S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

4 Nov, 2021

To read all of our coverage of COP26, click here.

Germany's largest banks need to be more aggressive on cutting coal financing and helping the country execute a speedy and orderly phaseout, environmental groups and investors say.

Since the passing of Germany's coal exit law in July 2020, Deutsche Bank AG, Commerzbank AG and other leading banks in the country have tightened requirements and imposed new restrictions for coal finance, yet loopholes remain. Most bank policies do not specify the immediate steps being taken to achieve alignment with European and global carbon emission-reduction goals and coal-exit deadlines, critics say. Key features still missing from lenders' policies include deadlines and consistent requirements for companies that would need financing during their transition from coal.

"The engagement process is happening, but the red lines haven't been drawn so far," Katrin Ganswindt, a coal-exit campaigner at environmental and human-rights organization Urgewald, said in an interview. Banks cannot afford to wait several more years for their clients' transition plans because this would delay lenders' own efforts to exit coal, Ganswindt warned.

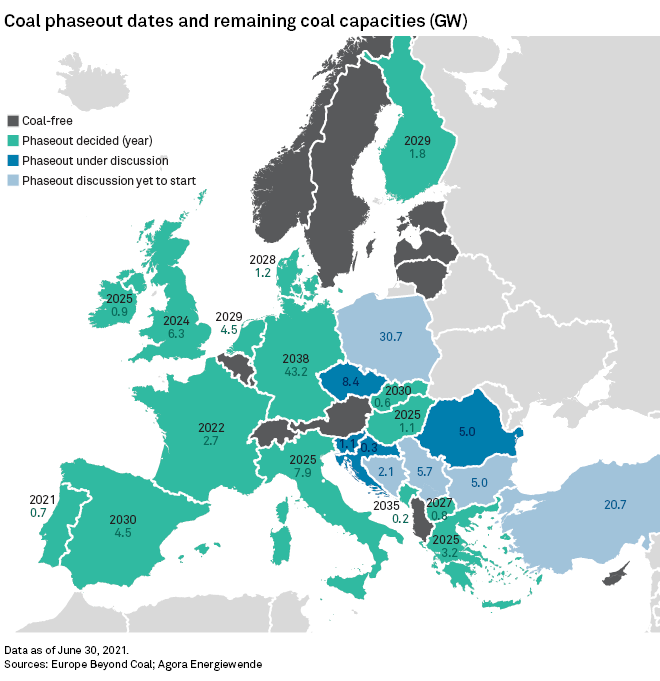

The clock is ticking for both banks and corporates in Germany. The three parties now in talks to form the next coalition government — the Social Democrats, the Greens and the Free Democrats — said in a statement Oct. 15 that they will seek to accelerate the country's phaseout by eight years to 2030.

This will align Germany's timeline with EU plans to speed up the reduction of greenhouse gas emissions to 55% by 2030 compared to 1990 levels, instead of the previously planned 40%. The more ambitious goal would also require a faster coal exit in the EU as a whole, as Germany has the largest remaining coal capacity in the bloc.

Open tap

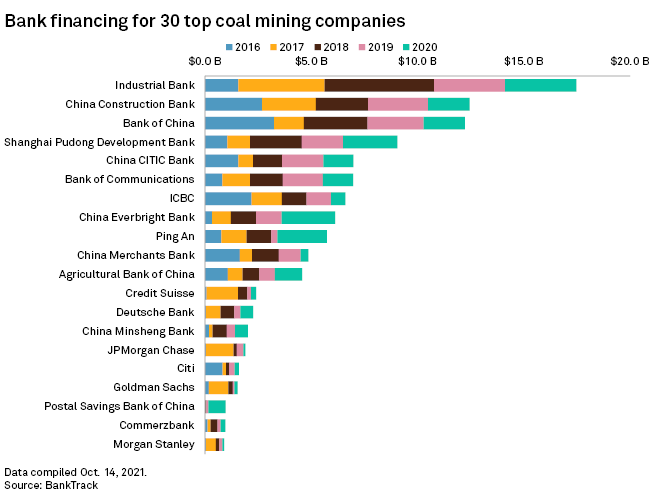

Global bank financing for the world's top 30 coal mining companies was higher in 2020 than in 2016, the year the Paris Agreement on climate change was signed, a fossil fuel finance report by several NGOs, including BankTrack and Reclaim Finance, shows. Deutsche Bank was named one of the top three global coal mining financiers outside of China.

