S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

26 May, 2021

By Jon Rees

British banks are set to come under renewed pressure to curb fossil fuel financing after the International Energy Agency warned that energy companies must stop all new oil and gas exploration projects in 2021 to meet climate change targets.

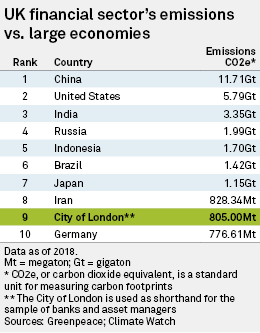

The financing of polluting industries is becoming an increasingly important issue for bank shareholders with lenders also facing scrutiny from governments, regulators and environmental campaigners. The British financial sector is among the world's largest polluters and, if it were a country, would be in the top 10 emitters of carbon globally, according to environmentalists.

Meanwhile, the International Energy Agency, or IEA, said in its report released in May that changes were necessary to meet the Paris Agreement on climate change goal of limiting global warming to 1.5 degrees Celsius above pre-industrial levels.

"There is no need for investment in new fossil fuel supply in our net-zero pathway," the IEA said.

Chris Hohn of hedge fund Children's Investment Fund Management (UK) LLP and founder of the "Say on Climate" campaign said in the wake of the IEA report that banks should not be financing fossil fuel expansion.

"The new IEA 1.5-degree scenario makes it clear that for all energy producers there should be no new investment in the expansion of fossil fuel production. No bank should be financing that expansion, and no insurer should be providing cover.

"Shareholders should vote against any plans that continue the expansion of fossil fuel production, otherwise they cannot claim to care about the climate. Where boards will not align, shareholders should replace the board," said Hohn in an emailed statement.

U.K.-based financial institutions including banks and asset managers in the City of London rank ninth in the world, and ahead of Germany, in carbon emissions at 805 million tonnes in 2019, or nearly twice the official U.K. figure of 455 million tonnes, which excludes finance, according to a report from Greenpeace and the World Wildlife Fund for Nature.

"The finance sector is driving the high-carbon economy, yet there is currently no requirement for it to reduce its emissions in line with government targets — unlike other industries," said Greenpeace in a statement accompanying the May report into the U.K. financial sector.

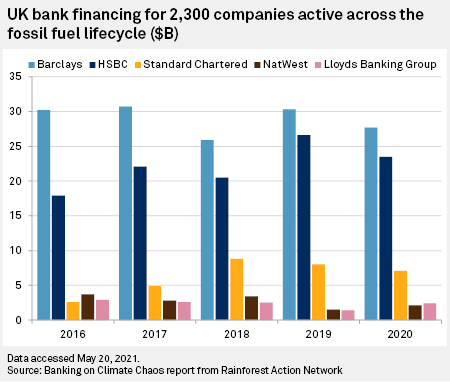

The Banking on Climate Chaos report, from the Rainforest Alliance of environmental groups including Dutch-based NGO BankTrack, shows British banks play a key role in fossil fuel financing.

It said, for instance, that NatWest Group PLC's exposure to fossil fuel financing for 2,300 companies active in the market went up to $2 billion in 2020 from $1.45 billion in 2019.

The Market Forces environmental group, which has previously targeted Barclays PLC, has said it will raise the issue of bank compliance with climate change targets at Standard Chartered PLC's annual general meeting next year.

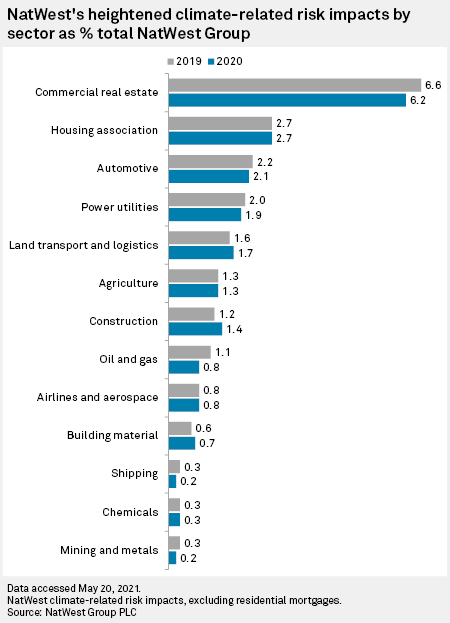

NatWest, banking sponsor of the forthcoming United Nations COP26 climate change conference in Glasgow in November, said its exposure to the fossil fuel market has decreased in the past year, contrary to the figures in the Climate Chaos report.

The bank said its exposure to the oil and gas sector had decreased by £800 million in the past year. It will stop lending or underwriting major oil and gas producers unless they have a credible transition plan in line with the 2015 Paris Agreement by the end of this year. The bank said fossil fuel financing made up a "tiny proportion" of its overall lending.

Sam Theodore, independent analyst and senior consultant for Scope Group, compared banks' efforts to turn away from fossil fuels to a supertanker turning at sea.

"Banks have long-term contractual commitments. It is not only that they look at profits — they do of course, and if they don't show them the market will beat them," he said via email.

He also noted that big energy companies no longer have 100% exposure to fossil fuels and have significant commitment to green projects.

"An exposure to Shell or to Total does not mean a 100% exposure to oil and gas. These are large going-concern businesses which are major employers, banks cannot just drop all financing overnight. Doing so, aside from contractual issues, would lead to a steep growth in unemployment in specific regions and countries, with likely negative social consequences."

NatWest is not the biggest British fossil fuel lender, according to Banking on Climate Chaos, with Barclays far in advance of other U.K. banks, lending $27.7 billion in 2020. Barclays said in a statement that its emissions from its energy portfolio will reduce by 15% by 2025, while power portfolio emissions will reduce by 30%.

StanChart, according to the Banking on Climate Chaos report, is a substantial lender to the fossil fuel industry, ranking 34th out of the world's leading banks in the field, after lending more than $7 billion last year. StanChart has been criticized by Market Forces, after it said the bank had taken part in a $400 million five-year syndicated loan to Indonesian coal producer Adaro Energy despite the bank's own calculations that this was incompatible with the Paris climate accord.

"We have made major strides in our coal policy over the past few years, we continue to review our positions in light of stakeholder feedback and we intend to remain leaders in articulating a path to net zero by 2050. We are committed to detailed transparency on our transition strategy and plan to put it to a shareholder advisory vote in 2022," a StanChart spokesman said via email.

The bank said it would not provide financial services directly to any new coal-fired power plants in any location.

Shareholder action

Michael Hugman, director of climate finance at the Chris Hohn-backed Children's Investment Fund Foundation, which supports policies combatting climate change, said, following the IEA report, that shareholders should vote against any plans relating to fossil fuel expansion.

"Where boards will not align, shareholders must be prepared to vote them down. Going forward, we also want to see the wider industry, including banks, stock exchanges and insurers doing their part by phasing out fossil fuel financing, starting with an end to coal use in the OECD by 2030," he said via email.

The EU's proposed Green Asset Ratio, due 2022, will put pressure on banks to be transparent about their involvement in fossil fuels, and Theodore said banks understand the issues.

"I am convinced by now the banks got the message: from politicians, including now the U.S., from investors, from public opinion, from media. Regulators are going to push more climate-related stress tests, as just happened in France, required disclosure [from regulators] will improve. So the world is getting there, slowly, and the pressure on the sector is all positive. But things cannot change overnight."