Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

4 Apr, 2022

By Karin Rives

With the 2022 proxy season about to move into full swing, publicly traded companies and investor activists are gearing up for what observers believe could become the most lively and contentious shareholder meetings in U.S. history.

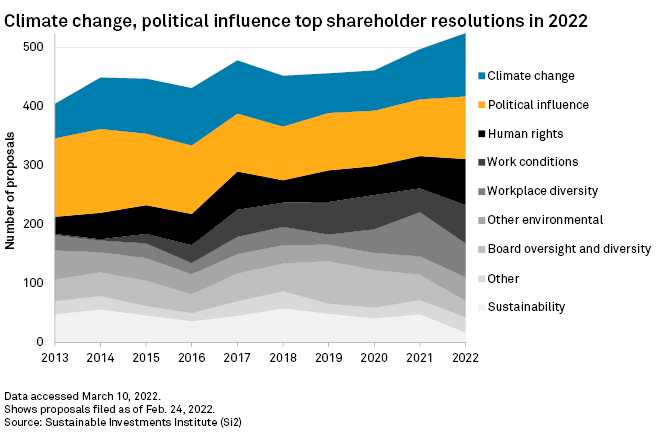

Climate change is topping the list among the record number of shareholder proposals filed so far. The closely watched Proxy Preview published by three investor advocacy groups in March reported that climate-related proposals, at 21%, comprised the largest share of 529 shareholder resolutions filed at that point.

Investors are asking companies to be more specific in how they set such goals: Emissions from entire value chains, detailed net-zero transition plans and aligning carbon reduction targets with the most ambitious goal under the Paris Agreement on climate change are now par for the course.

By March 31, the total number of shareholder resolutions filed had risen to 567, according to a tally from the Sustainable Investments Institute, on which the Proxy Preview's data relies. Climate resolutions still made up the largest share at 20%.

"It's a massive increase, totally unprecedented," Heidi Welsh, the institute's founder and executive director, said of the growing volume of proposals. "Last year, there were only 200 in the whole year that went to a vote. We're now looking at 300 still pending for votes."

"Climate change is the top issue to watch in the 2022 proxy season," executives with PricewaterhouseCoopers LLP and Broadridge Financial Solutions Inc. wrote in a March 14 preview published by the Harvard Law School Forum on Corporate Governance. "Many investors are no longer satisfied simply with greater disclosure of companies' climate impacts and risks. They're looking for concrete emissions targets. They want to see robust board oversight of climate risks."

Proposals for more transparency about corporate political influence and lobbying are close behind climate change, making up 19% of all resolutions, according to the Proxy Preview. Human rights at 15% is another priority for shareholders concerned with systemic racism and environmental justice.

Climate risks and 'multi-stakeholder capitalism'

There is a growing concern among investors over risks that businesses face from increasingly extreme weather and other impacts that affect infrastructure and supply chains. That is driving the surge in climate proposals this year, Welsh said in an interview. So is frustration over the Biden administration's inability to get its carbon reductions agenda through Congress, Welsh said.

Also on investors' minds is the U.S. Securities and Exchange Commission's proposed climate-risk disclosure rule. Although the rule is not expected to be finalized until late this year, many investors will be wondering if companies are preparing for the shift, possibly affecting their votes, proxy season observers say.

The SEC, meanwhile, is allowing many more proposals to move ahead than it did under the Trump administration. As of March 31, the SEC has already rejected 48 corporate challenges seeking to halt a shareholder resolution, compared with 37 for all of 2021, Welsh said. The change comes after the agency in November 2021 tossed a Trump-era memo that limited what investors could ask for, especially in the climate area.

Six of the largest U.S. banks, for example, will now face proposals requiring them to develop plans by year's end to stop financing new fossil fuel projects, the shareholder group Interfaith Center on Corporate Responsibility announced March 28.

Many companies are wary of what this proxy season may bring after some big wins for investor activists in 2021, including the ouster of three members from the Exxon Mobil Corp. board who were replaced with people believed to be more attuned to climate concerns. Such investor activism has incentivized corporations to work out a compromise with their shareholders instead of having to face a vote. So far this year, 23% of resolutions have been withdrawn due to such action.

Institutional investors are moving faster, at times surprising management teams with their votes, and 2022 is expected to bring more upheaval, The Conference Board warned in a February proxy season preview

Investors continue to shift their focus to environmental, social and governance issues, as well as "multi-stakeholder capitalism" focused on the welfare of employees and other constituents, the business group said.

"The proxy season has become an arena where the broader evolution of the role of the corporation in society is playing out," The Conference Board wrote.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.