S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

21 Sep, 2021

|

Permian Basin pumpjacks at dusk, north of Midland, Texas, in late 2019. |

Royal Dutch Shell PLC's decision to sell all of its assets in the Permian Basin to ConocoPhillips for about $9.5 billion appeared to mark a quick shift in strategy for the Dutch energy giant that had described the business as "core" just a few months ago.

But the deal disclosed Sept. 20 by both companies comes at a time when major oil and gas companies face mounting pressure from investors and regulators to curb emissions and diversify outside of fossil fuels. And for Shell, selling off its Permian business helped the company make progress on its goals of cutting its emissions that are the most difficult to reduce. The sale — one of the largest recent transactions in the U.S. shale patch — also freed Shell of an asset seen as lacking the scale needed to drive cost efficiencies that rival oil and gas giants have in the region, which is the country's most prolific in oil production.

"They were in a position where they either had to grow it or get out of it, and they found a willing buyer in Conoco," Morningstar analyst Allen Good said in an interview. "The net-zero [target] on top of that certainly made it an easier decision."

Shell emphasized the economies of scale as the driving force behind the sale.

"Our operated position was sub-scale and needed additional materiality to reach its competitive potential," Shell spokesperson Natalie Gunnell said in an email. "In an effort to optimize value from our Permian business, we reviewed multiple strategies and portfolio options for these assets, including opportunities to increase scale. This offer emerged as a very compelling value proposition."

Shell owns about 225,000 net acres in the Permian that produce about 175,000 barrels of oil equivalent per day. That is a significant acreage, but a fraction of what other oil and gas giants such as Chevron Corp. and Exxon Mobil Corp. possess in the region. Shell might not have been in a position to make an acquisition to grow its Permian business, Good said, adding that growing the Permian business might not have even been consistent with the company's overall divestment strategy and climate targets.

Shell said in July that it expected its oil production to decline by 1% to 2% annually over the next decade, after peaking in 2019, as it limits upstream investment to focus more on energy transition areas such as its LNG business and renewables.

Shell's Permian assets represented less than 1% of the company's carbon emissions from operations, according to the Wall Street Journal.

But Shell is also attempting to cut its carbon emissions and invest more in renewable energy under a more aggressive timeline than many of its peers, after a Dutch district court in May ordered the oil and gas giant to reduce its net carbon emissions by 45% by 2030 from 2019 levels.

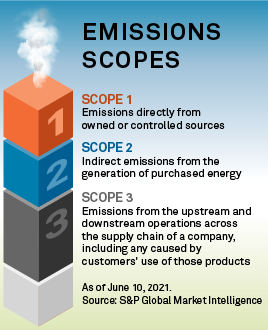

Shell was one of 12 of the world's biggest oil and gas companies that pledged on Sept. 20 to reach net-zero emissions from operations under their control, or Scope 1 and 2 emissions. Scope 1 refers to direct emissions from owned sources, while scope 2 are indirect emissions associated with the purchase of electricity, steam, heating and cooling.

|

That multicompany pledge did not include a specific timetable and it did not cover hard-to-eliminate Scope 3 emissions that arise from the oil and gas products companies sell and trade. The vast majority of oil and gas companies' emissions fall in this category.

However, Shell's target of reaching net-zero by 2050 does include its Scope 3 emissions, which the company said are more than 90% of its emissions overall.

"The only way really to reduce Scope 3 emissions is divestiture," Good said.

Many U.S. oil and gas companies' climate risk strategies do not include targets for reducing Scope 3 emissions. ConocoPhillips is among them. The company uses a greenhouse gas emissions intensity target focused on emissions under its direct control.

That is a common approach for the U.S. industry. But the strategy also makes it possible for a company to reduce its emissions intensity while the absolute volume of emissions released into the atmosphere rises.

ConocoPhillips Chairman and CEO Ryan Lance touted the acquisition of Shell's Permian assets as bringing "more low [greenhouse gas] intensity barrels to our mix." Shell itself said that since 2017, the company has cut its Permian operations' reduced greenhouse gas and methane intensity by 80% through infrastructure and technology investments.

ConocoPhillips revised its emissions intensity reduction target from 35%-45% for gross operated production to 40%-50% for both net equity and gross operated output, against a 2016 baseline. It also increased its quarterly dividend from 43 cents per share to 46 cents per share as part of the announcement.

"The transaction, the dividend raise and the improved emissions target address each of the vital elements of how our company continues to position itself as the strongest competitor in our industry," Lance said during a Sept. 21 conference call.