Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 Apr, 2021

By Bill Holland

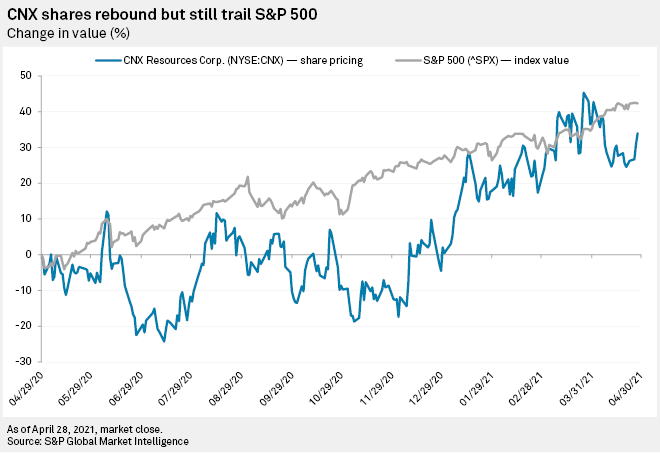

Appalachian shale gas driller CNX Resources Corp. will probably use most of its free cash flow to pay down debt, President and CEO Nicholas DeIuliis told analysts on an April 29 conference call to discuss a first-quarter earnings report that beat expectations.

It was the fifth quarter in a row in which the Pittsburgh-area exploration and production company posted positive free cash flows after following a strategy of paying little for firm transportation and avoiding any expensive acquisitions.

The company bought back $18 million of stock in the first quarter and paid down $70 million of debt while showing $105.5 million in free cash flows, according to S&P Global Market Intelligence's calculations. For the full year, CNX said it expects to spend about $450 million to produce 555 Bcfe of natural gas and liquids, generating $450 million in free cash, a figure it raised by $25 million based on a better outlook for NGL prices.

"The term we often use to describe our approach on M&A is just 'ruthlessly clinical,'" DeIuliis said. "What we don't ever want to do is get into one or two positions: one, where we acquired something and we sort of fall back on that classic descriptor of a 'strategic acquisition,' which is typically code for something that's destroyed value, or two, something that is largely or hugely speculative on a gas price view versus where the forward strips are."

"As long as we're seeing yields on free cash flow, the rate of return, so to speak, of a buyback is very compelling relative to a dividend," DeIuliis said. "If and when that changes … that closes [the] free cash flow yield and value gap, then something like a dividend makes much more sense."

CNX reported $81 million in adjusted net income for the first quarter, compared to $112 million in the prior-year period. Analysts surveyed by S&P Global Market Intelligence expected to see $62 million in adjusted income in the first quarter.

"CNX delivered a clean 1Q21 that beat on strong NGL prices," Stifel Nicolaus & Co. shale oil and gas analyst Michael Scialla told clients. "Management remains focused on return of capital via share repurchases and debt reduction, and 2021 free cash flow guidance increased as the seven-year plan to generate more than $3 billion of free cash flow remains on track."

A newly appointed chief excellence officer, Executive Vice President Olayemi Akinkugbe, revealed that CNX plans to roll out new technology to capture methane emissions from the company's pneumatic devices and controllers, which make up 50% of CNX's direct emissions.

"The blowdown solution under development also allows us to recirculate methane, which would otherwise be emitted into the atmosphere, back into gathering systems," Akinkugbe told analysts. Akinkugbe promised more specifics in the near future.

According to climate data provider Trucost, CNX had the lowest intensity of direct emissions of any of the nation's major shale gas drillers in 2019, after it spun off coal assets. Greenhouse gas emissions intensity is defined as tonnes of emissions per millions of dollars in revenue.

The corporation's production came to 140.6 Bcfe in the first quarter, compared to 134.4 Bcfe in the prior-year quarter. CNX realized an average price of $2.62/Mcf for its natural gas in the first quarter, including hedges, roughly flat to the $2.60/Mcf it saw in the same quarter of 2020. For its combined oil, gas and liquids production, CNX said it realized $2.73/Mcfe in the first quarter, higher than the $2.59/Mcfe it posted a year ago.

Trucost is part of S&P Global Market Intelligence.