Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

20 Jan, 2021

By Lauren Seay and Nathaniel Melican

A string of applications from cryptocurrency companies seeking national trust bank charters in the final months of 2020, and an approval in the first few weeks of 2021, are clearing a path through the ambiguity surrounding crypto regulation and could open the door for incumbent banks to enter the field.

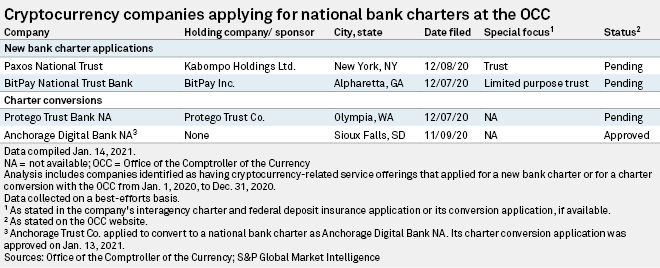

In November and December 2020, four companies sought either a charter conversion to a national trust bank charter or a de novo charter from the Office of the Comptroller of the Currency. The first to apply, Sioux Falls, S.D.-based Anchorage Trust Co., won conditional approval to convert to a national trust two months later. The OCC's response could set up Alpharetta, Ga.-based BitPay Inc. and New York-based Paxos Technology Solutions LLC to secure their new national trust bank charters, as well as Protego Trust Co., another state-chartered company seeking a national conversion.

A national trust bank charter will make it easier for the companies to operate nationwide and partner with big banks looking to venture into digital assets. The appointment of a crypto-friendly leader at the agency was the main reason for the sudden interest in the charter, one expert said, but the future of the pending applications and cryptocurrency regulation at the federal level rests in the hands of the President-elect Joe Biden's incoming administration.

"Unless a new [OCC] director comes in and reverses this, [and] so as long as the regulation stays in its current shape, I would expect a stampede of applications," David Yermack, a professor and chairman of the finance department at the NYU Stern School of Business, said in an interview.

A former executive at cryptocurrency company Coinbase Inc., former Acting Comptroller Brian Brooks was an ally for cryptocurrency during his tenure at the OCC. Since Brooks was named acting comptroller in May 2020, the OCC took several steps to clarify the relationship between banks and digital assets, such as allowing national banks and thrifts to provide custody service for crypto assets and confirming that banks can hold deposits as reserve against stablecoins. Most recently, the OCC authorized banks' use of node networks and stablecoins for payment activities.

Brooks expressed support of cryptocurrency companies securing national trust bank charters in a November 2020 interview with Forbes. In the interview, he indicated that a national trust bank charter would be an opportunity for cryptocurrency companies to operate nationally without having to obtain licenses in every state and that there could be crypto banks "very shortly."

"He's come in and done like five years worth of regulations in the space of six months to create opportunities for crypto," Yermack said. "Within the crypto community, this guy has been a godsend in the eyes of many investors and consumers."

Nationwide operations, bank partnerships

Anchorage weighed converting its state

|

"They definitely understand the technology in ways that I certainly didn't anticipate. I thought it would be a much more educational process," Quinn said. "They understand what we're trying to build and what we're trying to do. And I think that's kind of rare."

The company's newly approved national trust bank charter will allow it to more easily operate throughout the U.S. "Every time you want to enter a new jurisdiction, you have to do an analysis. Can we serve clients in that state? What kind of regulation do we need to follow? Do we need new licenses?" Quinn said. "It just made growing and scaling a lot more difficult."

A national trust bank charter will also open the door for U.S. banks to enter the cryptocurrency space by partnering with companies like Anchorage, Quinn said. Anchorage has received multiple requests for proposals from national banks whose customers have inquired about cryptocurrency custody services, she said.

"The big banks have really woken up and their customers are asking for services," Quinn said. "Being able to say to the big banks, 'We are OCC regulated as well. We can stand shoulder to shoulder with you and provide these services.' It's just really comforting to them. And I think it's going to help the big banks step into this space a lot more easily."

Future of cryptocurrency regulation

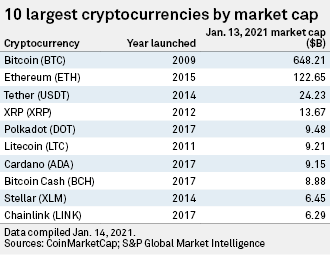

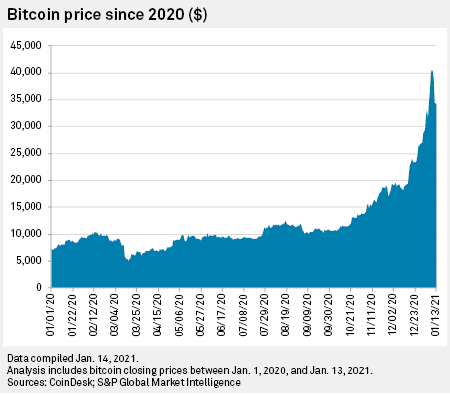

Bitcoin, the largest cryptocurrency by market capitalization, reached a new record value of more than $40,000 on Jan. 8. While cryptocurrency has been gaining traction in recent years, regulation of digital assets is still nascent.

|

"They've operated in a regulatory gray area. This is a completely new industry and it's still very unclear who regulates it," NYU's Yermack said. Ultimately, who Biden appoints for key financial regulatory roles will impact the near-term future of cryptocurrency regulation.

The OCC is not the only regulator looking to forge a pathway for cryptocurrency companies to operate as banks. On Sept. 16, 2020, Wyoming accepted its first cryptocurrency banking application under its Special Purpose Depository Institution charter, making Payward Inc., which operates as Kraken, the first regulated U.S. bank to focus on digital assets. About one month later, the state granted Avanti Financial Group Inc. a bank charter. Progress at the state level could influence federal regulation, Yermack said.

"You'll see competition among the 50 states and best practices kind of bubbling up from below and being emulated," he said. "Eventually, some of those things may migrate into federal regulation as well."