All banks have restricted direct funding of new coal power plants, projects and capacity extension, and have tightened lending criteria, but a lot of support still flows into the coal sector through debt and equity underwriting. About 72% of coal financing comes from underwriting shares and bonds and just 28% from lending, which means bank policies are missing over two-thirds of general coal financing, Ernst-Jan Kuiper, a climate campaigner at BankTrack, said in an interview.

Even if the underwriting is meant to finance the companies' transition, without clear step-by-step plans on their part, banks have no way of knowing whether some of it ends up supporting coal activities or contributing to a delayed coal exit, environmentalists said.

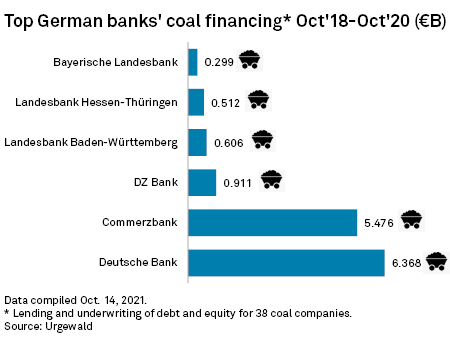

Looking at German banks' total lending and underwriting for 38 coal companies between October 2018 and October 2020, Urgewald found that Deutsche Bank came out on top only because of high underwriting volumes, while Commerzbank was the country's leader by loan volumes. Commerzbank's lending book had the highest exposure to greenhouse gas-emitting sectors among Europe's 26 largest banks, according to a Jefferies analysis published in June.

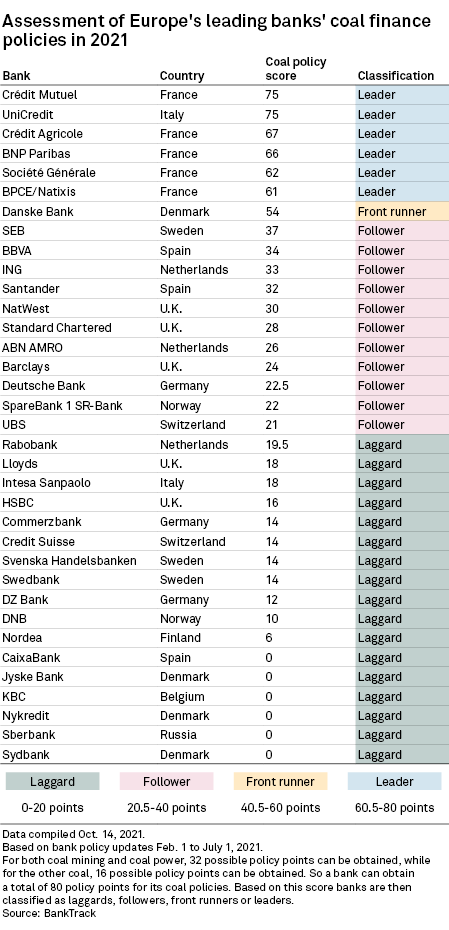

Indeed, German banks have some of the least advanced coal policies among their European peers, according to an analysis by BankTrack and responsible investment charity ShareAction.

Commerzbank does not comment on studies made by other institutions, a spokesperson for the bank told S&P Global Market Intelligence. "In general, as we are a leading German bank, our portfolio broadly reflects the German economy. ... With our products and financing, we support our clients in their transformation efforts. We keep looking closely at the transitional risks associated with this strategy," the spokesperson said.

Deutsche Bank is the only big German bank so far to set a deadline for ending thermal coal mining financing, including direct lending and capital markets transactions, by 2025. "The share of coal financing is already less than 0.1% of our loan portfolio and we are further reducing this share," a spokesperson for the bank said.

