S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

8 Oct, 2021

By Abby Latour

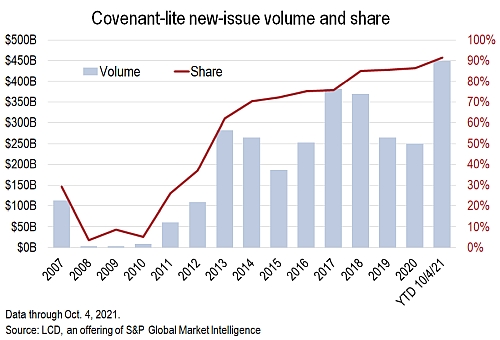

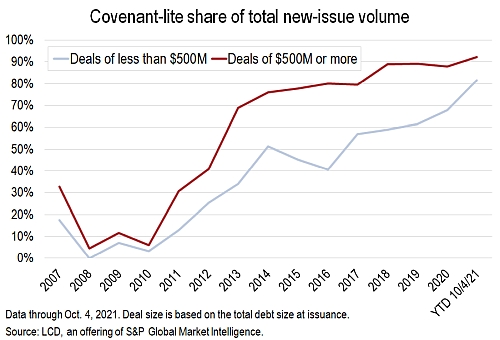

More than 90% of U.S. leveraged loans issued this year have been covenant-lite, a new record, further marking a two-decade-long transformation of the asset class in which nearly all newly issued loans have shed lender protections that once had been standard.

As of Oct. 4, the share of covenant-lite loans in the institutional loan market — which includes non-amortizing term debt, the type bought by CLOs — was 91%, the highest level on record, according to LCD.

Covenant-lite loans do not include maintenance covenants, which require borrowers to meet regular financial tests.

In absolute terms, year-to-date covenant-lite volume has already exceeded every full year on record. In 2000, covenant-lite loans represented roughly 1% of the market.

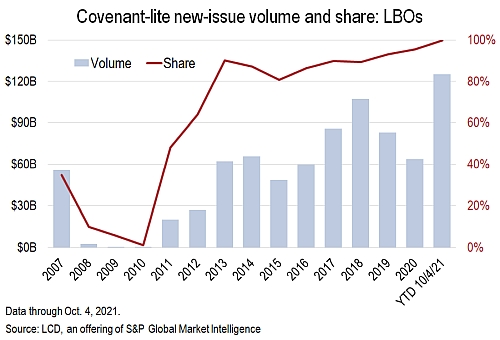

For loans backing LBOs, the share was even greater.

More broadly, some 86% of the $1.3 trillion in outstanding U.S. leveraged loans are covenant-lite, according to the S&P/LSTA Leveraged Loan Index. Likewise, that is a record.

The trend is worth noting because of the potential recovery levels. Covenant-lite facilities recover less than traditional term loans with maintenance covenants, an LCD analysis shows.

The trend toward covenant-lite debt in the syndicated loan market may also partly explain the rise of private credit loans. Private credit loans typically still offer lenders covenant protections, market sources say.

In recent years, private debt providers have taken market share from the syndicated loan market, LCD data suggests. The presence of covenants is one reason the structure is popular with lenders.

The vast majority of private loans still feature covenant protections, according to sources.

In fact, Stamps.com Inc. this week closed a $2.6 billion unitranche term loan backing an acquisition of the company by Thoma Bravo, the largest unitranche loan on record, according to LCD data. The term loan is covenant-lite. Behind the shift is competition among lenders and vast amounts of liquidity.