Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 Feb, 2022

By Adrian Jimenea and Francis Garrido

|

People walk by the offices of UBS and Credit Suisse in Paradeplatz in Zurich. |

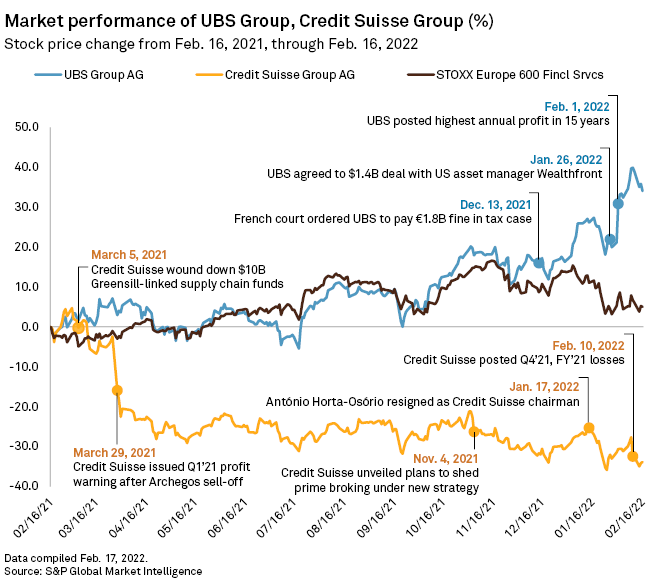

The share price gap between UBS Group AG and Credit Suisse Group AG widened significantly in 2021, reflecting the contrasting performance and expectations of the Swiss banks.

UBS shares rose 34.03% in the year to Feb. 16, bringing its market capitalization to CHF63.60 billion, nearly 3x the CHF21.48 billion market cap of Credit Suisse, the shares of which lost 33.87% of their value over the same period, S&P Global Market Intelligence data shows. The STOXX Europe 600 Financial Services index rose 5.02% in the year.

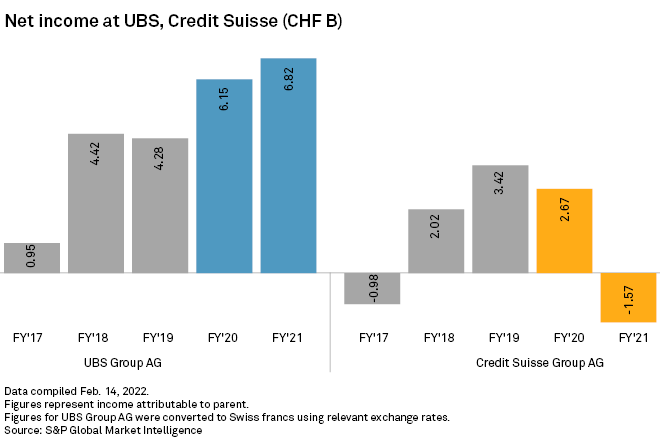

UBS — the full-year 2021 net income of which grew more than 10% to CHF6.82 billion, marking its highest annual income since 2006 despite recognizing provisions for its tax case in France — aims to continue its buoyant performance, while cross-town rival Credit Suisse — which booked a CHF1.57 billion loss for 2021 mainly due to its exposures to collapsed supply chain financer Greensill Capital (UK) Ltd. and U.S. hedge fund Archegos Capital — seeks to rebuild investor confidence through de-risking and business refocusing.

The two banks' 2022 outlooks are "quite contrasting," said Johann Scholtz, an equity analyst at Morningstar. They "face different situations" in 2022, with UBS starting from a position of strength while Credit Suisse remains in a period of transition, Pauline Lambert, executive director in the financial institutions team of Scope Ratings, told Market Intelligence.

The execution of Credit Suisse's revised strategy may prove challenging, analysts at S&P Global Ratings said. Offsetting the impact of the investment bank scale-down by boosting wealth and asset management could be constrained by tough competition and sensitivity to economic environments, and there are still "tail risks" over the impending resolution of the Greensill and Archegos matters, according to the agency.

Credit Suisse's strategy focuses "on strengthening and simplifying its integrated model and investing in sustainable growth, while placing risk management at the very core of the bank," a spokesperson told Market Intelligence.

Both banks could find it more challenging to grow revenues in an environment where market valuations are less supportive of assets under management, and therefore of fee income in their wealth management businesses, according to Scholtz. Credit Suisse is at the same time seeking to stem net asset outflows, he said.

Credit Suisse in 2021 saw net asset outflows of CHF2.9 billion in its Asia-Pacific business, while UBS generated net new fee-generating assets of $14 billion in the region in the same year.

Investors, however, should not "read too much" into the outflows, and it is encouraging that Credit Suisse has been seeing inflows so far in the first quarter of 2022, Eoin Mullany, an equity analyst at Berenberg Research, said. It is also a positive sign that the bank is observing "returning momentum" in trading activity, Mullany said in a Feb. 14 note.

Still, Credit Suisse revenues will likely remain pressured and "long-suffering shareholders will demand an improvement," according to Scholtz.

The S&P Capital IQ mean consensus estimate for 2022 revenues as of Feb. 18 was CHF32.78 billion for UBS based on 14 analysts reporting and CHF20.73 billion for Credit Suisse according to 10 analysts.

Credit Suisse had a weak start to 2022, CFO David Mathers said on an earnings call. Adjusted operating expenses will likely be at the top end of guidance at CHF17 billion due to increased compensation costs plus investment plans.

UBS, meanwhile, revised its cost-to-income ratio target for 2022 to 70% to 73% from 75% to 78%, a decision that reflects management's confidence, according to Scope Ratings' Lambert.

UBS is self-funding its growth initiatives through efficiency measures to reach approximately $1 billion of gross savings by 2023, a spokesperson said in an emailed response to questions.

UBS' performance growth means the stock seems fully valued, Scholtz said. In contrast, Credit Suisse shares look cheap, even when stripping out significant nonrecurring items, he said.

Management focus

"With numerous organizational changes, a reduced risk appetite and less supportive operating conditions, [Credit Suisse] will be seeking a new equilibrium," Lambert said. The actions the bank is taking may be positive but changing the culture and restoring investor confidence will take time," Lambert added.

Credit Suisse "is currently being run for capital preservation and fulfilling regulatory requirements, not shareholder returns," JPMorgan equity analyst Kian Abouhossein said in a note, adding that he was concerned about operational leverage following the bank's cost warning.

"We are executing our strategy with discipline and pace," the Credit Suisse spokesperson said via email, adding that the benefits should largely materialize from 2023 onward.

Meanwhile, UBS management appears to be "focused on returns over growth, as it will not dilute returns just to boost revenues in the near term," Berenberg Research's Mullany said in a separate note. UBS is implementing a $5 billion share buyback program and declared an ordinary 2021 dividend of 50 cents per share.

UBS is also expected to be disciplined on future M&A following its $1.4 billion acquisition of U.S.-based investment manager Wealthfront Corp., Mullany said. UBS intends to use Wealthfront for growth and direct technology before managing it for profit and loss. This means UBS CEO Ralph Hamers is taking "a longer-term view of potential growth opportunities," as he does not want to inhibit any new business by focusing on profitability too early, according to Mullany.