S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

23 Apr, 2021

By Lauren Seay and Nathaniel Melican

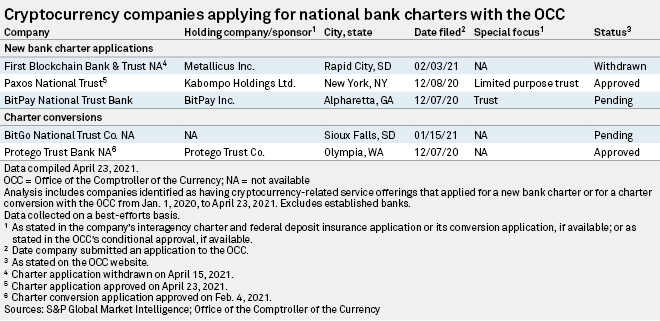

The Office of the Comptroller of the Currency on April 23 conditionally approved Paxos Trust Co.'s application to form Paxos National Trust, a de novo national trust bank.

Paxos is the first cryptocurrency-focused company to receive approval to form a de novo national trust bank following a string of applications in the final months of 2020. Two other companies, Anchorage Trust Co. and Protego Trust Co., have already received approval to convert their state charters to national trust bank charters. For Paxos, the national charter will allow the company to more easily operate throughout the U.S. as digital assets become more mainstream. The company plans to retain its state charter.

"It's sort of a wild time in the digital asset space where the adoption that our founder and our company believed ... is going to be coming eventually is actually coming to fruition, and it's tremendously validating," said Dan Burstein, general counsel and chief compliance officer at Paxos, in an interview.

Paxos applied for a de novo national trust bank charter with the OCC in December 2020. Several cryptocurrency custodians applied for national trust bank charters in the last few weeks of 2020 and the first few weeks of 2021, partly in hopes of capitalizing on the rising popularity of digital assets.

The national trust bank charter will allow Paxos to escape the limitations of state-by-state regulation and be seen as a viable partner as more financial institutions show interest in digital assets, Burstein said.

The Bank of New York Mellon Corp. announced Feb. 11 that it is forming a digital asset unit to hold, transfer and issue cryptocurrencies for its asset manager clients. But large banks are not the only ones keen on the digital asset space. Blue Ridge Bankshares Inc., a Charlottesville, Va.-based community bank with $1.5 billion in total assets, announced on Feb. 10 that consumers can purchase and redeem bitcoin at its Blue Ridge Bank NA ATM locations.

Several well-known consumer-facing companies, such as Tesla Inc., Visa Inc. and Venmo LLC, have announced moves into the space in recent months. The mounting popularity and increased interest in digital assets has pushed Bitcoin's value to record highs. Bitcoin's value stood at more than $50,000 on April 23, according to S&P Global Market Intelligence's Bitcoin Liquid Index.

While many digital asset companies are seeking trust bank charters in the wake of cryptocurrency becoming more mainstream in financial services, one company has withdrawn its application. First Blockchain Bank and Trust NA, which would have been a subsidiary of Metallicus Inc., on April 15 withdrew its application to form a de novo national trust bank. The company said it still plans to pursue a U.S. bank charter.

"We look forward to the creation of a U.S. crypto bank for the United States, solidifying the US as a leader in the digital banking blockchain revolution that is occurring around the globe," Metallicus CFO Irina Berkon wrote in a statement. "Our exact plans will be announced as they are developed by our team. In the meantime, Metallicus is excited as we continue to make progress in our state-by-state money transmission licensing process to deliver our products and services at the national level. We are currently serving clients in 39 states with more to be added soon."

Paxos hopes to pitch its services to the many financial institutions considering cryptocurrency services who might prefer finding a partner to building their own technology, Burstein said.

"It has sort of started out as dipping their toes into the water, and now it's becoming much more of a wading in the water," he said. "We're having more and more serious conversations with bigger and bigger companies."

While some other cryptocurrency companies opted to convert their state charters to national charters, Paxos will retain its state charter with the New York Department of Financial Services. Burstein said having both charters offers an advantage over other cryptocurrency custodians when pitching banks on partnerships.

"These companies are looking for the most trustworthy partner," he said.

Paxos will have 18 months to organize Paxos National Trust, but "we anticipate and expect that it will move along much more quickly," Burstein said.