S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

29 Jul, 2022

By Dylan Thomas

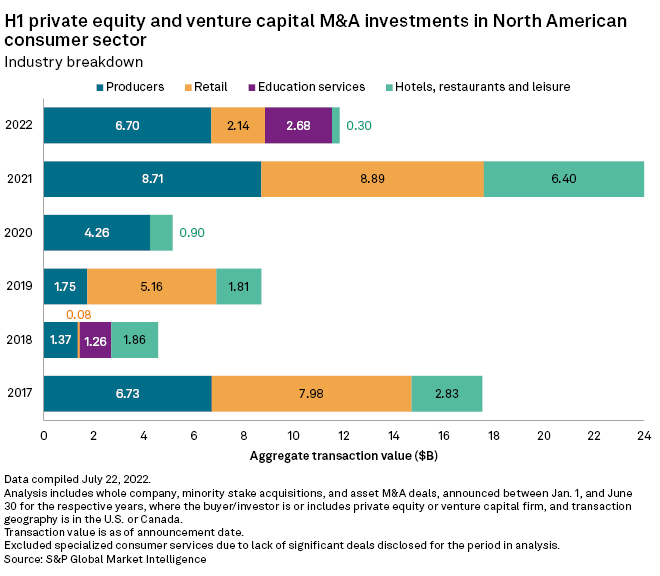

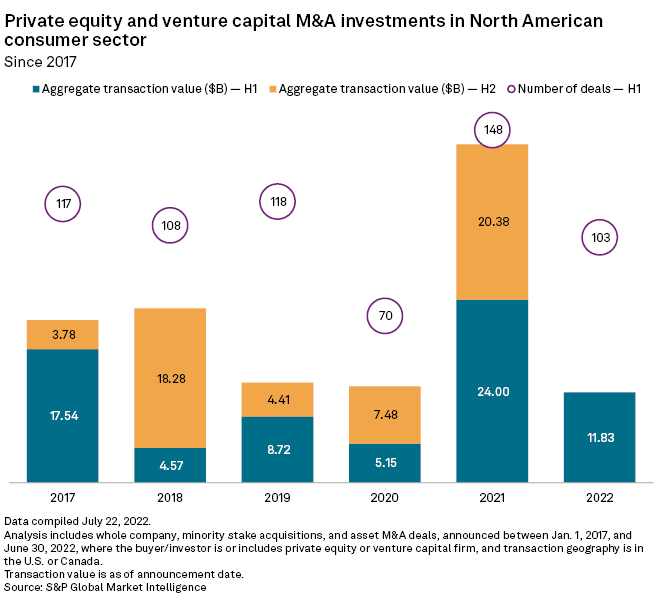

Private equity-backed M&A in the consumer sector fell in the first half of 2022, with entry activity plunging more than 50% to $11.83 billion, compared to the pace set in the same period in 2021 when the aggregate value totaled $24 billion, according to S&P Global Market Intelligence data.

Interest in the sector as measured by new funds in market also appears to be on the wane. In 2021, there were 69 private equity funds in market targeting consumer companies, but that number had shrunk to 15 as of July 22, according to the data.

Price watch

Retail companies face mounting challenges from inflation, ongoing supply chain disruption and the pressure to raise employee wages, pressure that is reflected in index performance. The market capitalization of the S&P 500 Consumer Discretionary Index dropped nearly 22% year over year as of July 26, while the overall S&P 500 Index shed about 12%. The S&P 500 Consumer Staples Index fared better, up about 4% during the same period.

As public markets declined in the first half, driving down company valuations, the average value of disclosed private equity-backed deals in the consumer sector fell by about 8% to $910 million compared to the same period a year earlier, according to Market Intelligence data, which includes both consumer discretionary and consumer staples companies.

The value of some retail companies fell more steeply in the second quarter. An example is retailer Kohl's Corp., which in early June rejected a takeover bid from private equity firm Sycamore Partners Management LP that reportedly would have valued the company in the mid-$50s per share. The company's share price went on to hit a 52-week low of $26.07 on July 26.

Falling valuations can provide discounted entry points, presenting a "significant [buying] opportunity for private equity," said Glenn Mincey, global and U.S. head of private equity for professional services firm KPMG, who added that sellers are "becoming much more reasonable" about the reset in valuations. Additionally, private equity's global store of investable capital remains at or near all-time highs and much of it is ready for deployment.

Consumer company deals post-pandemic will require private equity teams to focus on certain areas, said Kevin Martin, U.S. consumer and retail lead for KPMG. Investing in companies' digital capabilities remains one of the key value-creation levers in the consumer sector.

"The pandemic, if it did one thing, it enforced a lot of acceleration in the digital transformation agenda, and that provides a lot of opportunities for private equity. Now they are able to step into and think about consumer and retail businesses slightly differently," Martin said.

"How do you accelerate profitable growth in customer, in channel, in geography and in product? I think those are four key pillars that private equity can now think about when they're looking at making these investments," Martin said.

Sector complexity

The pandemic and its aftermath increased the complexity of the consumer sector. Both personal incomes and consumer spending ticked up in June, even as inflation pushes prices up, according to the most recent data from the Bureau of Economic Analysis at the U.S. Department of Commerce. The Personal Consumption Expenditures price index, showing the cost of goods and services, was up 6.8% in June from the same month a year ago, the biggest year-over-year leap since 1982.

At retail giants Target Corp. and Walmart Inc., shelves occasionally went empty during the upheaval of the pandemic, but they are now facing the opposite problem of "inventory bloat," packing stockrooms and eating into profits, according to a June report by KKR & Co. Inc.

"What we just went through in retail in the last three years, it's a complete roller coaster," said Dennis Cantalupo, CEO of Pulse Ratings Inc., a credit rating and consulting firm focused on the retail industry.

Cantalupo said he was surprised at the relatively high valuations paid by firms that entered the consumer sector in 2021 when rising wages and government stimulus prompted a temporary surge in consumer spending.

"If we're going through a volatile period in retail, and we don't know how far sales are going to drop over the next couple of years, then I'm going to have a hard time putting debt on that balance sheet until I know that this company is going to be able to service that debt," he said.

For private equity investors who bought into the consumer sector last year, a company's ability to service debt will be at the forefront, Martin added.

"There will be a tighter focus on cost, but also the top line," Martin said.