S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

24 Aug, 2021

By Zack Hale and Ellie Potter

| The Federal Energy Regulatory Commission received a wave of comments Aug. 20 in a hotly contested PJM Interconnection capacity market proceeding. Source: TebNad/Getty Creative via Getty Images |

The PJM Interconnection is facing fierce pushback to its proposed replacement for a highly contentious minimum offer price rule, or MOPR, used to blunt the effect of member states' clean energy policies in the grid operator's multibillion-dollar capacity market.

However, clean energy advocates are urging the Federal Energy Regulatory Commission to approve the proposed market rules without delay as states within the eastern grid operator's footprint continue to pursue a varied set of energy and climate goals.

The long-running FERC proceeding dates back to 2016 when a coalition of merchant generators complained (EL16-49, EL18-178) that out-of-market payments for at-risk coal- and nuclear-fired power plants in Ohio would artificially suppress PJM's capacity market prices.

After years of debate, FERC's Republican majority in December 2019 sparked an uproar from clean energy advocates by directing PJM to expand its MOPR — originally designed to prevent the exercise of buyer-side market power — to all new and some existing state-subsidized energy resources.

The agency's reasoning was that low capacity market prices will fail to provide existing thermal generators, many of which come online only during periods of high demand, with the "missing money" they need to continue to stay operational given the little revenue they were earning from PJM's energy and ancillary services markets.

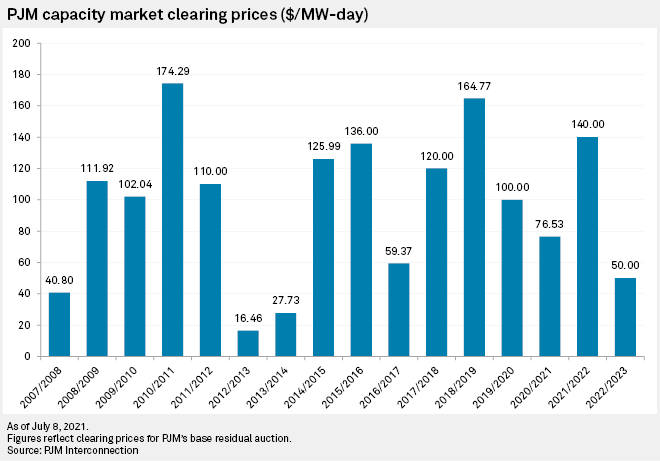

But FERC's order did not result in robust capacity market prices when PJM finally concluded a long-delayed capacity auction held in May for the 2022-23 delivery year.

The commission's December 2019 order also prompted Dominion Energy Inc. to flee PJM's capacity market, citing a conflict between the expanded MOPR and a new Virginia law that calls for major investments in offshore wind generation to help achieve a 100% clean energy grid by 2050.

Critics have also called the expanded MOPR "unworkable," and FERC Chairman Richard Glick is looking to approve new rules that accommodate state policies before PJM runs its next capacity auction in December for the 2023-24 delivery year.

After a multi-phase stakeholder process to develop a revised MOPR, PJM in late July asked FERC to approve a "focused" MOPR. (ER21-2582) The board-approved proposal would allow state-subsidized energy resources to escape the need to submit artificially high capacity market bids so long as they do not participate in state policies or programs "conditioned" on a resource clearing the market or making offers at a specific price. It would also require PJM to conduct case-specific reviews before the grid operator subjects new resources to default offer floor prices.

Protests to focused MOPR

The proposed changes, which received overwhelming support from stakeholders, nevertheless drew nearly a dozen protests at FERC, highlighting deep divisions over how to ensure that PJM maintains grid reliability within its 13-state footprint.

NRG Energy Inc., the owner of 5,000 MW of generation in PJM, warned that PJM's proposal "will crater the market."

"Continuously allowing a bucket of resources the opportunity to bid into a capacity auction at a level below a reasonable estimate of their actual cost eviscerates any 'reasonable opportunity' owners of existing generating facilities providing reliability service to PJM [have] of earning a return on and of equity from the commission-jurisdictional wholesale markets," the company said.

