S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

11 Jan, 2022

By Kris Elaine Figuracion

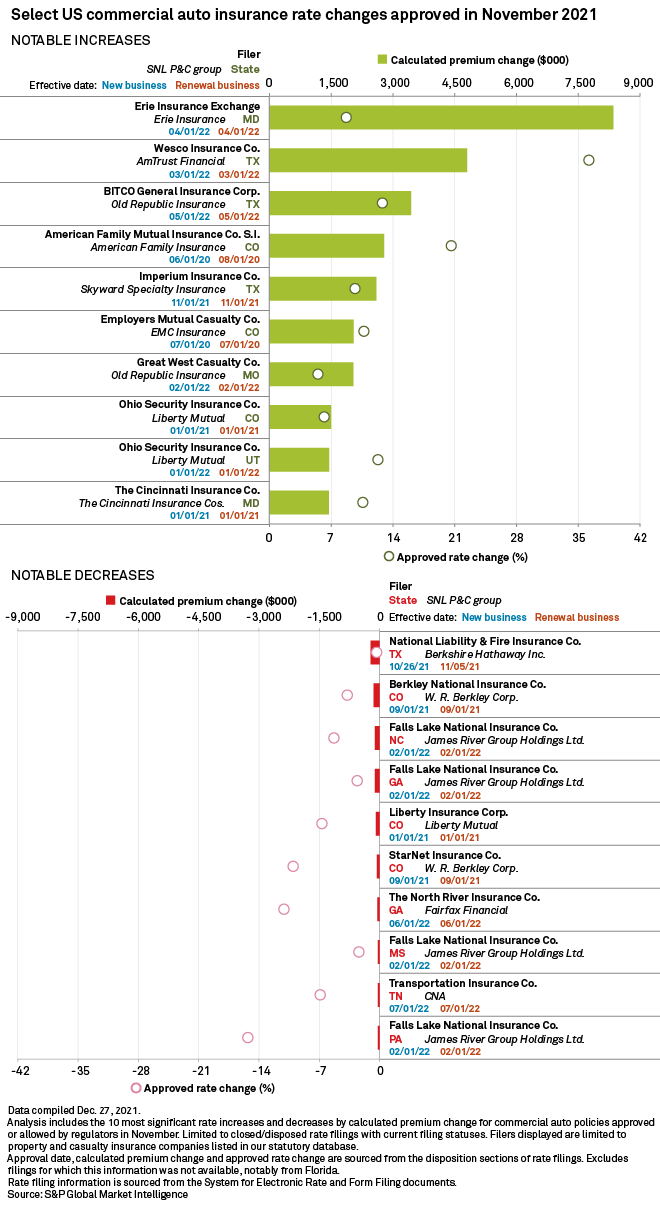

Commercial auto rate increases approved in Texas during November 2021 could lead to an additional $17.3 million in premiums written across the industry, the largest for any single state, according to an S&P Global Market Intelligence analysis. In fact, three of the five most-impactful commercial auto rate increases during the month were in Texas.

Old Republic International Corp. could see the largest cumulative positive premium impact from rate increases approved in November 2021. The company received approval for 20 rate hikes that, when combined, could boost the group's premiums written by $9.5 million. More than half of the projected gain is expected to come from six rate increases approved by regulators in the Lone Star State.

Erie Indemnity Co. is expected to see the second-largest rise in premiums, thanks to a single rate hike. The 8.7% rate increase stands to raise Erie Indemnity's premiums written by $8.4 million. The increase will affect about 17,300 policyholders.

On the other side of the spectrum, James River Group Holdings Ltd. could experience the largest cumulative negative premium impact from rate cuts approved in November 2021. The six rate reductions approved for the group during the month could lower its premiums written by nearly $327,000.