S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

14 Jun, 2023

Credit Suisse Group AG's investment bank will provide UBS Group AG with opportunities to bolster its franchise and strengthen its competitive position in the US and Asia, analysts said.

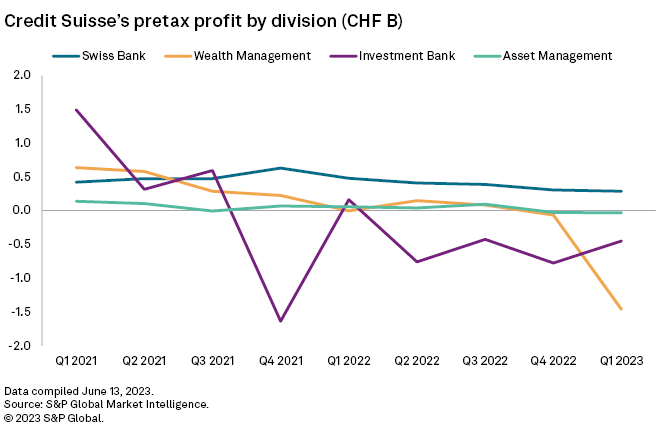

Restructuring the investment bank, which has been the source of most of Credit Suisse's financial and reputational woes in recent years, is one of the biggest challenges facing UBS following the closing of its acquisition of its cross-town rival June 12. But the bank is well positioned to take that task on, as its own healthy franchise will help it navigate the costly downsizing of the business, retaining key talent in regions and business lines that support its strategy, the analysts said.

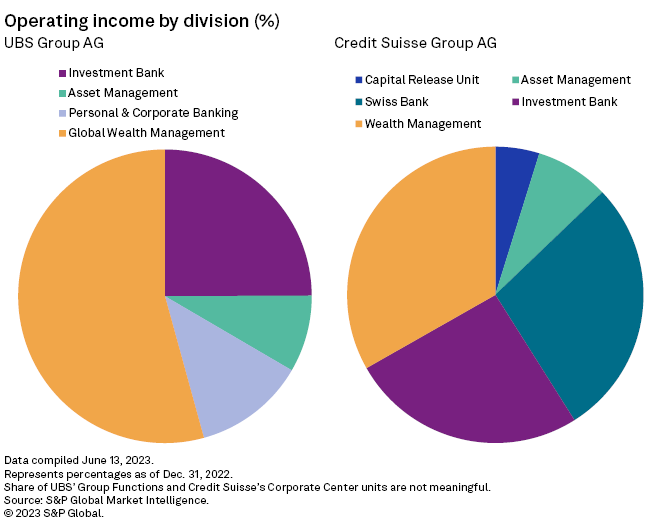

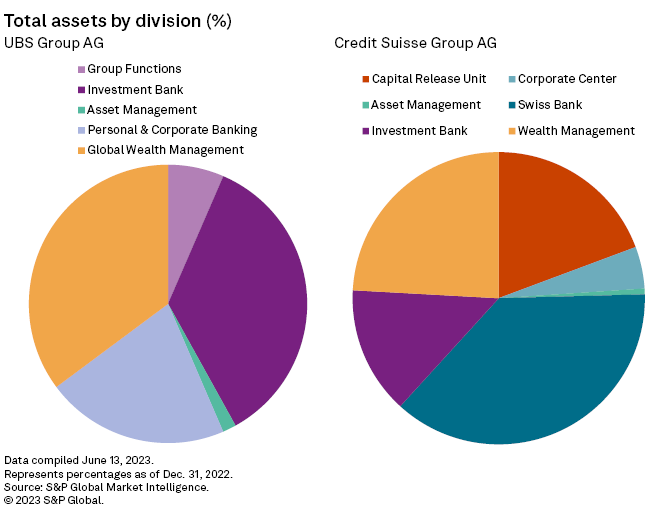

UBS said it would resize, de-risk and refocus Credit Suisse's unit to fit its own model of a capital-light investment bank focused on serving wealth management clients. CEO Sergio Ermotti said in late April that UBS expects to benefit from the diversification and complementarity Credit Suisse's investment bank brings to the group.

