S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

16 Dec, 2022

By Lauren Seay and David Hayes

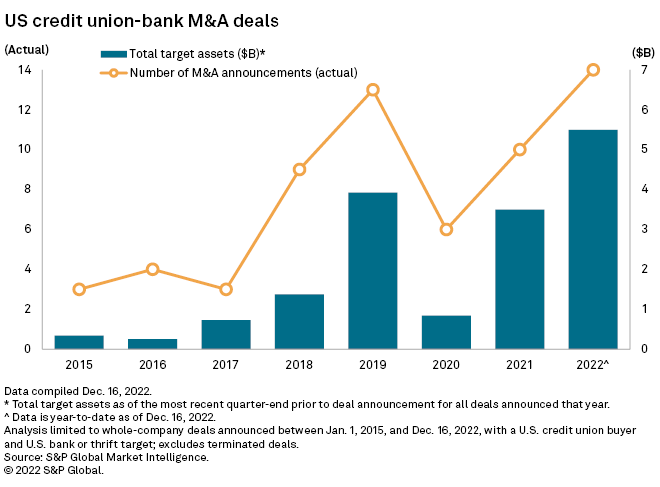

Credit unions have now struck a record number of bank acquisitions in 2022 following a spurt of activity in the final weeks of the year.

The record-setting deal announcement came Dec. 16 with LGE Community CU agreeing to acquire Greater Community Bank. The transaction marks the 14th such deal in which a credit union is buying a bank and surpasses the previous single-year high of 13 set in 2019, according to S&P Global Market Intelligence data, which excludes terminations.

The first half of 2022 saw steady credit union deal activity for banks, with nine such transactions. But, much like traditional bank M&A, the agreements slowed in the back half of the year, with just one deal coming to market from July 1 through October.

However, three credit unions announced deals for banks in December. The other two are Dort Financial CU's deal for Flagler Bank, announced Dec. 13, and Veridian CU's deal for American Investors Bank and Mortgage, announced Dec 6.

"Despite the economic uncertainty, we managed to announce a record number of credit union and community bank transactions," said Michael Bell, partner and co-leader of the financial institutions practice group at law firm Honigman LLP, which advised LGE Community CU. "Without the economic tumult, there would have been over 20 deals announced. If things clear up soon, be prepared to hear a lot of deal announcements in 2023."

Breaking records in 2022

The number of deals was not the only high-water mark set in 2022.

Flagler Bank and Greater Community Bank bring the total assets of bank targets involved in credit union transactions this year to $5.49 billion across 14 targets, well above the previous record of $3.92 billion across 13 targets in 2019.

Further, the total average assets of the 14 banks selling to credit unions stands at $392.2 million this year, above the previous record-high of $349.6 million across the 10 targets in 2021.

Michigan, Florida pipeline

While there is an obvious footprint gap between Michigan and Florida, some credit unions can view the extension as a practical way to serve customers that spend time in both states, deal advisers said.

"Michigan, and I think many Midwest states, have snowbirds — folks that spend the winter months in the state of Florida and their summer months in the Midwest," said Greg Cunningham, senior vice president at Donnelly Penman & Partners. "What we found with our clients was that they had a number of customers, good customers, that have been inquiring with them about being able to do their banking needs in the state of Florida when they would travel there for the winter."

Donnelly Penman & Partners did not advise on the Dort Financial CU deal but did advise on the other three transactions involving Michigan credit union buyers and Florida bank targets.

Moreover, Florida has a much more attractive population and economic growth outlook than Michigan.

According to data gathered by Nielsen, Florida's population is expected to grow by 10.26% from 2022 to 2028, above the national rate of 2.21%. Michigan's expected population growth during that time frame is 0.7%.

"It gives more opportunity for additional member and customer growth by entering into a higher growth market versus a declining market," said Andrew Christians, a managing director at Donnelly Penman & Partners.

Georgia is another Southeastern state where credit unions have targeted banks. Greater Community Bank is based in Rome, Ga., and is LGE Community CU's second community bank buy after it acquired Georgia Heritage Bank in 2018. Those transactions make up two of the seven deals in which a Georgia-based bank was bought by a credit union since 2015.