S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

11 Jun, 2021

By Hassan Aftab and Stefen Joshua Rasay

The content consolidation wave turned into a tsunami in May as U.S. media companies sought to better position themselves in the global streaming wars.

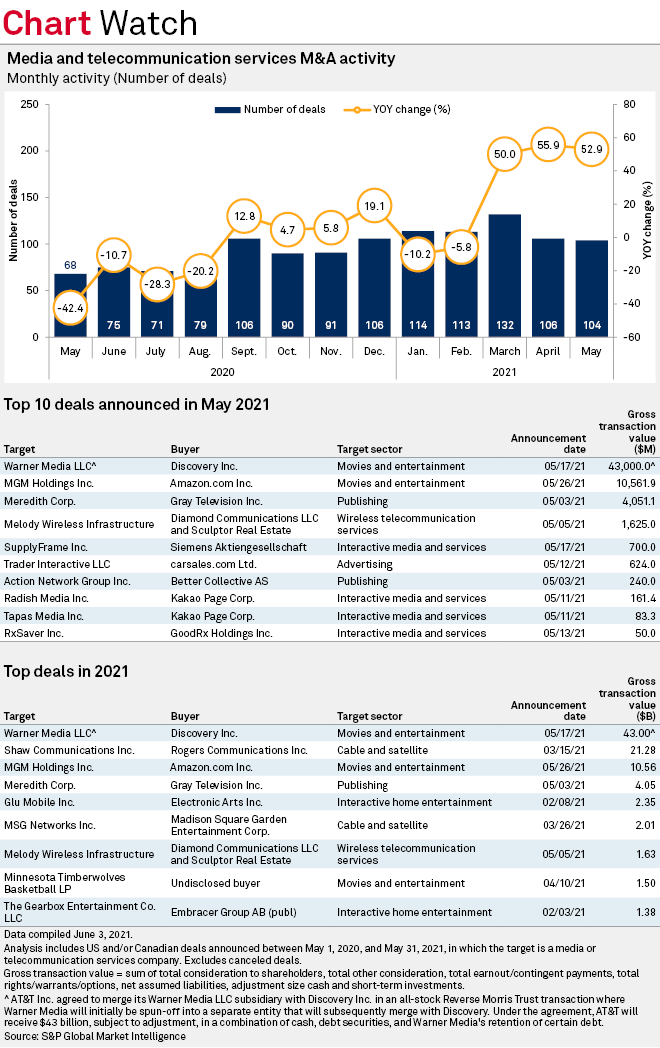

S&P Global Market Intelligence counted 104 sector deal announcements with disclosed transaction values in May, compared to 106 in April. By comparison, the sector saw 68 announcements in May 2020, when deal activity had stalled during the pandemic.

Discovery Inc.'s proposed agreement to merge its nonfiction and international entertainment and sports businesses with Warner Media LLC's entertainment, sports and news operations marked the largest sector deal announced in May. AT&T Inc., Warner Media's parent, will receive $43 billion in cash, debt securities and other considerations under the deal, which is expected to close in the middle of 2022.

Discovery President and CEO David Zaslav anticipates key assets brought together by the merger to boost the unified company to the upper echelon of streaming video providers like Netflix Inc. and Disney+. Zaslav expects Discovery to attract up to 400 million global direct-to-consumer subscribers through the combination, though he did not give a timeline.

In addition, AT&T CEO John Stankey said he sees the potential for the offering to expand further with different types of content, including music and gaming.

Goldman Sachs & Co. LLC and LionTree Advisors LLC were financial advisers for AT&T, while those for Discovery include Allen & Co. LLC, J.P. Morgan Securities LLC, Perella Weinberg Partners LP and RBC Capital Markets LLC. Neither company disclosed any financial advisory fees, but for comparisons' sake, Allen & Co. and another adviser each charged $50.0 million for an adviser fee and $5.0 million for a fairness opinion when they advised Time Warner on its 2018 sale to AT&T.

The second-largest deal was Amazon.com Inc.'s $10.56 billion planned purchase of MGM Holdings Inc. The move will give the e-commerce, cloud and streaming conglomerate a substantial catalog of content to battle streaming rivals The Walt Disney Co., Netflix and AT&T's HBO Max.

Retail analysts, including Dan Romanoff from Morningstar and Tuna Amobi from CFRA Research, expect the transaction to be part of a bigger push by Amazon to buy up other movie studios to further bolster its streaming library. However, Kagan analyst Wade Holden pointed out that many regulators are not very pleased with consolidation among tech conglomerates, and lawmakers are proposing bills that would impede their deal-making. Kagan is a media research group within S&P Global Market Intelligence.

While Amazon's financial advisers remained unnamed, MGM received financial advisory services from LionTree Advisors and Morgan Stanley. Fees for neither adviser were disclosed.

Gray Television Inc.'s $4.05 billion agreement to buy Meredith Corp.'s local media group TV stations in cash after Meredith spins off its National Media Group Inc. back to shareholders was No. 3 on the list.

Meredith expects to become a consumer-focused, lifestyle media company following the transaction, which is due to close in the fourth quarter. In June, Meredith accepted a revised proposal from Gray Television that will allow Meredith's shareholders to receive $16.99 per share, up from $14.51 per share previously, and a 1-for-1 equity share following deal closure.

Wells Fargo Securities LLC was sole financial adviser to Gray Television, while Meredith was advised by BDT & Co. LLC, Lazard Ltd. and Moelis & Co. LLC. The companies did not disclose advisory fees.