Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

7 Jun, 2022

By Vanya Damyanova and Marissa Ramos

Credit Suisse launched its 2024 strategy in November 2021.

Credit Suisse Group AG is in danger of losing investment bank and wealth management business as it goes through cultural and organisational changes.

The bank's 2024 strategy should deliver a leaner and lower-risk structure, with a smaller investment bank and more capital allocated to wealth management. Yet, analysts question Credit Suisse's ability to retain clients and market share in these two core areas during the revamp.

Switzerland's second-largest bank still faces reputational damage from the collapses of hedge fund Archegos Capital and financial services firm Greensill Capital (UK) Ltd. in early 2021. Additionally, the weak economy and tough market competition in 2022 could jeopardize the execution of its strategy, according to credit and equity analysts.

First-quarter revenue weakness in both investment banking and wealth management have further fueled market concerns about loss of business and franchise impairment in the two divisions.

Credit Suisse declined to comment. The bank's CEO, Thomas Gottstein, has said 2022 will be a year of transition.

Investment bank

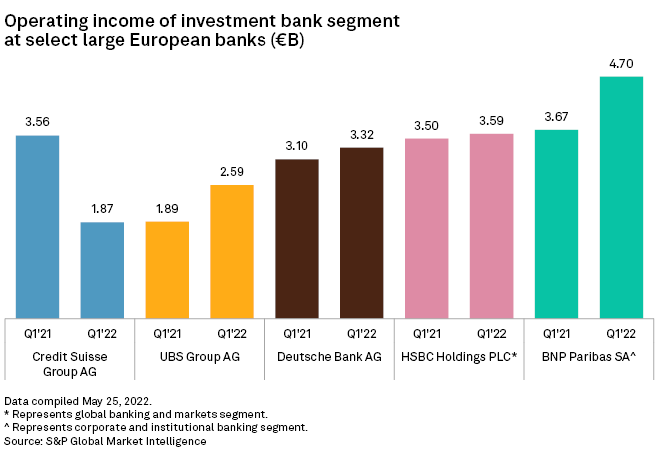

Market conditions were tough for all banks in the first three months of 2022, but Credit Suisse performed worse than its peers even if the negative market and restructuring effects are excluded, analysts said.

The prime services exit has likely hurt other parts of the investment bank. First-quarter figures showed signs of franchise erosion given Credit Suisse's material underperformance in fixed income, currencies and commodities trading, equity analysts at Berenberg said in a May 10 research note.

The investment bank is fast emerging as a key operational issue for Credit Suisse as the group continues to lose market share and front office staff to competitors, Société Générale analysts said in an April 27 research note. Boosting the unit's profitability in the future could be a challenge given the loss of prime services as a revenue source, they said.

Wealth management

In wealth management, Credit Suisse's first-quarter adjusted net revenues fell 22% year over year, mainly driven by lower transaction-based revenues, especially in Asia-Pacific. Sector revenues at other major European banks were flat or slightly above the prior-year level, according to Market Intelligence data.

Peers were also affected by negative trends during the quarter, including a slowdown in Asia-Pacific business. But the situation for Credit Suisse is more complex, Maria Rivas, senior vice president in DBRS Morningstar's global financial institutions group, said via email. Some of the Swiss group's revenue weakness may be explained by reputational damage suffered over Archegos and Greensill, Rivas said.

The bank's underperformance versus its peers raises questions about Credit Suisse's ability to maintain its otherwise strong wealth management franchise during the restructuring, Christian Scarafia, head of northern European bank ratings at Fitch Ratings, said in an interview.

Fitch downgraded Credit Suisse's long-term default rating to 'BBB+' from 'A-' on May 18, saying the group's weak operating profitability compared to peers highlights the execution risk to its restructuring and the challenges to boosting its performance over the next 24 months.

Restructuring challenges

S&P Global Ratings, which lowered Credit Suisse Group's long-term issuer credit rating to 'BBB' from 'BBB+' on May 16, said it views the bank's performance targets "as ambitious, particularly in the context of widespread management change and economic uncertainties."

"Negative one-offs and the fallout of parts of the group's investment banking business will dent medium-term profitability," Anna Lozmann, S&P Global Ratings lead analyst for Switzerland, Austria and central and Eastern Europe, said in an email.

Based on recent earnings and management announcements, it is clear that Credit Suisse will need longer to achieve its strategic targets and implement the planned culture and risk management changes, Moody's Roccati said. "The changes in senior management, which has been replaced almost entirely, remain a clear risk," Roccati said.

