S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

16 Aug, 2022

By Beata Fojcik

| Croatia will adopt the euro in January 2023, becoming the 20th country to do so. Source: Laszlo Szirtesi/Getty Images News via Getty Images Europe |

Croatian banks face losing roughly 20% of their annual profit once the nation's looming switch to the euro hammers lucrative currency operations. The long-term benefits from the change may make that a price worth paying.

Ditching the kuna will cost the industry some 1.4 billion kuna per year, mainly from lost foreign-exchange profits, reduced fees and lower interest income, according to the Croatian National Bank. Lenders, including units of UniCredit SpA, Intesa Sanpaolo SpA and Erste Group Bank AG, will also suffer approximately 900 million kuna of one-time costs because of the switch, the central bank told S&P Global Market Intelligence.

The lenders' payoff for these expenses may come from a stronger local economy, reduced foreign-exchange risk and regulatory benefits once they fall under European Central Bank oversight. Expectations for a stronger banking system also contributed to S&P Global Ratings, Moody's and Fitch all upgrading Croatia's sovereign ratings following confirmation that the country will become the 20th member of the eurozone in January 2023.

"Regardless of all the challenges and costs, banks strongly support and welcome the introduction of the euro in Croatia," the Croatian banking association told Market Intelligence via email. The move "will be extremely important for boosting investments, financing conditions and the long-term growth of the Croatian economy."

Joining the euro will boost the Croatian economy by giving it greater resilience to external shocks and by boosting access to financial markets, the central bank said. Lower trading costs for exporters and importers may also spur trade and inward investment.

Banks are set to benefit from a "positive spillover effect" as euro membership bolsters the local economy, said Regina Argenio, a credit analyst at S&P Global Ratings.

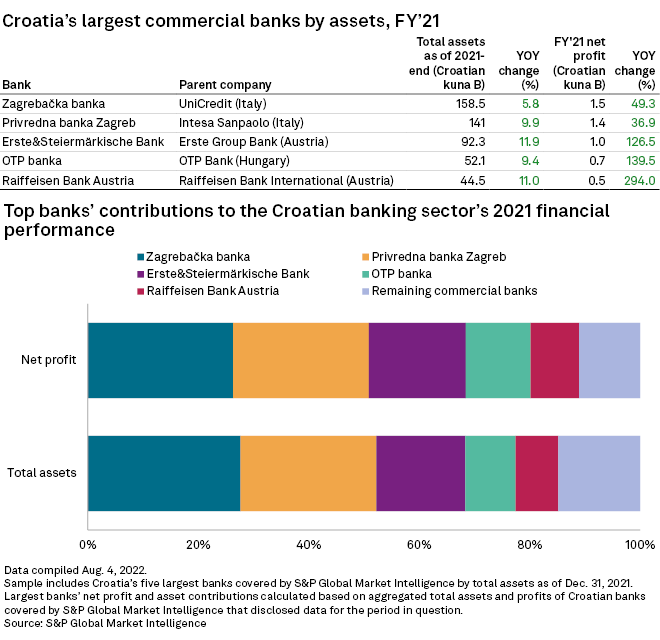

The nation's banking system is dominated by five overseas-owned banks, which accounted for more than 80% of total assets and net profit in 2021, Market Intelligence data shows. Zagrebačka banca dd, owned by Italian lender UniCredit, is Croatia's largest bank by assets, ahead of Intesa's Privredna banka Zagreb dd, Erste's Erste&Steiermärkische Bank dd and units of OTP Bank Nyrt. and Raiffeisen Bank International AG.

None of the five banks responded to requests for comment.

Adopting the euro will ease currency risks for lenders — even as they lose forex profits — because about half of Croatian bank deposits and loans are denominated in euros, according to the central bank. Such exposure meant that banks would face a "substantial increase in nonperforming loans" following an unfavorable currency shift, the central bank said.

A further benefit for banks will come from a €5 billion liquidity boost once a foreign-exchange currency buffer is phased out. This industrywide cushion will become redundant after Croatia adopts the euro, and its elimination will let banks pare costly foreign borrowings, according to the central bank.

