Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Oct, 2022

By Joseph Williams and Darakhshan Nazir

Cybersecurity M&A activity took a dive in the third quarter, dropping even more steeply than the broader technology sector.

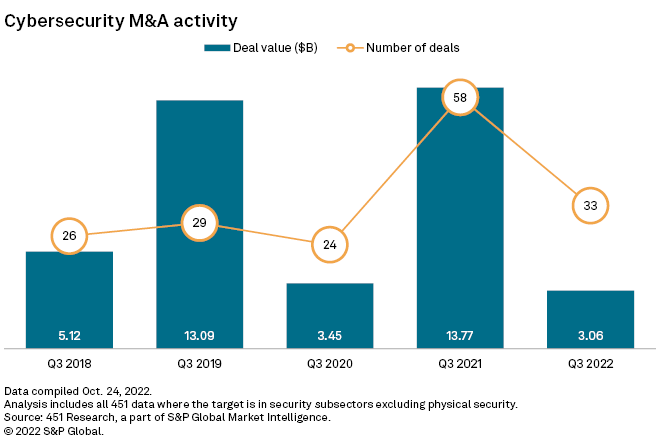

Global cybersecurity transaction volume dropped to 33 deals between July 1 and Sept. 30, compared to 45 deals in the second quarter and 58 in the third quarter of 2021, according to data from 451 Research.

Aggregate deal values in the third quarter totaled just $3.06 billion for transactions with disclosed terms, down more than 75% from the $12.94 billion reported in the prior quarter and the $13.77 billion in the year-ago period. Comparatively, the broader technology M&A market saw spending drop about 63% to $80.61 billion in the third quarter from $215.96 billion in the second quarter.

Cybersecurity had been a relatively stable dealmaking environment prior to the third quarter, and the sector seemed to be bouncing back as the third quarter drew to a close.

The first three weeks of the fourth quarter saw more money move through the sector than the entire third quarter. Between Oct. 1 and Oct. 24, cybersecurity acquirers disclosed an aggregate $6.90 billion in deal values from nine announced transactions.

One deal announced in October had its origins in a September offer. Vista Equity Partners Management LLC's $4.59 billion agreement to acquire KnowBe4 Inc. was presaged with a "highly unusual" September offer on nonbinding terms. Then, Vista Equity Partners made an official and binding offer in early October, according to 451.

The largest transaction announcement of the third quarter was Thoma Bravo LP's $3.01 billion bid for Ping Identity Holding Corp., which closed on Oct. 18. In general, private equity activity in the sector has been largely responsible for the sustained momentum despite the broader economic downturn. For the first three quarters of 2022, private equity investors accounted for eight of the 10 largest transactions in the sector, according to 451.

Private equity also helped keep valuations aloft as other sectors began seeing more discounted M&A announcements.

For example, Thoma Bravo valued Ping at 9.1x its trailing-12-month revenue on an enterprise-value basis. Vista Equity Partners is putting a 14.9x multiple on KnowBe4, according to 451. Thoma Bravo has been the second most active acquirer in the sector since 2021, with four transactions totaling about $21 billion, 451 said.

* See S&P Global Market Intelligence's analysis of second-quarter cybersecurity M&A trends.

* Use our Transactions Statistics page to run a custom screen of M&A by industry or geography.

In the third quarter, acquirers put the enterprise value of cybersecurity targets at 9.1x their trailing-12-month revenue on average. That is down slightly from a year prior when sector targets were valued at 9.3x on average, but it is still well above the third-quarter technology industry average of just 2.5x.

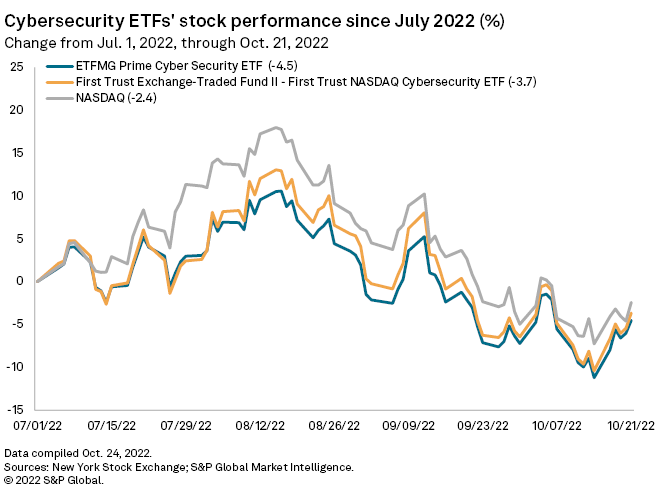

Public markets tracked a similar trend as the M&A market in the third quarter. After gaining back some ground in the middle of October, the ETFMG Prime Cyber Security ETF and the First Trust Nasdaq Cybersecurity ETF were down 4.5% and 3.7%, respectively, between July 1 and Oct. 21. That compares to a 2.4% drop in the broader tech-heavy Nasdaq Composite Index over the same period.

451 Research is part of S&P Global Market Intelligence.