normalized levels, and with the Estonian matter closed, the bank's ROE target is achievable, Parra said.

Its cost-to-income target is ambitious but also achievable, Parra said.

As of June 7, US$1 was equivalent to 6.96 Danish kroner.