Credit Suisse has replaced eight out of 12 members of its executive board in the last two years, Jefferies analysts estimated in a May 12 note. Three more board members, namely General Counsel Romeo Cerutti, CFO David Mathers and Asia-Pacific region CEO Helman Sitohang, are also leaving. After their departure, CEO Gottstein will be the only one who has served on the board prior to 2020.

Chairman Axel Lehman, who has held his post for less than six months, recently said Gottstein had his full support, rebuffing reports about a potential plan to replace the CEO.

Outlook

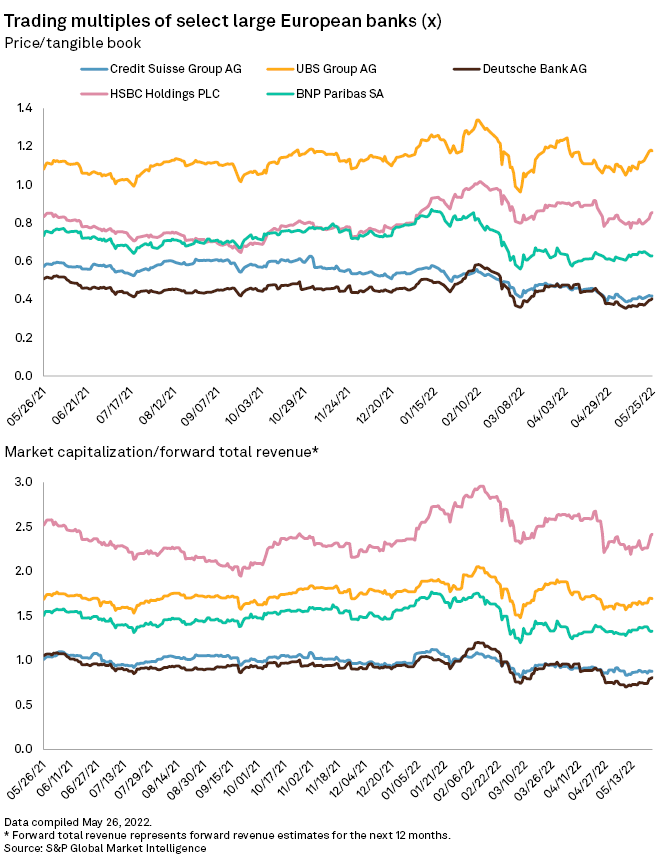

Credit Suisse is trailing most of its European peers in terms of trading multiples, owing to stock price decline and reduced consensus expectations for short-to-medium earnings, Market Intelligence data shows.

In the current uncertain market environment, investors are likely to shun Credit Suisse given the negative outlook for its performance, Firdaus Ibrahim, an equity analyst at CFRA Research said in an email. Instead, they are likely to pick bank stocks with better profit and dividend prospects.

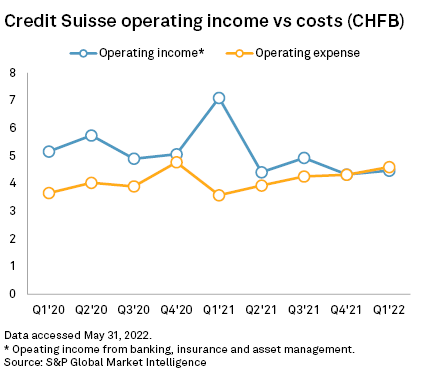

In the first quarter, operating expenses surpassed operating income for the first time in the last two years, Market Intelligence data shows.

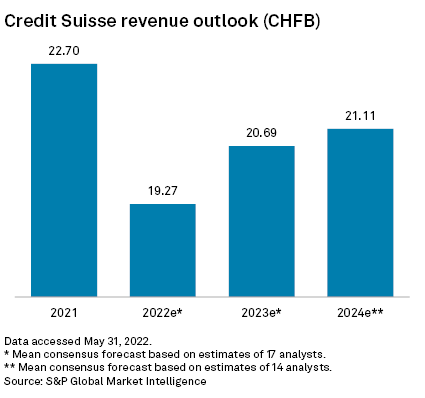

Mean consensus forecasts for the bank's revenues in 2022 point to a 15% drop year over year, with gradual recovery in 2023 and 2024.

In 2022, Credit Suisse is expected to struggle with falling revenues and rising costs as it tempers its risk appetite while supporting its restructuring and trying to retain talent in a competitive market, Ibrahim said.

"Reputational damage, together with deteriorating macro outlook due to geopolitical instability, may also impact clients' confidence, further hampering [the bank's] top line," Ibrahim said.

This S&P Global Market Intelligence news article may contain information about credit ratings issued by S&P Global Ratings. Descriptions in this news article were not prepared by S&P Global Ratings.