Lenders will also get another 34.2 billion kuna of liquidity, the central bank said, as the minimum reserve requirement rate is gradually cut to 1% from 9% by December. That would put lenders in line with the ECB standard.

Shifting to the euro will have costs for lenders beyond lost currency exchange business and the need to overhaul IT systems. The banks will also lose some net interest income when converting their kuna-denominated loan and deposit portfolios into euros due to interest rate differences between Croatia and the eurozone. That disadvantage may ease now that the ECB has started raising borrowing costs, Argenio said.

The lingering effects of COVID-19 and the fallout from the war in Ukraine may also delay some of the economic benefits of euro adoption. Croatia's economy may grow 5.5% this year and 2.5% in 2023, based on Croatian central bank data, compared to 2021's 10.2% post-lockdown bounceback.

"The ongoing uncertainties associated with the Russia-Ukraine conflict might have an impact," Argenio said. "The country has a significant dependence on Russian energy."

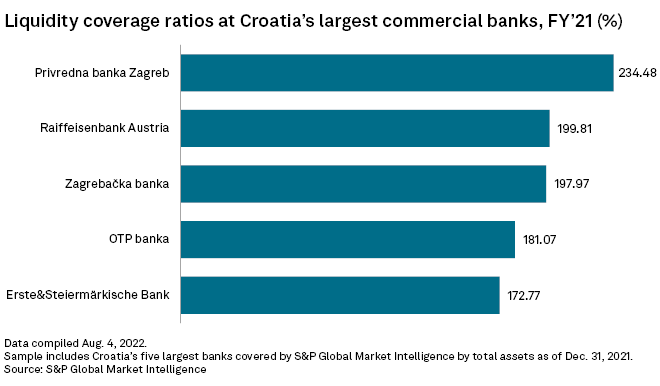

Still, local banks have cushions to weather upheavals. The sector's liquidity coverage ratios averaged 202.5% in 2021, according to the central bank. That surpass a 173% average in the fourth quarter of 2021 for ECB-supervised banks. The ratio is calculated by dividing banks' highly liquid assets by 30-day net cash flow.

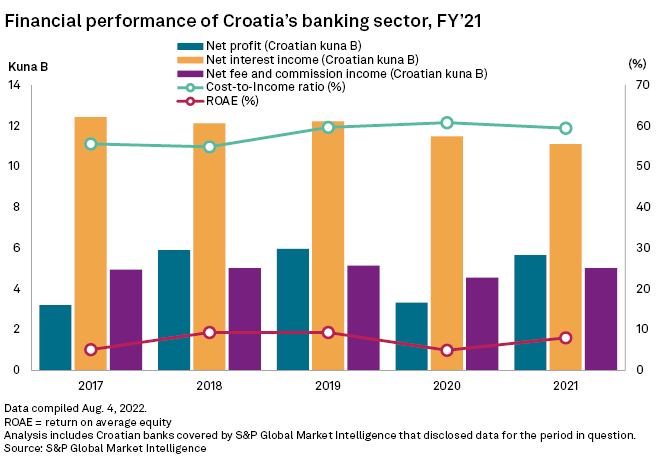

Croatian banks also outperform European peers in terms of profitability and costs. Aggregate return on equity was 8% in 2021 against the European average of 7.1%, Market Intelligence data shows. The cost-to-income ratios were 59.4% versus 64.3%. That efficiency helped Croatian lenders boost industrywide profits more than 70% last year to 5.7 billion kuna.

Lenders may now be able to build on these strengths as euro membership cuts risks in the industry and in the nation's broader economy.

Croatia's adoption of the euro will "reduce foreign-currency risks for the banking sector," Moody's said as it upgraded the country last month. The move "will also have a positive impact on our assessment of government liquidity and external vulnerability risks."

As of Aug. 15, US$1 was equivalent to 7.37 Croatian kuna.

This S&P Global Market Intelligence news article may contain information about credit ratings issued by S&P Global Ratings. Descriptions in this news article were not prepared by S&P Global Ratings.