S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

15 Apr, 2021

By Cathal McElroy and Rehan Ahmad

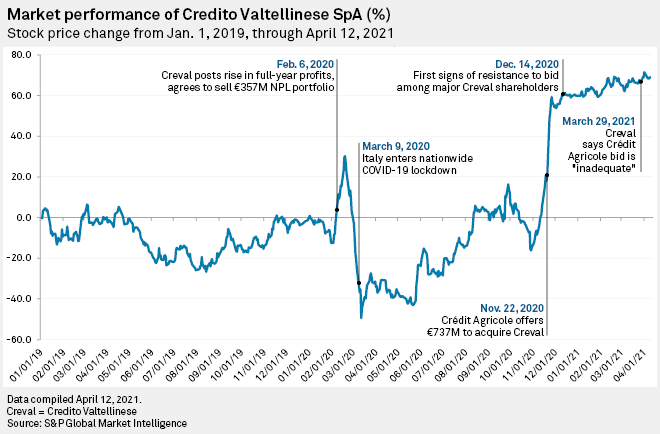

In the latest development in what is surely one of 2021's most enthralling pass-the-popcorn M&A sagas, major Credito Valtellinese SpA shareholder Denis Dumont came out to publicly oppose Crédit Agricole SA's takeover offer for the Italian bank, after which the French bank improved its offer.

Dumont, who owns a 5.78% stake in the lender, according to S&P Global Market Intelligence data, joined a host of other major shareholders openly resisting Crédit Agricole's €10.50-per-share bid that valued Credito Valtellinese, also known as Creval, at €737 million. Since Crédit Agricole made its offer in November 2020, Creval's share price has surged to €12.29 from €8.30, pushing its market capitalization to €862.8 million as of April 13, S&P Global Market Intelligence data showed. Only 0.00045% of Creval's shares have been tendered since Crédit Agricole launched the bid March 30 through its Italian unit.

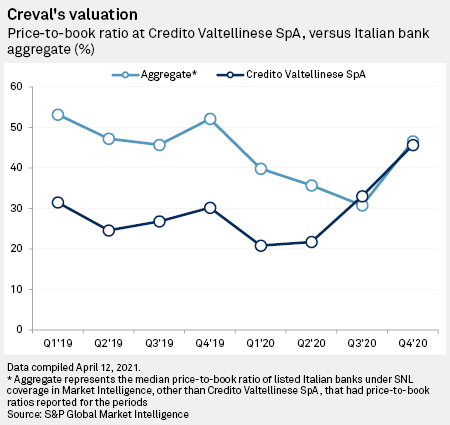

Creval's price-to-book ratio increased to 45.64% in the fourth quarter of 2020, roughly in line with the average for listed Italian banks, up from a low of 20.80% in the first quarter of 2020.

Creval has suggested a fair price for the company between €12.95 and €22.70.

If Crédit Agricole's bid fails this time around, the health of Creval's loan book in the coming quarters may shift its share price closer to what it is currently on offer, Arnaud Journois, lead analyst, European financial institutions at global credit rating agency DBRS Morningstar, said in an interview.

"Creval's share price is going to weaken at some point," Journois said. "When nonperforming loans increase [due to the impact from the COVID-19 pandemic], the overall value will deteriorate because it will need to book additional provisions eventually."

Lockdown blues

Italy remains in lockdown after restrictions on movement and the opening of some businesses to prevent the spread of COVID-19 were reintroduced in the second week of March. The country's business lobby Confindustria cut its growth forecasts for the economy by 0.7 percentage points to 4.4% for 2021 due to weaker-than-expect growth in the final quarter of 2020 and the first three months of 2021.

Creval booked €147.7 million in provisions in 2020, down from €222.9 million in 2019. €2.4 billion of the bank's loans are under moratoria due to government measures aimed at limiting the impact of the pandemic on borrowers. Around 11% of Creval's loans under moratoria relate to sectors that are most impacted by the country's lockdown.

Whatever impact the pandemic is yet to have on Creval's loan book, Crédit Agricole sees an opportunity to expand its limited footprint in the Italian market by buying out the bank. The deal would add around 700,000 retail and SME customers to Crédit Agricole Italia SpA's books, increasing its market share to 6% from 3% in the lucrative Lombardy region, and boosting its balance sheet to around €100 billion.

The French lender already owns a 12.3% stake in Creval through Amundi Asset Management SAS, according to S&P Global Market Intelligence data. Crédit Agricole has also assured investment fund Algebris (UK) Ltd. that, whatever the outcome of the bid, it will buy its stake in Creval, which amounts to 5.29%, the data showed.

Dumont's opposition to the offer comes after several major Creval shareholders and its board of directors publicly dismissed Crédit Agricole's proposal. The resistant shareholders include Hosking Partners, which owns a 5.13% stake according to S&P Global Market Intelligence data, Alta Global, Melqart Asset Management, and Petrus Advisers, which combined are reported to own a further 12.8% of the company, at least. Crédit Agricole needs 50% plus 1 share to be tendered if the bid is to proceed.

'Bid up or shut up'

Those opposed to the offer believe Crédit Agricole's bid is undervaluing one of Italy and Europe's more promising banks. In an emailed statement to S&P Global Market Intelligence, Petrus Advisers described Creval as a solid bank with good credit quality and a clean balance sheet. Creval's excess capital is "best-in-class among European banks and represents an additional buffer to navigate any macroeconomic scenario," it said.

"Creval is well positioned to continue to create value for shareholders, with or without Crédit Agricole," said the statement. "Crédit Agricole is creating enemies each day. They should bid up or shut up."

Crédit Agricole did not respond to a request for comment.

Its revised offer may be welcomed by the opposing shareholders, but it is unclear if a proposal will get any closer to Creval's proposed price range. Johann Schultz, European banking analyst at Morningstar, noted that Creval is a tiny fraction of Crédit Agricole's size and the deal "is not that important" to the bank's bigger picture, he said.

"Italy is hardly the most attractive banking market as it stands," Schultz added. "Crédit Agricole shareholders would not really want them to pay up too much for a business in Italy."

Crédit Agricole's recent experience in Italy has been underwhelming. The bank was forced to book two goodwill impairment charges against Crédit Agricole Italia in the fourth quarter of 2020, €1 billion from the Crédit Agricole Group and €900 million from Crédit Agricole SA. The charges were due to prolonged low interest rates weighing on the Italian unit's interest margin and value in use, it said.

"If you've just written off goodwill on your existing franchise in Italy and then go and chase and pay up for an acquisition there, it doesn't really make a lot of sense," Schultz said.

Dumont had said he was open to a takeover but not at the price originally offered by Crédit Agricole, and has committed to taking action to support Creval's future as an independent lender if the offer isn't sufficiently improved.

For Crédit Agricole, a cooling-off period in the aftermath of a failed bid may work to its advantage over the longer term, Schultz said. Creval's current share price is incorporating a "take-out premium," which is likely to melt away in the aftermath of a failed bid, said Schultz. With no sign of any competing bidders for Creval, Schultz added, "time will be on Crédit Agricole's side."