Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Jan, 2023

By Alison Bennett and Ronamil Portes

The regulatory and competitive pressures the largest banks faced last year regarding overdraft fees are starting to trickle down to the nation's smallest institutions.

It is unlikely that community banks will reduce or eliminate those fees to the same extent the financial industry saw at the nation's biggest banks in 2022, under pressure from both the Consumer Financial Protection Bureau and competitors, because community banks are more reliant on overdraft fees as a revenue source, analysts and attorneys told S&P Global Market Intelligence.

"In 2023 and beyond, you're going to see some migration of those changes from bigger banks to smaller banks," James Stevens, co-leader of the financial services industry group at Troutman Pepper, said in an interview. "Small banks have been looking at that and thinking about, 'What does that mean for us?'"

Community banks depend more on these fees

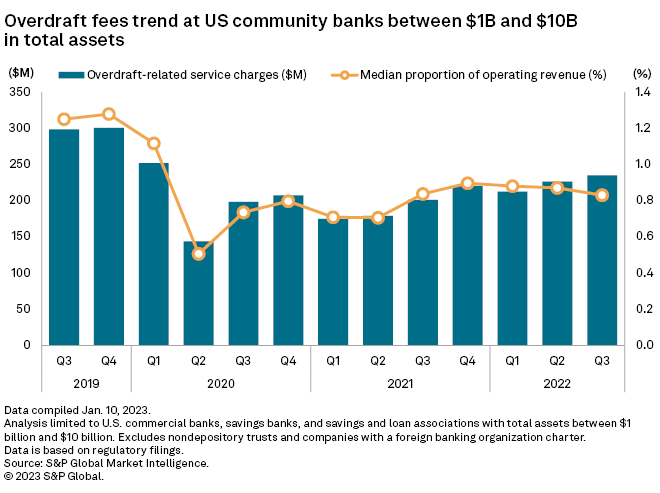

U.S. community banks with between $1 billion and $10 billion in total assets have reported an increase in total overdraft-related service charges in all of the past seven quarters except for one as of Sept. 30, 2022.

Meanwhile, the median proportion of overdraft fees to operating revenue for those banks remained mostly steady since the third quarter of 2021, and dropped slightly in the third quarter of 2022 to 0.83%.

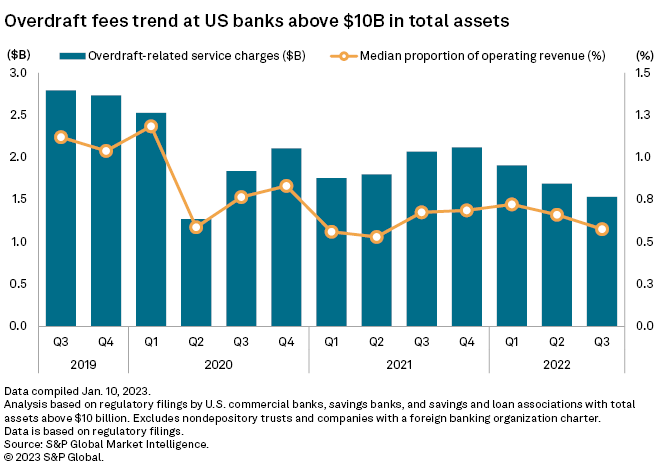

On the other hand, banks with more than $10 billion in assets have reported a decline in overdraft fee income every quarter since the fourth quarter of 2021. At Sept. 30, 2022, those banks reported $1.53 billion in overdraft-related service charges, but overdraft fees made up a median of just 0.58% of operating revenue, reflecting some of the big changes over the past year. Median overdraft fee income as a proportion of operating revenue for these banks has declined every quarter since the first quarter of 2022.