Historically, Credit Suisse has had a stronger presence in the US, especially in investment banking, and that could boost UBS' market share in the region, said Johann Scholtz, an equity research analyst at Morningstar. There are also opportunities in Asia, where the merging of the banks' equities operations would support the wealth management business, Scholtz said.

UBS has already taken steps to retain key Credit Suisse personnel across Southeast Asia. It is in advanced discussions with senior dealmakers based in Korea, Thailand, Vietnam and India with a target of keeping more than 100 bankers in the region, Bloomberg reported June 5.

Apart from an expansion in the US, the takeover of Credit Suisse's investment bank will enable UBS "to achieve its strategic goals in global banking" and "enhance its advisory capabilities in high-growth sectors," Zurcher Kantonalbank analyst Michael Klien said in a note after the merger announcement.

Radical downsizing

UBS will set "an incredibly high bar" for taking in Credit Suisse investment bankers to avoid "cultural contamination," Chairman Colm Kelleher said at a conference May 24.

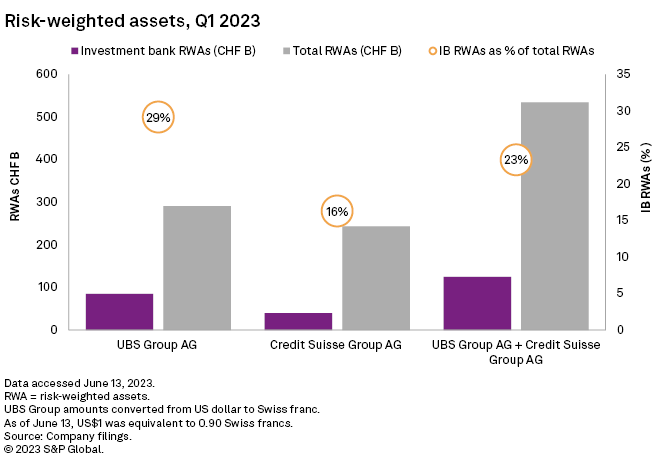

UBS has a lower appetite for risk-taking, and about 70% of the roughly $8 billion in annual run-rate cost reductions it aims for by 2027 could be concentrated on Credit Suisse's investment bank, according to Scholtz. The majority of the unit's assets will likely be placed in a separate noncore division, said Vitaline Yeterian, senior vice president for global financial institutions group at DBRS Morningstar.

Most of the European investment bank of Credit Suisse is expected to disappear within the next six to 12 months, eFinancialCareers reported June 5, citing a senior insider.

UBS has the advantage that it can downsize Credit Suisse's investment bank at a much faster pace than its troubled smaller rival could do before the merger, as UBS has enough organic profitability from its own operations to absorb the restructuring costs, Scholtz said. UBS also has CHF9 billion of government guarantees to lean on if losses related to the winding down of noncore assets exceed CHF5 billion.

UBS has said the size of the merged investment bank will not exceed 25% of group risk-weighted assets in the future.

What should stay and what should go

UBS will likely focus the cuts on Credit Suisse's fixed-income trading rather than equities trading operations, which offer better synergies with wealth management, Scholtz said. UBS exited the bulk of its fixed-income trading during the last revamp of its own investment bank, the analyst noted.

On the advisory side, UBS is expected to keep the operations Credit Suisse was originally planning to spin off under the brand First Boston, Scholtz said. The US-based First Boston operations comprise capital markets and advisory services, including leveraged finance. Asked about that business during a first-quarter earnings call April 25, UBS CEO Ermotti said a diversified portfolio "includes also having leveraged finance."

Details about the integration of the investment bank and the rest of Credit Suisse's units remain scarce. UBS has postponed publication of its second-quarter results by over a month to Aug. 31. A spokesperson for UBS said the bank needs more time to prepare the results.

Analysts believe that the group will come out with details sooner rather than later. "We expect more information on UBS' financial plan and strategy regarding the integration of Credit Suisse to be disclosed during UBS' earnings call or as part of a dedicated investor day," Yeterian said.

Scholtz expects "a lot more clarity" during the earnings call as pro-forma figures still do not paint a clear picture of the upcoming revamp.