Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 Aug, 2021

Cloud-computing giants and phone companies have decided they need each other to drive the market for 5G business services.

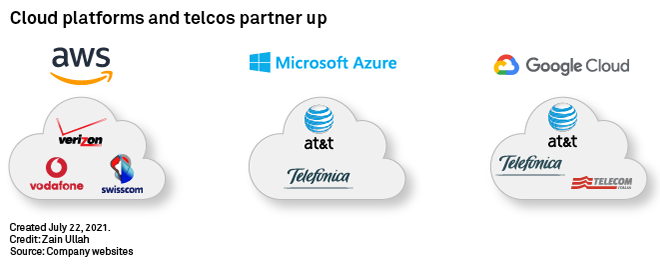

Amazon Web Services, Google Cloud and Microsoft Corp. have all signed partnerships with telcos in recent months as they seek new opportunities amid slowing growth in demand for data storage. Telcos, including AT&T Inc. and Verizon Communications Inc., are also looking to revive flagging revenue while tapping into cloud computing's ability to make super-fast 5G networks more efficient and cheaper to run.

"The cloud companies need to reinvent themselves," said Omdia analyst Vlad Galabov. "Communications service providers have the same thing — everyone has a mobile phone, a network — so both have saturation."

The parties are working together to bring computing functions such as data processing onto the 5G network, closer to where data is generated. This system, known as multi-access edge computing, or MEC, enables partners to offer enterprise services such as real-time analytics, manufacturing automation and live product tracking.

Verizon and Amazon Web Services — the cloud arm of Amazon.com Inc. — are offering this feature to individual businesses after expanding their partnership to include Private MEC in April.

Verizon also has a separate tie-up with International Business Machines Corp. to jointly develop MEC services.

"Demand for the technology is global, which gives both companies a lot of potential for new opportunities and markets," IBM Vice President Marisa Viveros told S&P Global Market Intelligence. IBM boosted its second-quarter cloud revenue 13% to $7 billion this year.

Google Cloud has signed deals with the likes of AT&T, Telefónica SA and Telecom Italia SpA. The Alphabet Inc. unit wants to help telcos monetize 5G as a "business services platform," Google Cloud CEO Thomas Kurian said in 2020.

Microsoft and AT&T took their partnership to a new level in June, with the software company agreeing to buy 5G technology and engineering staff from the telco. Microsoft will now manage AT&T's 5G network traffic, and the telco will continue to operate the infrastructure.

"In the future, cloud providers could take on more network-based workload opportunities, and thus potentially more operational roles," an AT&T spokesperson told S&P Global Market Intelligence.

Such a trend could ultimately raise the question of who actually operates 5G infrastructure — telcos or cloud companies — said Kevin Restivo, research manager of European Enterprise Mobility at IDC. "We're just seeing the groundwork being laid for the next decade of how telcos are run and who wins and who loses out of that."

It may also make it harder for telcos to differentiate themselves if they are all relying on the same cloud-computing providers, Omdia's Galabov said.

Verizon is not contemplating farming out its network operations, as the telco "sees incredible value in owning its own network," a company spokesperson said. Telefonica and Telecom Italia did not respond to requests for comment.

For now, telcos are focused on drawing on cloud-computing providers' strengths to help hasten the rollout of enterprise 5G offerings.

Cloud-computing giants "can help the telcos monetize investment by adding value and offering a channel to the customers," said Brian Partridge, an analyst at 451 Research, a research division of S&P Global Market Intelligence. They are "framing what they do well and overlapping that with what the operators do well."