Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Jan, 2023

Short sellers stuck with consumer discretionary stocks throughout 2022, betting that persistently high inflation would continue to erode demand.

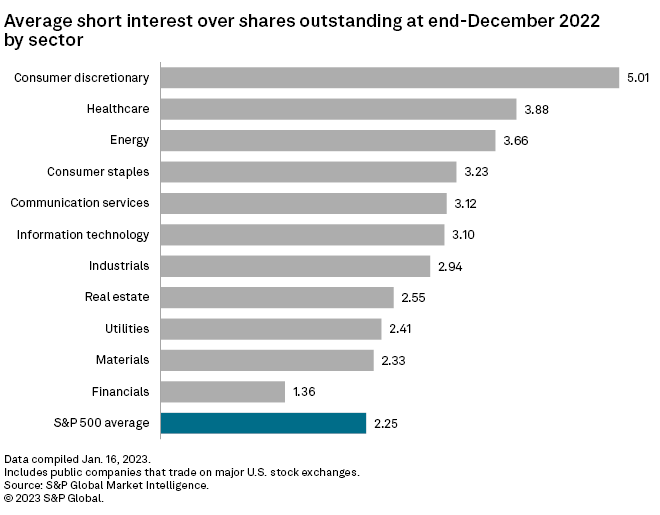

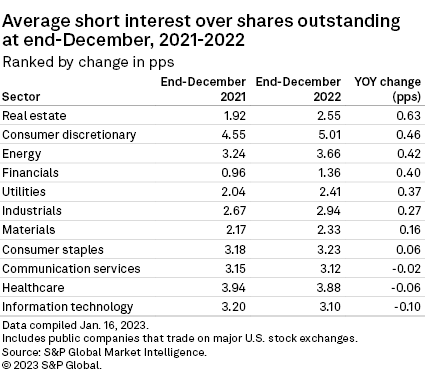

Short interest in consumer discretionary stocks on all major U.S. exchanges ended 2022 at 5.01% and was the most-shorted sector throughout the year, according to the latest S&P Global Market Intelligence data. Short interest, which measures the percentage of outstanding shares held by short sellers, averaged 2.25% for the S&P 500 at the end of 2022.

Consumer discretionary has been the most-shorted sector in U.S. equities since July 2021, when it overtook healthcare. Short interest in the healthcare sector was 3.88% at the end of December, down from its 2022 peak of 4.48% at the end of May.

Financials was the least-shorted sector throughout 2022, averaging 1.36% short interest at the end of December, which was up from below 1% at the beginning of 2022.

Closer look at consumer discretionary

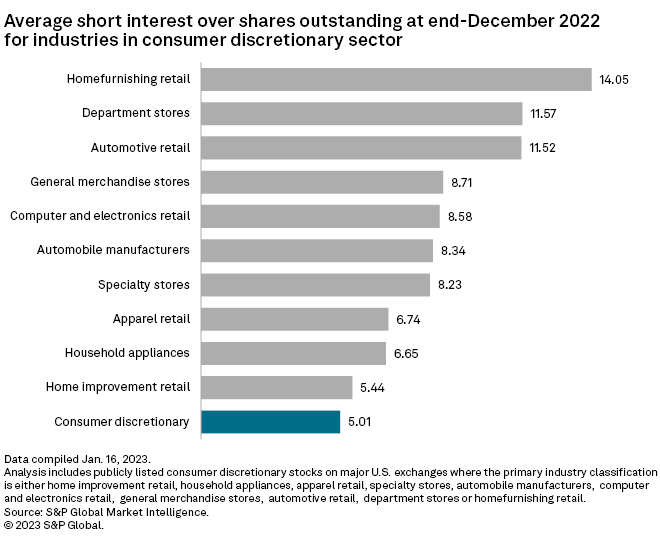

Within the consumer discretionary sector, short sellers bet heavily against home furnishing retail stocks, which had short interest of 14.05% at the end of December. Department stores and automotive retail stocks also drew a large amount of short selling, at 11.57% and 11.52%, respectively.

