Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

4 May, 2022

By Karin Rives

|

Compute North installs crypto mining equipment in April 2022 for Marathon Digital Holdings in Texas. Marathon plans to be carbon neutral by the end of the year. |

The 6 MW Hatfield Powerhouse and canal was the largest hydroelectric project in Wisconsin history when built in the early 1900s and was still supplying the local grid with clean energy in February 2022. That month, a cryptocurrency developer with green ambitions cranked up the first of 600-some bitcoin mining computers soon to be housed in containers on the banks of the Black River.

|

Hatfield's new mission brought a slice of the $1.9 trillion digital currency industry to a rural Mid-Western town. The small hydro plant also represents a shift in the way energy-hungry companies mining for digital coins approach their power needs.

Crypto miners are setting up shop across the U.S. at a dizzying speed while trying to counter bad publicity over their growing carbon footprint. Their promise: to transform global banking and e-commerce systems while offering investors outsize returns — and to do it in a low-emissions way.

But with the U.S. now the world's largest mining destination and the industry's energy demand continuing to surge, the cryptocurrency greening campaign faces some headwinds.

States are pushing back

In New York, lawmakers have advanced a bill that would impose a two-year moratorium on any cryptocurrency "proof of work" operations and require a full environmental impact statement before future projects are permitted. Proof of work is the energy-intensive and dominant process bitcoin and most other cryptocurrency networks use to authenticate transactions.

"The point is to figure out exactly what the impacts will be to our renewable energy capacity and our climate goals and to go from there," said Jordan Lesser, legislative counsel for state assembly member Anna Kelles, who sponsored the bill.

"We have binding targets in our law to have 70% of energy generation in New York state by 2030 come from renewable sources," Lesser said. "If we put in a lot of renewables and that doesn't go to offset our existing energy usage but is absorbed by cryptocurrency mining it [may be] difficult or perhaps impossible for us to meet our goals."

Even in Texas, center of the crypto-mining gold rush, concerns are growing that the industry could be using too much of the state's wind capacity and could drive up power prices for homes and businesses. Texans spent nearly $7 billion in tax dollars a decade ago to connect wind farms in the western part of the state with cities farther east.

"We paid years ago to integrate all that wind, and a lot of that was premised on getting low-cost power," said Katie Coleman, an energy attorney in Austin. "The crypto using up renewables will probably increase our peak prices."

Texas electric grid operator ERCOT in March imposed a new approval process on cryptocurrency operators before they can connect to the grid. Regulators had grown concerned the industry may be taxing the state's energy resources too heavily.

The reviews can take several months and could have a chilling effect on the industry, Coleman said.

Fossil-free crypto by 2030

Unsustainable energy consumption — and the potentially existential risk it poses — is weighing on an industry that has grown tenfold just since 2020, according to the platform CoinMarketCap.

In 2021, cryptocurrency investors and companies launched an initiative dubbed the Crypto Climate Accord, pledging to transition their operations by 2030 to renewable energy sources. The initiative, modeled after the Paris Agreement on climate change, has since attracted more than 250 members.

Industry players also have developed eco-friendly talking points, seeking to cast miners in a new light. Data centers can serve as "catalysts for clean energy" development by soaking up excess renewable energy and spurring investments in more generation, crypto company executives told a congressional hearing in January. And cryptocurrency operations can provide grid stability by curtailing operations during times of high demand, they said.

At the same time, the industry's carbon footprint remains significant. In 2021, bitcoin relied on fossil sources for about 42% of its energy needs, including offsets, Brian Brooks, CEO of Bitfury USA, Inc., one of the world's largest bitcoin technology companies, told the congressional hearing.

