Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Mar, 2021

By Calvin Trice and Husain Rupawala

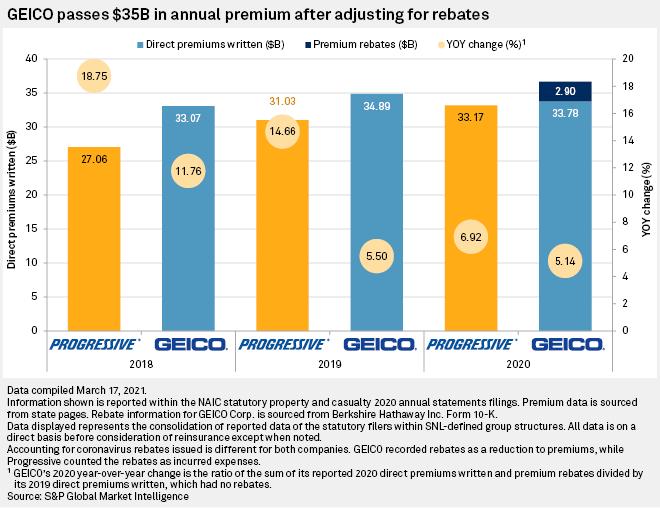

GEICO Corp.'s personal auto premiums passed $35 billion in 2020 while Progressive Corp. continued to narrow the gap between the two companies, according to an S&P Global Market Intelligence analysis.

After adjusting for premium rebates due to the coronavirus, Progressive continued a recent trend of growing faster than Berkshire Hathaway Inc.'s GEICO. Progressive grew at 6.92%, while GEICO experienced 5.14% growth based on statutory filings for 2020. The former had been closing in on GEICO for second place nationwide in private auto direct premiums written on the strength of consistent double-digit annual percentage growth.

State Farm Mutual Automobile Insurance Co. has been the perennial market share leader in the sector by a comfortable margin.

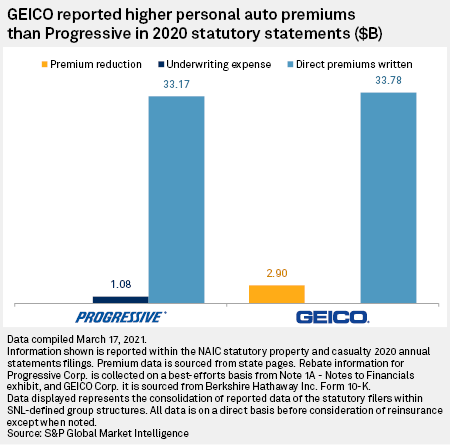

GEICO's growth rate and 2020 direct written premium total includes $2.90 billion in reported statutory premiums that the insurer would have expected to collect without the pandemic discounts it provided for new and renewal customers.

Excluding that figure, Progressive's dollar-for-dollar premium intake was within $1 billion of GEICO's $33.78 billion total for 2020, which would have been the rivals' closest-ever margin of difference. GEICO's direct written premiums declined without the adjustment.

Progressive also gave its private auto insurance customers temporary premium rebates to reflect fewer driving miles and accident claims but paid them as a business expense that did not lower premiums received. That expense totaled more than $1.08 billion, according to an S&P Global Market Intelligence analysis. Progressive's true growth rate is also slightly understated by its fiscal year accounting. Progressive stated that its fiscal year 2019 was one week longer than its fiscal year 2020.

In the long term, Progressive is likely to remain the industry's growth leader, CFRA analyst Cathy Seifert said in an interview. Still, price will always be the primary mover of new business and overall market share, and GEICO could keep pace with Progressive in the short term, Seifert said.

"We're starting to see price competition creep back into the auto insurance market," she said. "My sense is that GEICO might be more competitive on price, and that might enable them to put up some decent [growth] numbers."

Reduced driving and heightened pricing competition will likely be a drag on growth, Susan Griffith, Progressive's president and CEO, indicated during the company's March 2 quarterly earnings conference call.

"We are looking very surgically at each state, channel and product to give the right discounts to make sure we manage that trade-off between growth and profitability," Griffith said, according to a transcript.

In 2021, GEICO made a rare inorganic growth move with the purchase of Southern County Mutual Insurance Co., an acquisition that brought in an additional $141.1 million in direct written premiums.

Another driver of market share will be companies' development of analytics-based underwriting, Seifert said. Pandemic-induced remote work will have a permanent effect on driving patterns that reduces or eliminates consumers' commuting, she said. In that area, Allstate Corp. could have a growth advantage along with Progressive, Seifert said.

Given the active homebuying market, bundling home and auto coverage will also be a key determinant of market share and premium growth, and Allstate's more developed homeowners' presence will be an ongoing advantage there, she said.

"While Progressive and GEICO have a presence, they don't really have a significant presence," Seifert said.

Progressive grew its direct written premium by nearly 20% in 2018 and by almost 15% in 2019 before the pandemic-related slowdown of 2020. GEICO has also grown in recent years, but not at Progressive's rate.

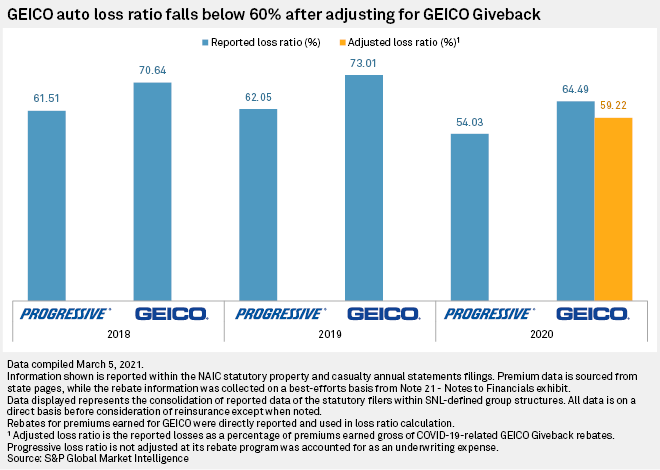

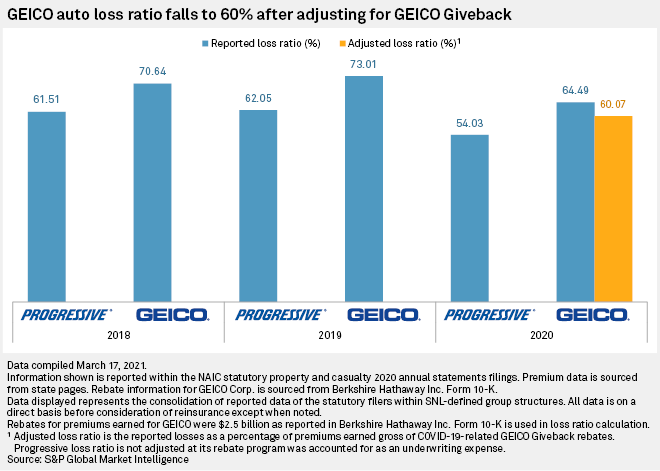

Adjusting for GEICO's premium discounts, the company saw its loss ratio dip below 60% for the first time in recent years. GEICO had reported a 70.64% ratio in 2018 and a 73.01% ratio in 2019.