Yet Deutsche Bank's policy is one of the most lenient. It permits the financing of companies that are more than 50% dependent on coal, measured either in terms of their energy generating capacity or actual output, if they present credible diversification plans. The bank's policy does not specify what constitutes credible.

A 50% threshold is far too lax, Urgewald campaigner Kathrin Petz said in an interview. Most other banks have set 20% to 35% thresholds for financing coal-dependent clients. Landesbank Baden-Württemberg's policy is the most restrictive, with 20% threshold for new and existing foreign clients and plans to cut the threshold for existing German clients to 25% in 2025.

Regional bias

Many lenders have also set different restrictions for their domestic and foreign clients, which does not make any sense and should be changed in the future, said Jeanne Martin, senior manager in the banking standards team of ShareAction. "Whenever I see such a distinction, I always wonder, is it because they have more clients in the region that has a less ambitious threshold?" Martin said.

Commerzbank's policy prohibits new business relationships with companies in the energy supply sector for which the share of electricity generated from coal, based on production performance, is higher than 30% for Germany-based companies and higher than 50% for clients based outside of Germany.

Landesbank Baden-Württemberg, or LBBW, the largest German federal state bank by total assets, has also set different thresholds for existing clients but is less restrictive for domestic than foreign companies. Under its new policy announced in July, the bank will not provide financing to Germany-based energy suppliers in its existing client portfolio that generate 35% of electricity or revenue from coal, while the threshold for existing foreign clients is 20%.

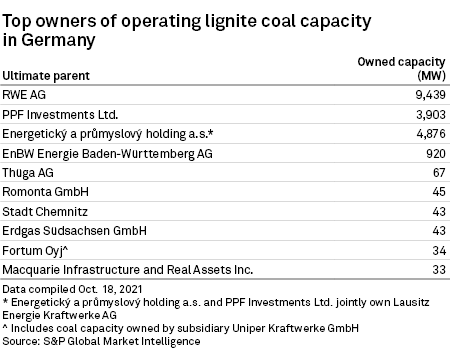

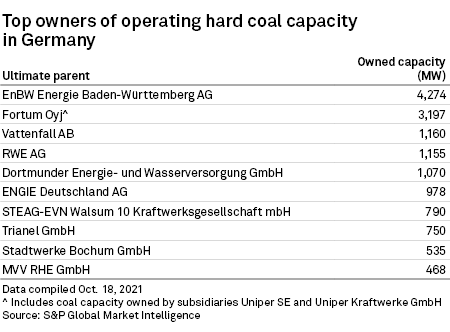

While Deutsche Bank and Commerzbank's financing is more international, LBBW and fellow federal state banks Landesbank Hessen-Thüringen Girozentrale and Bayerische Landesbank, mainly provide financing for the biggest hard coal and lignite power plant owners in Germany — RWE AG and EnBW Energie Baden-Württemberg AG.

A wider problem

These issues are not limited to German lenders. The top 10 European banks by volume provided more than $9.6 billion of coal mining financing to the 30 largest companies in the sector from 2016 to 2020, while the figure was $17.60 billion for coal power financing, BankTrack data shows.

"I've been in multiple bank dialogues as an investor ... and I continue to be frustrated at the lack of robust expectations," said Lauren Compere, director of shareowner engagement at Boston Common Asset Management. "Especially on coal, the timeline needs to be accelerated and expectations need to be put in place now with corporate clients."

"Ultimately, what we as investors are asking for and really, truly trying to understand is how banks are reducing and accelerating the timeline to exit coal," Compere said. "If a bank has adopted a net-zero strategy, what does that mean at all levels, including at the origination level and those that oversee those client portfolios?"

Assessment is key, and it needs to be backed by robust carbon methodologies like the Partnership for Carbon Accounting Financials, Compere said. But banks also must use this assessment to set firm targets and metrics, not just for their overall coal portfolio but also across subsectors to help investors really understand the risks.

All of this must happen sooner rather than later. "If the timeline is 2030, we're actually very focused on the here and now. What are you doing now to set targets and metrics? What are going to be the interim goals for 2025?" Compere said. "I think banks are a little bit reluctant to provide true visibility on this because it makes them vulnerable."