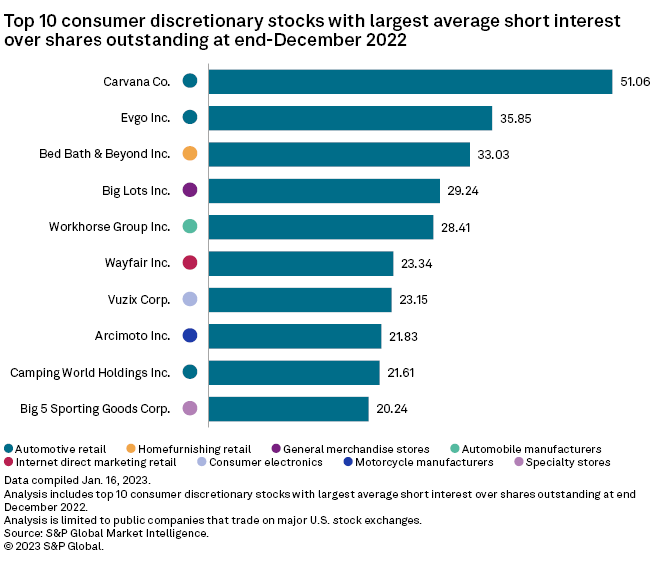

Carvana Co., EVgo Inc. and Bed Bath & Beyond Inc. were the three most-shorted consumer discretionary stocks at the end of 2022.

Short interest in Carvana grew from 12.59% at the end of 2021 to 51.06% at the end of 2022.

Most shorted across sectors

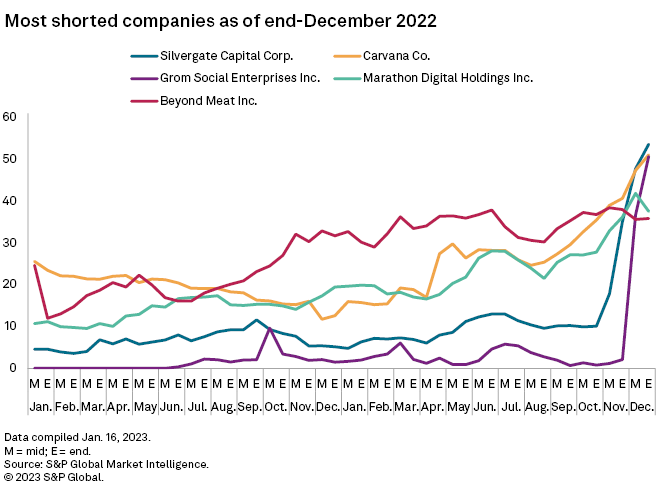

Carvana was the second most-shorted stock at the end of 2022, after Silvergate Capital Corp., which saw its short interest jump from 10.09% at the end of October to 53.6% at the end of December.

Grom Social Enterprises Inc. was the third most-shorted stock at the end of 2022 with 50.64% short interest, up from just 2.1% at the end of November.

Real estate posts largest jump

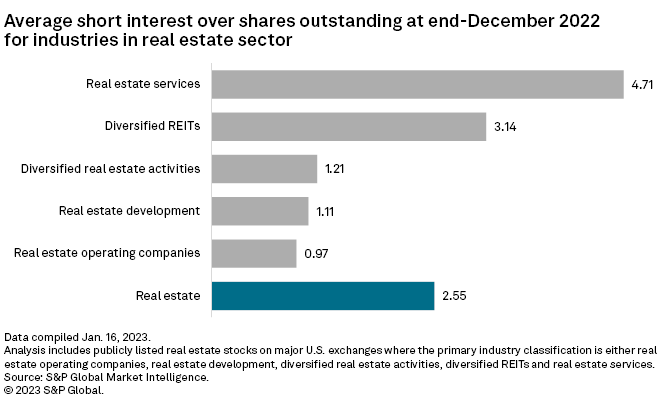

Short interest in the real estate sector increased by the largest percentage during the year among sectors, jumping from 1.92% at the end of 2021 to 2.55% at end of 2022.

The sector was hindered by the ongoing work-from-home movement that has particularly impacted commercial real estate.

Within the sector, real estate services were the most shorted at the end of 2022, with 4.71% short interest.