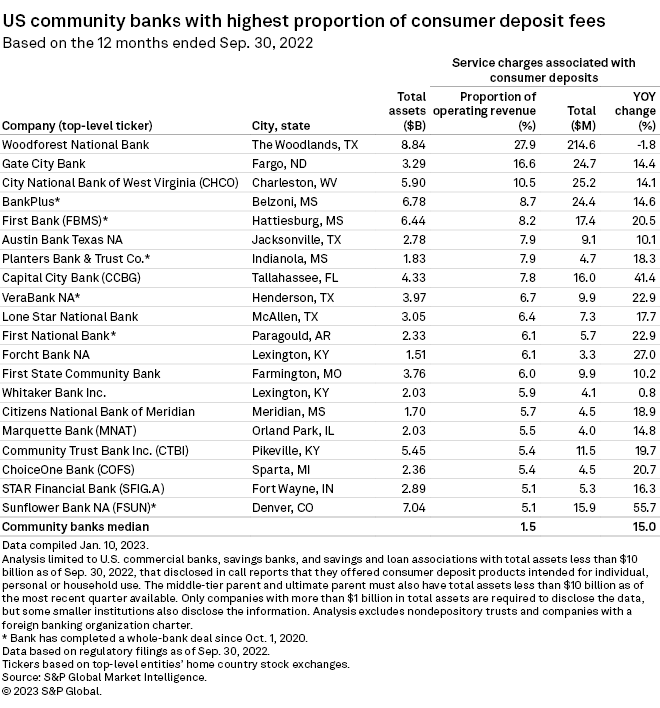

In the quarter ending Sept. 30, 2022, three community banks stood out as generating more than 10% of their operating revenue through service charges related to consumer deposits, which include overdraft fees, maintenance service charges, and ATM fees. Woodforest National Bank topped the list by earning 27.9% of its operating revenue with these charges, more than 10% above the bank in second place: Gate City Bank, which generated 16.6% of its operating revenue through these charges. Charleston, W.V.-based City National Bank of West Virginia came in third with 10.5% of its operating revenue coming from consumer deposit charges.

While community banks depend on these deposit fees more than larger competitors, they could soon be forced to rethink their overdraft fee practices, industry experts said.

"There's certainly going to be pressure or scrutiny placed upon all institutions, no matter what size, no matter if they're federally chartered or state-chartered," Charlie Stutts, partner and banking specialist at law firm Holland & Knight, said in an interview. "The focus will be on enhanced disclosures, and then customer communications and resolution to those instances where they are charging the fees."

Regulatory pressures culminating

Much like the CFPB, which regulates banks with more than $10 billion in assets, the Federal Deposit Insurance Corp. is gradually turning its attention to overdraft activity, experts said, though it has not announced any specific action in this area. Industry experts said the FDIC is expected to be the linchpin of the Biden administration's efforts with small institutions.

"What we've been hearing from smaller banks is that they're hearing the FDIC start to talk about overdraft," Chris Willis, a partner with Troutman Pepper who closely follows bank regulation issues, told S&P Global Market Intelligence.

The shift in attitude toward overdraft practices has put examiners "between a rock and a hard place," according to Jeff Naimon, a partner who works with banks and nonbanks at Buckley LLP.

"A lot of the long-time examiners are looking at long-time deposit practices of the banks they supervise and are surprised when all of a sudden, [the practices are] being questioned as potentially illegal," he said.

Community banks are also stuck between a rock and a hard place as they see the CFPB's efforts creating a national conversation on overdraft, which forces them to make difficult decisions in a competitive environment, according to Steven Simpson, a bank adviser at Cornerstone.

"It's a tough equation for banks. They really have to dance on that razor's edge," he said.

While the FDIC's focus may not be as sharp as the CFPB's crackdown on the larger banks, prudential regulators are starting to push their regulated banks "to go in that direction," Willis said.

Specific states are also starting to pay close attention to overdraft fees.

California Democratic Gov. Gavin Newsom approved a bill in September 2022 that requires state-chartered banks and credit unions to annually report to the state what they earned from overdraft fees and nonsufficient funds fees. They also must provide the percentage of revenue comprised of those fees. Those banks have until March 1 to submit the information to The California Department of Financial Protection and Innovation, and the data will be released to the public.

Prior to that, only banks with more than $1 billion in assets are required to disclose overdraft income information to federal regulators.

Competitive pressures

Competitive pressure is growing too, experts told S&P Global Market Intelligence. As a significant part of that, financial technology companies are luring in increasing numbers of customers, advertising low or no fees for banking services that can be conducted entirely online.

"That's a big issue at big banks and small banks," Naimon said. "The fintechs are making those offers, and they're getting a lot of customers. Some banks are operating on outdated technology, and much of the world is operating on new technology. Community banks are facing not only a tech issue, but a fee issue, so they're facing kind of a two-front battle."

With pressure building from many directions, smaller banks need to be looking forward.

"Change is coming," Troutman Pepper's Stevens said. "It's going to be driven ultimately by regulatory and competitive pressure. Now is the time to start figuring out what works for your institution, and what you want to do to the extent that you rely on fees, what products and services you can add."

Hesitant to give up fee income

Though regulatory and competitive pressures are trickling down to community banks, they are unlikely to make changes as dramatic as those made by the biggest banks last year, Willis said. However, they are re-examining their overdraft fee practices, experts said.

"We're seeing banks look at and assess both the circumstances in which they charge customers, whether they can provide a little bit more grace one way or the other for the customers," Naimon said.

Community banks are looking at how much they charge and "whether they feel that's appropriate in light of market changes," Naimon said.

But community banks are unlikely to give up overdraft fee income completely, experts said. Instead, they are looking at new services that would allow them to give customers a break on overdraft while the bank continues to generate revenue, according to Capco managing principal Adrian Ungureanu.

Some banks are putting in place monthly fees to cover overdrafts and insufficient fund transactions. They have realized that consumers "are not opposed to paying for services as long as they're justified in the value of it," he told S&P Global.

A good option could be to garner clues from larger banks, Ungureanu said. For example, he said, Wells Fargo & Co. is now offering a "flex loan" for customers in amounts of either $250 or $500 for a flat fee of $12 or $20 as part of its overdraft overhaul. That provides flexibility and relief to consumers while it continues to bring in money, he added.