S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

5 May, 2021

By Hailey Ross and Jason Woleben

Direct premiums for directors and officers insurance grew significantly in 2020 amid a near-historic level of demand as companies continue to face elevated levels of litigation.

"Litigation volumes that companies have faced is really one of the primary factors that's driving that added need for protection," S&P Global Ratings analyst Brian Suozzo said.

Insurers in the last few years have been trying to minimize risk in the business line by raising attachment points, Suozzo said in an interview. S&P Global Ratings analyst John Iten noted that carriers have also offered smaller limits to reduce risks to any one particular policyholder.

"There aren't a lot of new players coming in, so that would tighten up capacity, which would of course make the insurance more expensive," Iten said.

Growth as prices spike

Priya Huskins, senior vice president of management liability at insurance brokerage Woodruff Sawyer, said the D&O market's constrained capacity makes sense given the amount of increased requests for coverage.

There are a limited number of insurers willing to provide D&O insurance for public companies. Huskins pointed out that the same insurance carriers seeking to renew insurance with existing public companies are also being asked to provide insurance for SPAC IPOs, traditional IPOs and all of the private companies that are going public through the De-SPAC process.

"It's no surprise that there's a huge amount of demand for this insurance," Huskins said in an interview. "Given the limited amount of supply, we continue to see very high prices."

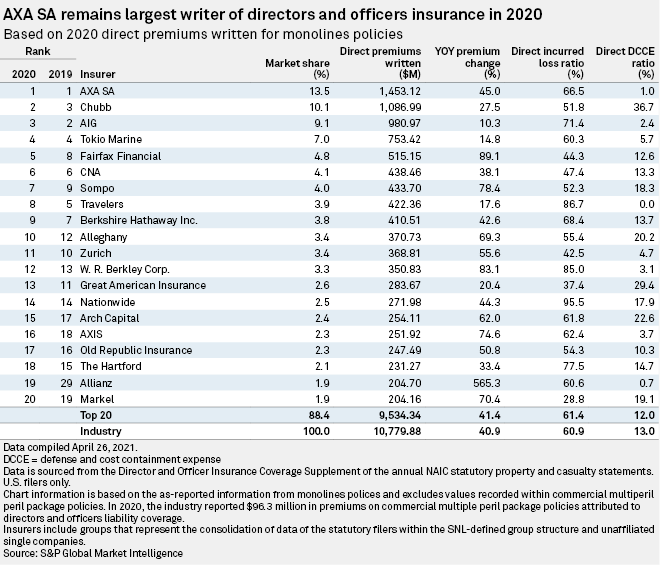

Direct premiums written for the D&O commercial business line increased 40.9% year over year industrywide in 2020, according to data compiled by S&P Global Market Intelligence. Written premiums ticked up by 41.4% among the top 20 writers.

AXA SA, Chubb Ltd. and American International Group Inc. were the top writers of D&O insurance in 2020, controlling 13.5%, 10.1% and 9.1% of the U.S. market, respectively.

Axa saw its written premiums increase 45% over the course 2020, with direct premiums written totaling approximately $1.45 billion.

Allianz SE, which has a very small portion of the U.S. D&O market share, saw its direct written premiums increase 565.3% in 2020, by far the largest increase among the 20 largest carriers. Fairfax Financial Holdings Ltd. controls 4.8% of the overall market share and saw the second-largest increase in written premiums last year at 89.1%.

Stable loss ratio

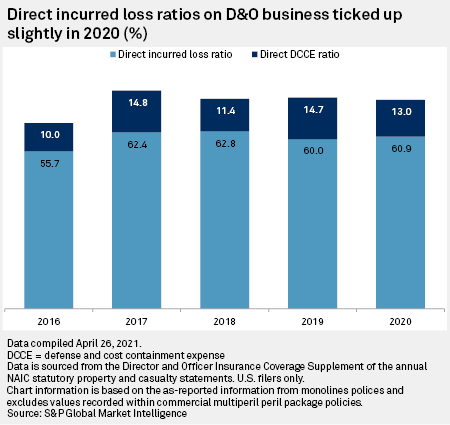

While premiums have grown substantially over the past two years, 19.7% in 2019 and 40.9% in 2020, the industry's direct incurred loss ratio for D&O insurance over the same time period has remained relatively stable.

D&O was a "soft line" for several years, according to Iten, as insurers were not getting as many rate increases. But things picked up as companies started to realize that social inflation was starting to "push loss trend way down to what they were pricing for," Iten said.

The analyst also noted that courts were largely closed in 2020 because of the pandemic, a phenomenon that might have led to a backlog of claims.

"That may be why the loss ratio isn't reflecting what companies are saying about social inflation and the reason for those rate increases," Iten said.

COVID-19 brought a new class of potential claims losses for insurers in the D&O segment, according to a recent report from Fitch Ratings. These include allegations against company leadership for shareholder value declines or insolvencies from the economic fallout, as well as potential claims that may be filed against companies that failed to protect employees and customers from exposure to the virus.

Fitch noted that these types of D&O claims will likely take several years to resolve, and added that the "sharply improving" pricing environment brings potential for a "post-pandemic profit improvement."

Iten expects another "good year for rate increases" for insurers on the commercial casualty side, including D&O insurers, in light of the accelerated pricing momentum through 2020 that has also carried into the first quarter of this year.