Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

30 Jul, 2021

By Bill Holland

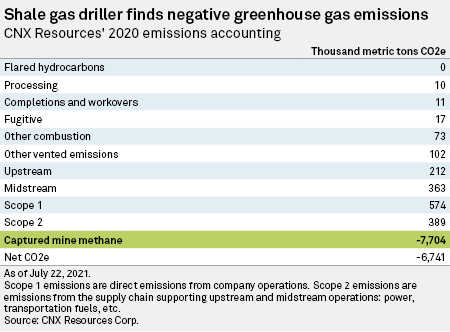

CNX Resources Corp. announced that it is net carbon negative in major emissions because of methane capture at a Virginia coal mine, but some observers challenged the idea that the Appalachian shale gas driller and former coal company can be considered completely carbon negative.

Being a negative emitter would make CNX unique in the oil and gas exploration and production segment, an industry that is taking steps to survive a global transition away from fossil fuels. The company made the most of this assertion with an appeal to investors interested in environmental, social and governance issues.

"Many in the energy industry and capital markets continue to speak in the abstract and distant future about ESG, sustainability, resiliency, carbon intensity and the industrial logic of consolidation," CNX President and Chief Executive Officer Nick DeIuliis said in a July 22 statement that accompanied the corporate responsibility report announcing that the company was carbon negative. "CNX pursues a different path: one that prioritizes the development of our extensive existing asset base over further scale and that focuses on transparency, measurable outcomes, current and nearer-term deliverables, and long-termism defined by growing per-share intrinsic value."

DeIuliis said the company's effort "results in a net carbon negative footprint today, a truly sustainable business model of a low-cost producer that regularly returns capital to shareholders and the opportunity to pursue exciting new opportunities for further methane capture and abatement."

"We believe we are the rare combination of tangible, impactful and local ESG results coupled with low-risk free cash flow per-share generation that presents the best-in-class option for ESG-focused investors," the CEO said.

|

Analysts examine CNX emissions

Oil and gas industry analysts agreed that the company is in a unique situation, but some said CNX is probably not at net-zero on emissions, much less net-negative. As CNX itself said, they observed that the company is not accounting for carbon emissions from the burning of its product, methane, which are Scope 3 emissions as defined by the U.S. Environmental Protection Agency.

According to the EPA, Scope 3 emissions come from assets not owned or controlled by a reporting company but are still connected to the organization's value chain. Scope 1 emissions are direct greenhouse gas emissions from sources controlled or owned by the company, and Scope 2 emissions are indirect greenhouse gas emissions tied to the company's purchase of electricity, steam, heat or cooling. CNX said it was net carbon negative for Scope 1 and Scope 2 emissions in its corporate responsibility report.

CNX Chief Excellence Officer Olayemi Akinkugbe said the company can set an example for the industry. "I take issues with [organizations' announcements that] 'We're going to be X, Y, or Z in 2030 or 2040 or 2050,'" Akinkugbe said in an interview. "Clearly, there is no accountability there."

"The goal for us here is to just make sure people are looking," Akinkugbe said. "We wanted to show them this is leadership. Yes, this is tangible. Let's stop talking about aspirational."

But the idea that CNX is net negative might be a stretch, said Andrew Grant, Carbon Tracker Initiative's head of climate, energy and industry research. A London-based think tank, Carbon Tracker examines the impacts of the energy transition on capital markets.

"Is [CNX] carbon negative? Arguably, no," Grant said. "There is a short-term warming benefit to removing methane, a more potent contributor to global warming. They've effectively removed somebody else's Scope 1 emissions and moved it to their Scope 3 emissions."

The containment of the methane is noteworthy, but it might not make CNX carbon negative, said Michael Ferguson, Americas sustainable finance leader at S&P Global Ratings.

"I don't think I'd agree that this makes them a negative carbon emitter," Ferguson said. "In some manner of speaking, it may be technically true that their Scope 1 emissions are netted out by capturing someone else's coalbed methane. But obviously, this doesn't account for Scope 3 emissions, which would be the overwhelming majority of CNX's emissions."

"It does potentially highlight that there's a need for [greenhouse gas] capture in reaching 2-degree scenarios, though," Ferguson added. "In the case of methane, it's a lot more potent as a greenhouse gas than carbon is, so something like this could be impactful." The 2-degree scenario was part of the 2015 Paris Agreement on climate change: Countries and companies will try to limit global warming to no more than 2 degrees Celsius by 2100 to avoid potential environmental catastrophe.

Capturing methane has climate benefits, and CNX should get credit, Raymond James & Associates oil, gas and renewables analyst Pavel Molchanov said.

"Keeping track of methane abatement is entirely legitimate," Molchanov said. "From a climate standpoint, it is essential. Methane as a greenhouse gas is 20-times more potent than CO2. Oil and gas companies that reduce methane emissions — which can be done through various means — are performing a valuable service for the environment."

CNX subtracts captured methane from emissions

The greenhouse gas accounting at CNX is straightforward. The company recognizes its Scope 1 and Scope 2 emissions, but the company deducts coalbed methane that it captures inside Coronado Global Resources Inc.'s giant Buchanan metallurgical coal mine complex and then resells. CONSOL Energy Inc., the forerunner of CNX, sold the mine to Coronado in 2016 as CONSOL spun off coal operations to focus on oil and gas. CONSOL became CNX in November 2017.

"That methane has to be swept out of that mine in order for you to be safe, to actually operate," CNX's Akinkugbe said. "And typically when you sweep it out, it goes through the ventilation system, goes through the ventilation shaft and is vented into the atmosphere."

"What are we doing based on activity on Scope 1, Scope 2 ... is preventing this from going to the atmosphere," Akinkugbe said. "Given that we've been doing this for decades, our math is we are net negative."

CNX, like most U.S. oil and gas producers, does not track Scope 3 emissions. Producers typically say that emissions in this category are impossible to estimate and are more appropriately charged to customers that use the product.

"We focus on Scope 1 and 2 because that is what we directly manage, unlike Scope 3," CNX spokesperson Brian Aiello said. "No one is zero carbon on Scope 1, 2, and 3 — not an [exploration and production] company, a pipeline company, a wind company, renewable utility, smartphone maker or clothing line company; no one — which confirms our view that the world runs on carbon."

Aiello said CNX will have more to say about Scope 3 emissions "in the near future."