The Electric Power Supply Association, a merchant generator trade group, also took issue with PJM's assertion that subsidies for offshore wind in states like New Jersey will "only lower costs" for consumers in other states such as Pennsylvania and Ohio. "Significantly, in making this assertion, PJM concedes that the July 30 filing will do exactly what New Jersey and others have in mind: allow one state's policy choices to distort wholesale prices in other states," the association said.

The Pennsylvania Public Utility Commission and Public Utilities Commission of Ohio jointly argued that FERC should require the grid operator to study the ongoing effects of its MOPR policies. The proposal's accommodation for state policies "unjustly transfers the consequences of a particular state's policy preference(s) to all states and consumers within the PJM region," the commissions asserted.

PJM's internal market monitor predicted that PJM's proposed rules for reviewing the exercise of buyer-side market power "will make it effectively impossible to pursue and complete a timely investigation." The rules require PJM and the market monitor to confer with the capacity market seller in advance of any "fact-specific review," but they would also "rely on a projection of capacity market outcomes using assumptions about supply conditions and sell offer prices," the market monitor noted.

The National Rural Electric Cooperative Association praised PJM's effort to reform the MOPR "in a manner that should better accommodate self-supply resources owned by public power entities acting under longstanding business models." But it also expressed concern that PJM's proposed tariff language may not be clear to some cooperatives.

Exelon Corp., the nation's largest nuclear power generator, and Public Service Enterprise Group Inc. jointly pointed to real-world outcomes in PJM's latest capacity auction in support of the grid operator's proposed replacement. In doing so, they asserted that Exelon's 1,819-MW Quad Cities nuclear plant in Illinois was effectively frozen out of PJM's capacity market as a result of the state's zero-emission credit program, which compensates emissions-free resources for their climate benefits.

Exelon and Public Service Enterprise Group specifically noted that PJM's post-auction analysis indicated that Quad Cities' failure to clear in the last auction likely increased capacity prices by over $10/MW-day, or an additional $90 million, "borne in large part" by Commonwealth Edison Co. ratepayers.

"Because of the expanded MOPR, consumers must pay a premium, the market acquired unneeded capacity and Exelon will not be compensated for the reliability service that it is in fact providing to the market," the utilities said.

Proposal also draws support

While merchant generators blasted the proposal, environmental groups argued that payments for nonpolluting energy sources correct for market failures.

"Compensation for the environmental value of policy-supported resources should not be considered an illegitimate distortion of markets that must be excluded but rather a correction that is needed to achieve a more efficient outcome," the Natural Resources Defense Council, Sustainable FERC Project, Sierra Club and the Union of Concerned Scientists jointly argued.

The focused MOPR can also offer market transparency and certainty in some instances, according to Advanced Energy Economy, a clean energy trade group. It "appropriately recognizes that the vast majority of state policies supporting the development of advanced energy technologies are adopted for reasons that are well within the authority of states, compensate for attributes outside of the PJM capacity market and are not the proper subject of market power mitigation," the group said.

Other clean energy trade groups called the proposal a return to fundamental market principles.

"Under the proposal, it would only apply to capacity market sellers that have the ability and incentive to suppress the capacity auction clearing price, and that price suppression would provide an overall net benefit to an affiliated Load Interest," the Solar Energy Industries Association and the American Clean Power Association maintained.

American Municipal Power Inc. said it disagrees with parts of the proposal but views the entire focused MOPR as "far superior to the status quo." The MOPR is "but one part of PJM's capacity construct," the public power provider added.

And the New Jersey Board of Public Utilities, a key player in the MOPR debate, reported that it is anticipating a second phase of upcoming stakeholder deliberations over PJM's capacity market construct. "Tomorrow's capacity market must feature efficient pricing structures, which not only recognize but help achieve the goals of states and corporate buyers driving the clean energy revolution," the board said.

Ellie Potter is a reporter with S&P Global Platts. S&P Global Market Intelligence and S&P Global Platts are owned by S&P Global Inc.