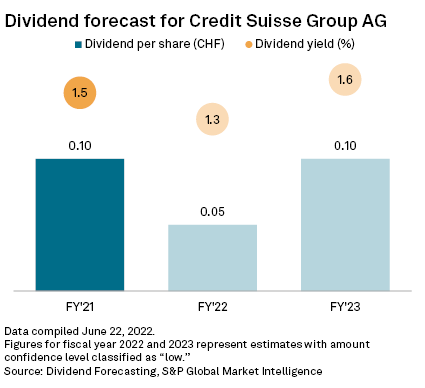

Credit Suisse Group AG will halve dividends next year as it struggles to revive profits amid the fallout from the collapse of hedge fund Archegos Capital, according to S&P Global Market Intelligence analysts.

Switzerland's second-largest bank will pay out CHF0.05 per share, the analysts said in a June 16 note. The lender distributed a CHF0.10 annual dividend in May after reporting a 2021 loss.

"We predict another cut in 2023 with a significant risk of suspension," the analysts said.

The forecast comes after Credit Suisse published its third profit warning this year and a projected second-quarter loss because of market volatility, weak customer flows and client deleveraging. The U.K.'s Financial Conduct Authority has also ordered the lender to do more to prevent misconduct and improve senior management accountability, according to a June 12 Financial Times report, adding to reputational damage suffered by Credit Suisse in the wake of billions of losses from the failure of Archegos and financial services firm Greensill Capital (UK) Ltd. last year.

"Back-to-back incidents at Credit Suisse have damaged investor confidence," the Market Intelligence note said.

A Credit Suisse spokesperson declined to comment on the outlook for dividends or earnings when contacted by Market Intelligence.

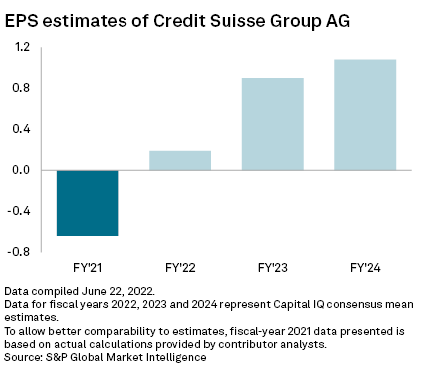

The bank will likely post EPS of CHF0.19 for 2022, followed by CHF0.93 in 2023, according to analyst estimates compiled by Market Intelligence. Last year, the bank made a loss of CHF 0.67 per share.

Analyst forecasts for dividends next year range from CHF0.04 to CHF0.25, based on Market Intelligence data.

The bank paid CHF0.2776 per share in 2019 and CHF0.2625 in 2018. The lender continued making payouts amid the coronavirus crisis, even as many eurozone banks suspended dividends completely at the request of regulators.

Solid second-half earnings could help Credit Suisse avoid a dividend cut, even if a reduction is the baseline estimate, the Market Intelligence note said. Payouts could also go up in the next couple of years.

"There is definitely room for a better dividend if the bank manages to avoid other scandals and conduct its restructuring well," Kevin Soyer, director of dividend forecasting at S&P Global Market Intelligence, said by email.

| * Access Credit Suisse dividend data. * Download charts with EPS and stock price estimates for Credit Suisse. * Learn more about the performance of the Swiss banking sector. |