Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Apr, 2022

|

A client at a grocery and bakery store pays for his goods with a smartphone in São Paulo. |

Thiago Saldanha helped his sister expand her independent retail business in Brazil and felt firsthand the difficulties that small and medium-sized businesses face trying to get credit. The experience prompted Saldanha to build CashU, a fintech that uses supply chain data to evaluate and grant credit to companies that have traditionally been unable to tap into formal banks for loans.

CashU is one of many new fintechs in the region tapping into alternative sets of data to provide loans to people and businesses who cannot access credit or have to pay high rates. Savvy entrepreneurs are using low-cost technology to mine data from new sources like mobile apps and checking accounts to offer credit to individuals and small businesses that previously had few other options.

The opportunity is massive. Small and medium-sized enterprises represent 99% of businesses in Latin America and the Caribbean and 67% of employment, according to the Organisation for Economic Co-operation and Development. The lack of access to adequate financing has led to an estimated funding gap of $1.2 trillion, according to the Inter-American Development Bank Group.

The convergence of technological innovation and adoption has created the opportunity for financial inclusion, said Wesley Smith, global lead, information ecosystems, at LexisNexis Risk Solutions, which provides data analytics to companies for better credit scoring. A flurry of fintechs has emerged to tap a neglected market with new technology.

"There's always been massive pent-up demand for financial sustainable services," Smith said.

Big potential, big risks

But while the potential is big, so are the risks. Traditional financial institutions have avoided such populations partly because the small amounts are often not worth the investment. Those who would argue that scale can compensate for lower-income individuals and businesses might look to Nu Pagamentos SA, owner of Nubank, which only managed to eke out a small adjusted net profit last quarter while boasting some 50 million customers. Brazil's central bank has also recently raised capital requirements for large fintechs under certain categories.

Then there are the macro risks. Widening inflation and hefty rate hikes have made it harder to offer competitive rates to prospective clients, while increasing default rates.

People leave digital fingerprints — not only the personal information created through interactions with websites but also purchases, services requested, social media posts, sites browsed and search terms entered — that a human cannot understand because of the immense amount of data flowing from smartphones into networks. But with machine learning, patterns emerge that can help detect fraudulent behavior and high-risk activity. Those patterns can help providers to better understand individuals who are considered risky, which then helps those individuals obtain credit even if they have historically been excluded because they are outside of the formal ecosystem.

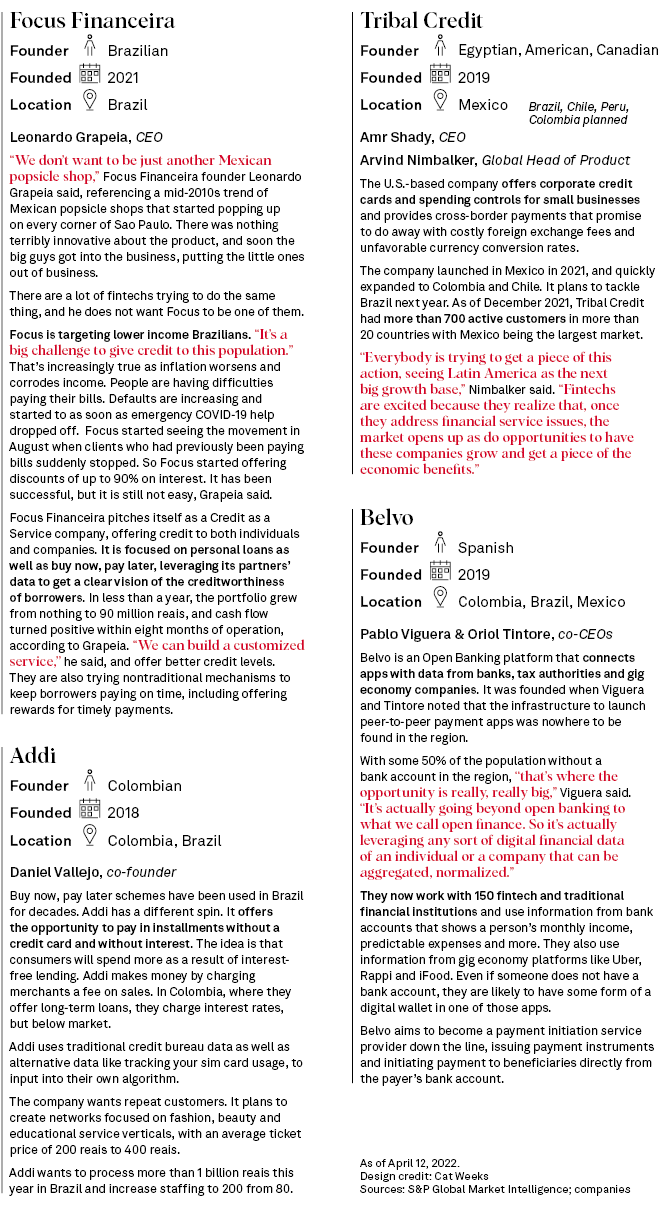

The opportunity has attracted millions in venture capital funding to the region. CashU raised 6.1 million reais in a seed round in January; Addi, a Colombian company that specializes in microcredit for online purchases, raised $200 million late last year in equity and debt capital; and San Francisco-based Tribal Credit, which offers corporate cards to startups and SMEs, raised $60 million in Series B funding led by SoftBank Latin America Fund.

Banks do not want to fall behind

Traditional banking institutions are well-aware of the flurry of funding and new credit lines happening in their backyards.

Banco do Brasil SA, a two-century-old, state-controlled bank, is developing in-house programs tapping artificial intelligence and looking at partnerships and investments in startups to expand into tapping alternative data, according to Pedro Bramont, head of digital business at the institution.

While the bank is diving in, Bramont also notes the perils involved in this new business model, particularly regarding privacy and fraud matters. Clients may not fully consent to the use of social media data, for example, or they may not be aware of how information is being used. Know Your Customer diligence may also be impaired when the data is collected exclusively through secondary sources. These risks will require improved security and analytical systems.

Many fintechs are moving at warp speed, quickly jumping from country to country using proprietary algorithms and taking on big risks, said Shawn Budde, a principal at fintech advisory Ensemblex. While Brazil and Mexico may have more in common than, say, Brazil and Vietnam, the cultures and realities on the ground are vastly different. Every market will have its peculiarities and will require unique and custom-built models.

Among the challenges are credit bureaus, which vary greatly from country to country, as does the data and quality of data that they contain. Some places have negative-only credit bureaus. In other places, you have to be a bank to access the credit bureau. The expectation that a company can easily replicate from country to country is naïve. "Our experience has been that that leads to pretty bad results," Budde said. "This is a very risky business."

Some observers believe those risks are overstated. "I'm seeing more and more horizontal infrastructure that is enabling some of the regulatory compliance government's work that has to be done well and allowing companies to do that and scale internationally," said Alex Lazarow, a partner at global venture capital firm Cathay Innovation. "That being said, it's impossible to copy and paste a business from one place to another."

While not all of these fintechs will be successful, Lazarow is seeing a lot of inspiring businesses.

But for those willing to take the risk, like CashU's Saldanha, there is more than enough demand for this new and evolving credit segment.

"There are all sorts of lines of financing that are needed and plenty of space for rival fintechs to thrive," Saldanha said. He welcomes competition in the segment to make it more attractive for investors and venture capitalists. "I hope CashU eventually becomes just one part of a huge ecosystem because the market is so vast and there is so much opportunity."