S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

17 Mar, 2022

By Rehan Ahmad

|

| Blank-check listings provide an alternative route for private companies to go public. |

New listings of blank-check companies in Singapore and Hong Kong will likely be constrained by competition from relatively strong IPO markets, more stringent regulatory requirements and difficulties in finding targets.

Singapore has hosted three listings of special purpose acquisition companies since the city-state allowed such listings in September 2021, including Temasek Holdings (Pvt.) Ltd.-backed Vertex Technology Acquisition Corp. Ltd. and Tikehau Capital-backed Pegasus Asia. Hong Kong Exchanges and Clearing Ltd. has not hosted any SPAC listings since its framework became effective Jan. 1, although it received 10 applications as of March 16, a spokesperson of the bourse said. The applicants include Aquila Acquisition Corp., which is set to list on March 18, the spokesperson added.

Singapore Exchange Ltd. declined to disclose the number of listing applications it has received from SPACs, skeleton organizations launched with the intention of buying and reverse merging with a private company.

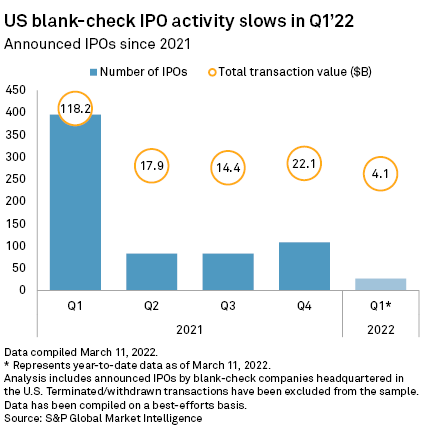

"The cooling off in the U.S. market will have an effect on SPACs in Asia, but it is early days in Asia and there is a need for the product here," said Thomas Kollar, Hong Kong-based corporate and securities partner at law firm Mayer Brown. "SPACs will get done in Asia but volumes may be more muted than originally anticipated."

Estimates by Hong Kong-based consulting firm Quinlan & Associates show the SPAC market in the region is expected to be worth up to $39.6 billion by 2025.

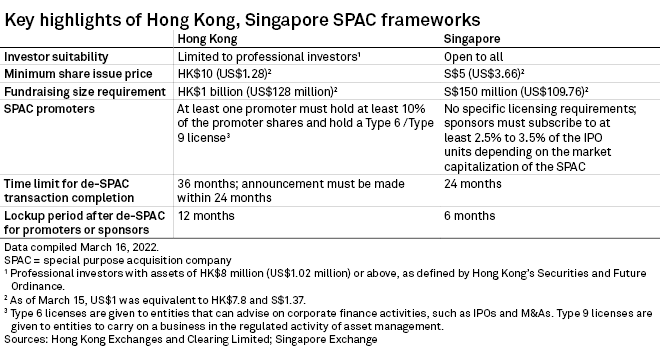

Singapore and Hong Kong are among the latest markets to join the SPAC party, which is still dominated by the U.S. where the hype started to cool off after hitting a high point in the first quarter of 2021. Hong Kong opted for a more conservative approach, requiring higher sponsor commitments and lockup periods, while Singapore's framework is slightly more relaxed and has been described as similar to that of the U.S., according to some analysts.

Liquidity will be a challenge

Experts identified liquidity as a potential challenge for shell companies seeking to list in Hong Kong and Singapore, as there needs to be enough qualified investors participating in order for a SPAC to go public. Hong Kong only allows professional investors to be SPAC investors, whereas Singapore Exchange allows for retail investor participation in a SPAC IPO.

"One potential short-term challenge may be the large number of listing applications already in the pipeline, which will compete for liquidity in the market," said Xiaoxi Lin, partner at Linklaters. Linklaters advised Hong Kong's first SPAC applicant, Aquila Acquisition.

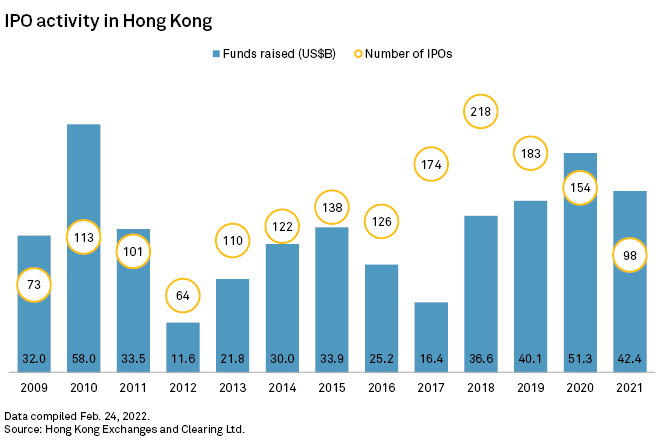

Companies in Asia continue to utilize the traditional IPO route to list. While the smaller Singapore stock exchange saw just eight IPOs in 2021, Hong Kong has remained a hot destination for listings, helping companies raise $42.4 billion in aggregate proceeds in 2021, compared to $51.3 billion in 2020. In the first two months of 2022, Hong Kong's stock exchange helped seven companies raise $1.17 billion through IPOs, according to its website.

Finding targets

SPACs in the region may struggle to find targets after listing as they run against specific time frame requirements. In Singapore, SPACs need to merge with a private business within two years, and Hong Kong SPACs need to do so within three years.

"The one challenge all SPACs will face regardless of their listing venues is the time frame to find an acquisition target and the successful de-SPAC," said David Liu, head of Asia-Pacific for Kroll's compliance risk and diligence practice. "For those listed in Hong Kong and Singapore, they have just started the journey and will be looking at the time frame limitations."

Further, Liu said the minimum market capitalization requirement for Hong Kong SPACs is $128 million and $111.6 million for Singapore SPACs, higher than the range of $50 million to $100 million for U.S. SPACs. "This could limit or exclude smaller acquisition targets," Liu said.

Several Southeast Asian unicorns have been popular merger targets for U.S. SPACs, although some eventually chose to pursue the traditional IPO route.

"There are many factors impacting the decision whether a company chooses a SPAC or IPO route. Two key factors are timing and disclosures," Liu said.

Companies often will proceed or withhold the timing of their listings, depending on market conditions. Firms that choose to list in the U.S. via a SPAC will also need to abide by U.S. disclosure rules, compared to different disclosure rules if they list in their local stock exchange.

Southeast Asia's ride-hailing giant Grab Holdings Ltd. went public in the U.S. via a SPAC in December 2021. Meanwhile, Indonesian online travel services company PT Traveloka Indonesia

Traveloka declined to comment, saying it does not "comment on market speculation."

"A number of high quality of SPACs have filed in Hong Kong — Aquila Acquisition Corp. or Trinity Corp. for example — where sponsors are high quality and sector or financial experts," said Raghu Narain, head of investment banking for Asia-Pacific at Natixis Corporate & Investment Banking. "They have specific angles to merge with good target companies with business in [mainland] China that allows for Hong Kong and [mainland] China target companies to merge with these SPACs, and have a consequent public listing in HKEX."

Aquila Acquisition is backed by China Merchants Bank Co. Ltd.'s international asset management arm and aims to focus on technology-enabled companies in new economy sectors in Asia with a focus on China, according to its filing. Trinity Acquisition Corp., which targets global consumer lifestyle companies with "compelling growth potential" in mainland China, is backed by Chinese sporting goods giant Li Ning Co. Ltd. and LionRock Capital Ltd., according to its filing.