S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

14 Mar, 2022

By Lauren Seay and Zuhaib Gull

Credit unions stockpiled an additional $379.05 million in subordinated debt in the fourth quarter of 2021.

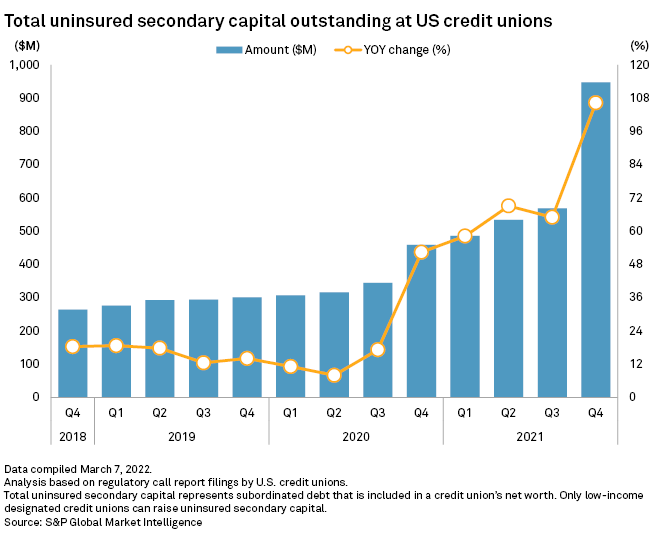

Total outstanding uninsured secondary capital levels for U.S. credit unions stood at $947.5 million in the fourth quarter of 2021, up 66.7% from $568.5 million in the linked quarter and 106.3% from $459.2 million in the year-ago period. Increasing interest among credit unions as they look to grow, recent regulatory rule changes that expand the number of institutions able to access secondary capital and a government stimulus program are setting 2022 up to be a record year for credit union subordinated debt levels, market participants said.

"Credit unions have finally realized that this is out there and can be done and people should do it," Michael Bell, partner and co-leader of the financial institutions practice group at law firm Honigman LLP, said in an interview. "The market is exploding. I've never seen it so active."

NCUA rule changes

While credit unions' interest in subordinated debt has been on the rise over the past year, the 66.7% surge quarter over quarter was a likely result of many credit unions rushing to access secondary capital before a slew of changes from a final rule from the National Credit Union Administration, or NCUA, that came into effect Jan. 1, according to Michael Macchiarola, CEO of the advisory firm Olden Lane.

That final rule increased the NCUA's time frame for reviewing applications to 60 days from 45 days. The final rule also defined subordinated debt as a security, which makes the process more complex and more costly for credit unions as they now have to attain qualified securities counsel, Macchiarola said.

"People rushed to get plans done under 2021 regime instead of 2022 regime because it was simpler," Macchiarola said.

The largest change in the NCUA's final rule was expanding how many credit unions can access secondary capital. Complex credit unions, defined as those with more than $500 million in total assets, and new credit unions, defined as those that have been in operation for less than 10 years and have total assets of not more than $10 million, can now access subordinated debt.

"That [expansion] will be the big story over the coming year," said Nathan Powell, managing director and product lead of Kroll Bond Rating Agency's analytics team. "We'll start to see which institutions are lining up or will line up to start borrowing."

Macchiarola said he is already seeing growing interest from complex credit unions.

2022 levels to surge

The fourth-quarter 2021 surge in total secondary capital levels is just the beginning of what is to come, market participants said. Total subordinated debt levels will skyrocket in the first few quarters of 2022 as a result of the increase in the number of credit unions able to access subordinated debt as of Jan. 1 and a government program set to be funded soon.

"A complex credit union offers an interesting entrant here because they're all above $500 million so they tend to raise in bigger sizes," Macchiarola said. "You're seeing larger players and larger amounts today."

Additionally, funds from the U.S. Treasury Department's Emergency Capital Investment Program, a program created to provide funds to Community Development Financial Institutions or Minority Depository Institutions to help their communities, are expected to come through in the first and second quarters. The funds will flow to credit unions in the form of subordinated debt. Macchiarola said about $2 billion will be distributed among 85 credit unions.

But a surge of outstanding secondary capital levels in 2022 could further anger banking industry groups who believe credit unions' tax-exempt status gives them an unfair advantage, Powell said.

"Subordinated debt is just another thing that gets everyone sort of worked up," Powell said. Due to their tax-exempt status, banking industry groups believe "credit unions don't really need additional capital because the industry is well-capitalized," Powell said. "They're also concerned the credit unions may issue this debt to acquire banks, and that's certainly seen as a threat."

Funding growth

For most credit unions, secondary capital is a way to fuel both organic and inorganic growth.

"Sub debt usually comes up in almost every conversation about bank acquisitions," said Glenn Christensen, founder, president and CEO of CEO Advisory Group, an M&A consulting company focused on the credit union industry. "That's something that is going to be an important tool for credit unions as they move forward."

Credit unions must pay cash for banks because they do not have stock to issue, so secondary capital can serve as a tool to boost their capital ratios in the event of a bank acquisition, Christensen said.

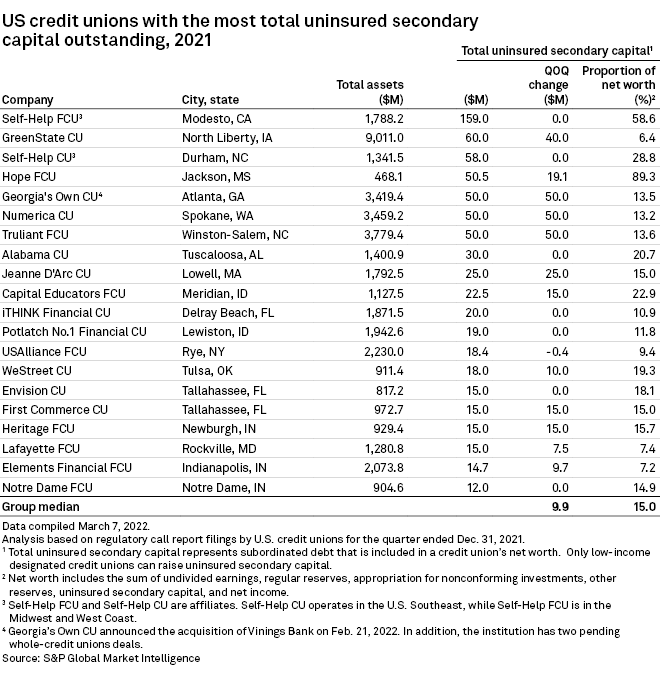

Of the top 10 credit unions with the most outstanding subordinated debt as of Dec. 31, 2021, three have announced at least one bank purchase in the past eight months. GreenState CU, which had the second-most total outstanding secondary capital at Dec. 31, 2021, announced three bank purchases in 2021.

In addition to M&A, the boost to capital can also help fund organic growth initiatives such as technology investments, opening branches and growing loans, experts said.

"There's a lot of credit unions that have so much more growth potential than they're able to realize because they're constrained currently by their earnings level," Christensen said.

Secondary capital has also proved helpful as credit unions grapple with the surge in deposits since the onset of the COVID-19 pandemic.

"That deposit growth has constrained capital levels because assets have grown faster than credit unions have been able to put that money to work in profitable loans," Macchiarola said. "So people are turning to secondary capital to offset some of that deposit growth."