S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

6 Jan, 2022

By Beata Fojcik

Czech lenders are optimistic of another strong year in 2022, even as central bank rate hikes put a dampener on the record demand for mortgages seen in 2021.

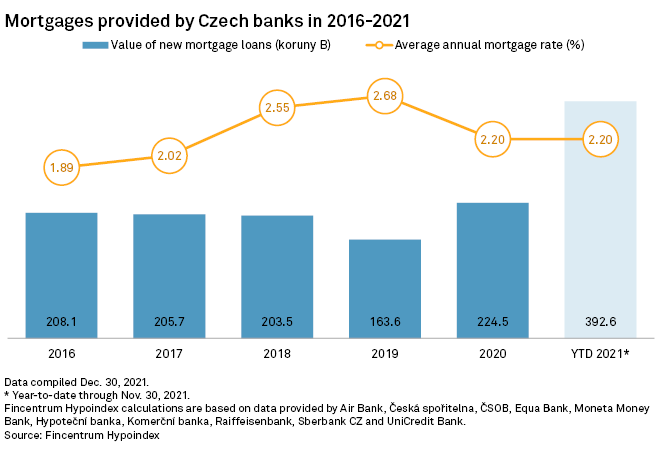

The value of new retail mortgage loans is expected to reach roughly 420 billion koruny in 2021, according to Czech mortgage-tracking website Fincentrum Hypoindex, growing from about 225 billion koruny in 2020 amid low interest rates and an economic recovery following the early period of the COVID-19 pandemic.

"The year 2021 was extraordinary from the point of view of mortgage sales, and banks did not anticipate such a rapid growth rate," Tomáš Pfeiler, portfolio manager at Czech broker Cyrrus, told S&P Global Market Intelligence.

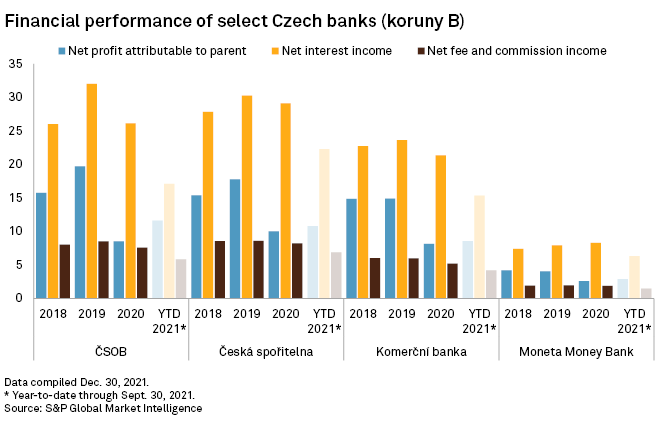

While such strong mortgage growth is not forecast to be repeated, lenders stand to benefit from improved net interest income and reduced provisions as the impact of the pandemic on their loan books lessens, banks and analysts said.

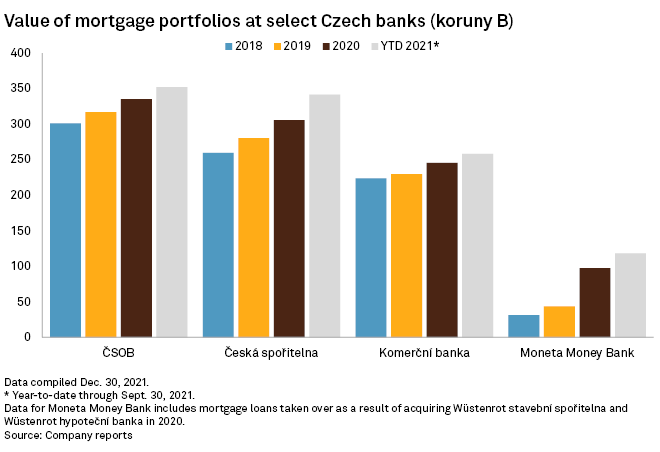

KBC Group NV unit Ceskoslovenská obchodní banka a.s., the Czech Republic's largest bank by assets, recorded a 31% year-over-year increase in the value of newly issued mortgages in the first nine months of 2021, while its total housing loan portfolio increased 5% year over year to 352.1 billion koruny.

The country's second- and third-largest banks, Česká spořitelna a.s. and Komercní banka a.s., also reported strong mortgage sales, which translated to year-over-year growth of 14.3% and 6.8% in their total retail mortgage portfolios, respectively.

Moneta Money Bank a.s., which in 2020 completed the acquisition of mortgage financing units Wüstenrot stavební spořitelna and Wüstenrot hypoteční banka, recorded a 132.7% year-over-year increase in issuance, which drove its total mortgage portfolio up 30.7% during the first nine months of 2021 to 118.1 billion koruny. Moneta is set to further increase its presence in the Czech market after shareholders recently approved its planned merger with Air Bank a.s.

Yet the Czech mortgage segment could slow by 30% to 40% in 2022, according to Pfeiler, as the impact of several central bank rate raises in 2021 begins to be felt. Rates have crept up since June and were hiked by 125 basis points in November and 100 basis points in December. The regulator has not ruled out further increases in 2022 if inflationary pressure persists.

The central bank has also tightened mortgage requirements for retail borrowers from April 2022 in order to address the easing of credit standards by local banks and what it described as overvalued apartment prices in the Czech Republic. The new borrowing rules are expected to affect roughly 10% of mortgage applicants and, combined with the central bank rate rises, will result in a significant drop in the mortgage segment, said the Czech Banking Association's chief economist, Jakub Seidler.

The impact of the rate hikes will take some time to filter through. Czech banks offered 37.2 billion koruny worth of retail mortgage loans in November 2021 alone, an increase of 5 billion koruny from October according to Fincentrum Hypoindex. While the average mortgage interest rate was 2.7% in November, banks have already been applying rates of 4% and more to new applications. "In the second half of November there was already a certain slowdown in mortgages but on a full-year basis it will be negligible," Pfeiler noted.

While the issuance of new mortgages is set to fall in 2022, Czech lenders will reap the benefits of rising interest rates in other areas, the Czech Banking Association's Seidler said. "Due to the high value of reserves held by the domestic banking sector at the Czech central bank, the interest income of local lenders is expected to increase significantly next year," he noted.

Pfeiler also believes that the rate hikes will help banks offset the worsened mortgage output. "In general, domestic financial institutions are raising their net profit guidance and next year is expected to be successful in terms of profitability. A positive impetus to banks' income will also come from the further easing of provisions in connection with the post-pandemic recovery," Pfeiler said.

The potential increase in banks' interest margins could make up for any negative impact from central bank rate hikes, a Moneta Money Bank spokesperson said. Komerční banka, which is owned by France-based Société Générale SA, told Market Intelligence it expects a recovery in consumer loans and investment project financing, which means that overall credit growth could be similar to 2021.

As of Jan. 5, US$1 was equivalent to 21.72 Czech koruny.