S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

5 May, 2022

By Hailey Ross and Jason Woleben

Directors and officers insurance experienced another year of strong growth in 2021, with premiums nearly doubling from what they were in 2019.

The U.S. D&O hard market reached an apex in 2021, said Priya Huskins, senior vice president of management liability for Woodruff Sawyer. Supporting the market was the confluence of some large D&O settlements, a number of unresolved open D&O insurance cases and an overall feeling of uncertainty around late-stage private company litigation, among other things, Huskins said in an interview.

Insurers see relief around IPOs

Direct premiums written for the D&O commercial business line increased 38.5% year over year industrywide in 2021, according to data compiled by S&P Global Market Intelligence.

In the past, litigation against IPO companies was a particularly difficult area for insurers as those entities would tend to get sued more often than mature public companies in both state and federal court, Huskins said. However, a 2020 court ruling in Delaware opened the door for companies to restrict claims being brought against them to federal court alone.

In 2021, other state courts recognized provisions that kicked cases out of state courts, causing the landscape for newly public companies to completely change and "improved dramatically," Huskins said.

Premiums soar

All but two of the largest D&O insurers in the U.S. saw double-digit premium increases for the business line in 2021.

For at least the second year in a row, Axa SA, Chubb Ltd. and American International Group Inc. were the top writers of D&O insurance, controlling 15.3%, 9.1% and 8.1% of the U.S. market in 2021, respectively.

Axa saw its written premiums increase 57.2% over the course of 2021, with direct premiums written totaling approximately $2.28 billion.

Arch Capital Group Ltd., which has a 3.2% share of the U.S. D&O market, saw its direct written premiums grow 87.1% in 2021, the largest increase among the 20 largest carriers. W. R. Berkley Corp. controls 4.0% of the overall market share and saw the second-largest increase in written premiums last year at 70.3%.

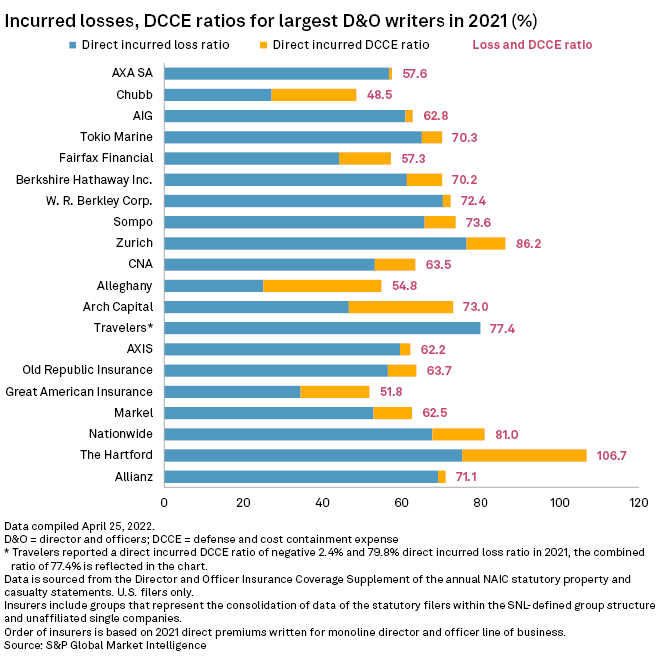

Loss ratios decline

The U.S. D&O market's direct incurred loss ratio fell to 54.6% in 2021, representing a five-year low. The decline can be attributed to the large year-over-year increase in direct premium earned. The industry's direct premiums earned jumped 44% in 2021, rising to $12.72 billion from $8.84 billion in the prior year. Direct incurred losses rose by roughly 30% to $6.94 billion.

Several years of D&O insurance's rapid premium growth led to a "material decline" in 2021's direct loss ratios, Fitch Ratings analyst James Auden wrote in a note.

Although D&O underwriters faced heightened claims from securities class action filings in the years before the pandemic, changes in economic and judicial activity in response to the pandemic resulted in a more than 50% decrease in filings in 2021 from 2019. Class action filings could again increase in the event of future recessions that result in higher corporate insolvencies and defaults or a sharp equity market downturn, Auden said.

Liberty Mutual Insurance Co. confirmed a misstatement in its latest NAIC filing where its paid direct losses were blank and there were no figures for direct defense and cost containment. It has been excluded from the loss and direct defense and cost containment ratio calculations.