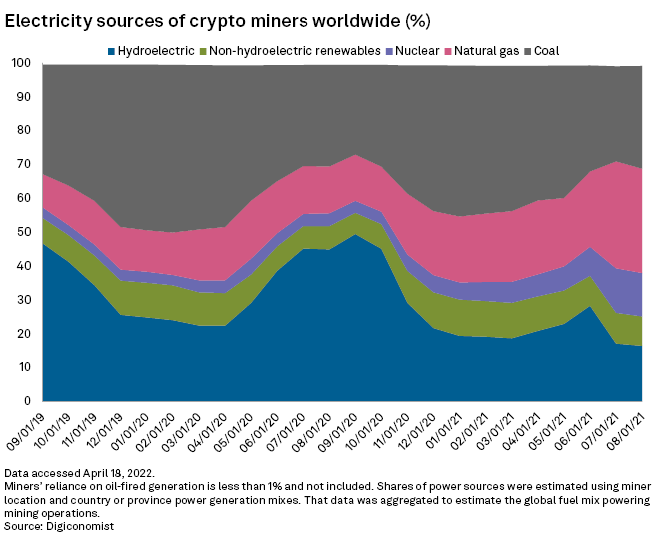

Globally, the industry actually increased its reliance on coal and natural gas after it was kicked out of China in 2021 over energy and regulatory concerns, suggested a March study co-authored by Dutch economist Alex De Vries that was published in the scientific journal Joule.

World's largest crypto mining plant

In contrast to New York, Texas leaders have actively sought cryptocurrency investments, turning the Lone Star State into a top mining destination. Texas also is where the tension between the industry's need for cheap and abundant energy and its environmental issue are on full display.

Mining giant Marathon Digital Holdings Inc. announced in April that it would relocate from a coal plant in Montana to wind and solar farms in other states such as Texas to meet its goal to be carbon neutral by the end of 2022. The company is already deploying a 280 MW facility in west Texas.

The same month, industry players Blockstream Corporation Inc. and Block Inc. broke ground on a 3.8 MW solar and 12 MW battery-powered bitcoin mine in the state with technology from Tesla Inc.

But Texas is also where Riot Blockchain Inc. is building the world's largest bitcoin mining plant on 100 acres without any promises of going carbon neutral.

In 2021, Riot spent $480 million on 85,500 so-called ASIC bitcoin mining computers for its Texas Whinstone facility, according to company financial filings. By the end of 2022, Whinstone is expected to use 570 MW of electricity, Riot CEO Jason Les wrote February in a response to a congressional inquiry into the industry's energy use.

Riot signed a 10-year power purchase agreement in 2020 with Vistra Corp. subsidiary TXU Energy Retail Co. LLC. The company offers clean energy options for its industrial customers, but Riot's PPA is for "on-grid power" that reflects ERCOT's overall grid capacity, Les explained in his letter to lawmakers. That means the Whinstone mining site gets about 28% of its power from renewables and 64% from coal and natural gas-fired power plants, with the rest coming from nuclear and other sources.

Hydro as a 'win for everyone'

Andrew Webber, CEO of energy services startup Digital Power-Optimization LLC, said he has found one answer to the industry's energy problem: thousands of small and mid-sized hydro plants nationwide, many of which are underutilized or falling into disrepair.

DPO and its partner Wiconi Hydro, a private investor group that bought the Hatfield Hydro Project in 2019, estimate that a small-scale project the size of Hatfield could generate about $1.5 million in net profit over a four-year period. The companies' new venture, Cascade Digital Power, expects the revenue stream to multiply as more hydro plants are added to the mix.

|

The 6 MW Hatfield hydroelectric plant in Wisconsin has been upgraded to power a small crypto mining facility. |

After millions of dollars in new upgrades, the Hatfield hydro plant is now producing twice as much power as it did a few years ago. The project can fly under the radar because it has no measurable impact on the grid or on local power bills.

The situation is different in communities that remain highly dependent on hydropower. Some communities have been advised to tread carefully with cryptocurrency miners shopping for cheap, green electricity.

"A utility with excess capacity must evaluate the opportunity costs and benefits of a new large crypto load versus retaining capacity for other economic development opportunities," Fitch Ratings wrote in a January report "Crypto mining operations typically bring in very little additional economic benefits in the form of jobs or ancillary business to a local economy."

But Webber said Cascade's cryptocurrency mining operation will be kept small enough to consistently be sustained during the low-flow winter season, using only about 1 MW. The rest of the power the hydro plant produces will be sold to the grid.

"If anything, we're bringing more renewables online," he said. "It's a pretty clear win for everyone."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.