S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

22 Dec, 2021

By Lauren Seay and Ronamil Portes

Many community banks might not be willing to give up overdraft revenue despite growing pressure to defray the practice from both competitors and regulators.

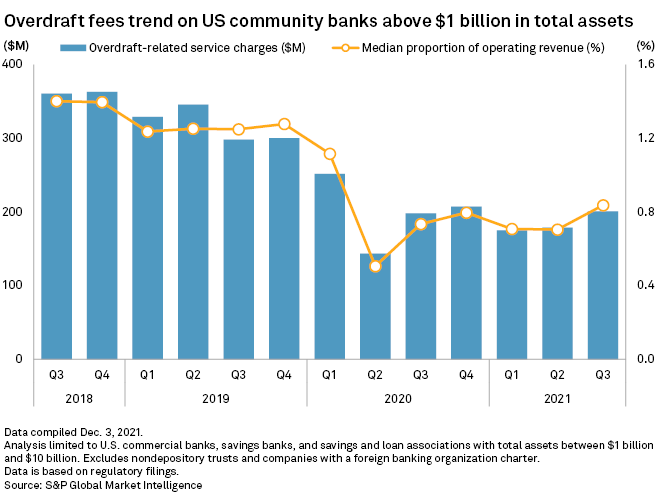

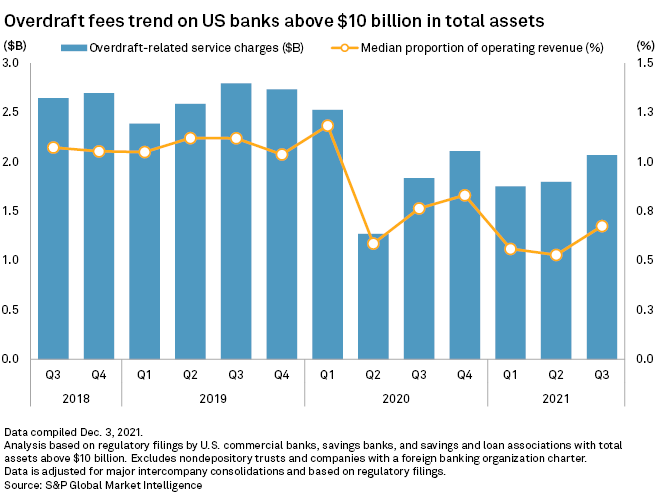

Overdraft fee income constitutes a larger part of community banks' operating revenue than it does for larger banks. In the third quarter, the median ratio of overdraft fees to operating revenue across community banks between $1 billion and $10 billion in assets stood at 0.84%, compared to 0.67% among banks with over $10 billion in assets. Banks under $1 billion in assets do not have to report overdraft revenue.

While community banks are not yet feeling as much political and regulatory pressure as the larger banks on the issue, many are beginning to rethink their overdraft practices to proactively respond and preserve the attendant noninterest income, experts said.

"They're in a much more precarious position because their overdraft fees account for a much larger portion of the overall profit," said Justin Hayden, managing principal at consultancy firm Capco, in an interview. "A lot of these community banks won't survive if they turn around and cut it off one day without having any planning in place to offset the revenue."

Mounting pressure

Regulatory, social and competitive pressures culminated in 2021, pushing a handful of larger banks to overhaul their overdraft practices.

Capital One Financial Corp. made headlines with its Dec. 1 announcement that it is eliminating overdraft and nonsufficient fund fees, making it the largest U.S. bank to make such a move. About a week later, JPMorgan Chase & Co. announced changes to its checking accounts to help consumers avoid overdraft fees. Earlier in the year, Ally Financial Inc. announced that it would eliminate all overdraft fees.

Overdraft-related service charges for all U.S. banks declined dramatically in the second quarter of 2020 at the onset of the COVID-19 pandemic and have remained down from pre-pandemic levels, according to S&P Global Market Intelligence data.

For community banks, the ratio of overdraft fees to operating revenue has somewhat recovered — up 11 basis points in the third quarter from the year-ago period — but remains more than 40 basis points below 2019 levels.

Despite the mounting pressure to rethink overdraft practices, experts attributed the decline in community banks' overdraft fee income to consumer behavior, such as greater discipline and awareness among consumers and the excess cash in consumers' pockets, rather than a change in overdraft fee practices.

Much of the regulatory and political pressure to change overdraft practices has been isolated to the largest banks, but community banks are increasingly feeling competitive pressure as more large banks change their overdraft practices and neobanks gain market share, industry experts said.

Some think the pressure will be too much for community banks, forcing them to reconsider the practice in 2022 and to adjust their fee schedules as neobanks touting consumer-friendly policies have gained traction and taken market share.

"It's becoming a competitive necessity for banks to take a new look at this," Ron Shevlin, director of research at the consulting firm Cornerstone Advisors, said in an interview. "We're past the point of sit and wait and see what the rest of the market does. ... There's just too many institutions and providers already doing something. It's going to force everybody else's hands."

But many community banks may not feel the need to respond to the competitive pressure just yet as excess cash and tepid loan demand continue to weigh on loan-to-deposit ratios, said Gabe Krajicek, CEO of Kasasa, a financial technology company that provides products and consulting to community banks and credit unions.

"They have more deposits than they know what to do with. So if they were aggressively trying to gain consumers, then they would care a lot about the competitiveness of their overdraft fee," Krajicek said in an interview. "The pressure to get more competitive will coincide with the pressure to drive deposits."

As a result, most community banks will not opt to completely nix overdraft fees in order to preserve noninterest income, Krajicek said.

Exploring options

Because they are not under a microscope like the largest banks, community banks "don't need to do a big bang where they come out and announce they're just going to get rid of overdraft fees," Capco's Hayden said.

Instead, community banks will take more moderate approaches to preserve that fee income while also responding to mounting pressures, experts said.

Some banks are opting to offer one account with zero overdraft fees as an option for consumers, rather than nixing overdraft fees on all checking accounts. Cities for Financial Empowerment Fund, a nonprofit organization, established its Bank On initiative to help financial institutions develop and maintain checking accounts that are accessible to underbanked individuals. For an account to meet the Bank On standards, it must have no overdraft fees.

Bank On has seen an uptick in banks offering accounts that meet the standards as pressures have intensified, said David Rothstein a senior principal at the CFE Fund and leader of the Bank On initiative. But "most of the financial institutions we're working with still have products that do have overdraft," Rothstein added.

Alternatively, some community banks may choose to lower their overdraft fee amount and increase other fees on other accounts to offset the lost income, experts said. Another option community banks are evaluating is giving consumers time to avoid the overdraft charge, similar to JPMorgan Chase's recent move.

"It's not as simple as just discontinuing it. It's just too much revenue for the banks to leave on the table," Cornerstone's Shevlin said.

Banks that choose to completely eliminate overdraft fees will likely do so as a statement to consumers, Krajicek said.

"If you see it happening, that [financial institution] is making a statement about how they feel about consumers because that will not be helping them economically in any way," Krajicek said.