Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

8 Nov, 2022

By Abbie Bennett and Alex Blackburne

| Operation of PG&E's Diablo Canyon nuclear plant could be extended with help from new state and federal policies. Source: Roger Ressmeyer/Corbis/VCG via Getty Images |

Climate change and the global energy crisis are making nuclear power attractive again to countries and utilities that were once eager to shift away from nuclear generation.

|

Across Europe, countries are reconsidering plans to decommission portions of their nuclear fleets after Russia's invasion of Ukraine drastically reduced the continent's natural gas supply. Japan has begun restarting the reactors it shuttered in the wake of the 2011 Fukushima Dai-ichi disaster. In the United States, a wave of retirements has stalled, with states and now the federal government offering new subsidies to keep the plants online.

California's Diablo Canyon exemplifies this trend. The nuclear plant was expected to shut down, in part because it could not compete with cheap renewable energy and natural gas, but might be rescued through renewed policy support.

"We need to have the option available to keep the lights on and keep making progress towards net-zero carbon emissions," California state Sen. Bill Dodd, a Democrat who authored the bill that could save Diablo Canyon, said during debate on the legislation. "The risks to Californians are too great."

After the state's power grid narrowly avoided widespread blackouts over the summer, officials made a last-ditch effort to tap new state aid hinging on federal assistance, representing a potential shift in how the U.S. views and values nuclear power. Now, Diablo Canyon operator PG&E Corp. has asked the U.S. Nuclear Regulatory Commission to review a license renewal application that the utility filed in 2009 but later withdrew. The renewal is the next necessary step to keep the plant running through 2029 or later.

It is an increasingly common scenario playing out across electric grids, as rising energy prices, looming carbon-reduction goals and climate concerns lead policymakers to find ways to keep nuclear plants running and possibly consider building new ones.

"We had examples of plants that had license renewals but closed early anyway because natural gas was so cheap that it wasn't economically attractive to run the plant, not because anything was wrong with it," said Matthew Crozat, executive director of strategy and policy development at the Nuclear Energy Institute, a trade group.

Nuclear power's share of electricity generation has been in decline since the mid-1990s. Last year, for the first time, it fell below 10%.

"Even the most optimistic estimates can only see nuclear power at best keep its market share around 10%," said M.V. Ramana, professor and Simons Chair in Disarmament, Global and Human Security at the University of British Columbia.

But even at a smaller market share, nuclear energy's carbon-free, dispatchable power generation may be an attractive option for power grids as they transition away from carbon-emitting coal- and natural gas-fired power plants. Recent increases in the price of fossil fuels and the continued struggle to build out new clean energy supply chains are leading to a growing recognition that existing reactors may be critical to the clean energy transition.

US puts plants on 'life support'

The U.S. relies on nuclear power for about 20% of its electric generation, but its nuclear fleet is aging. Most existing plants were built between 1970 and 1990, and building new facilities proved prohibitively expensive. South Carolina utilities stopped construction on the V.C. Summer plant after sinking $9 billion into the project, and Southern Co.'s Alvin W. Vogtle Nuclear Plant in Georgia has been mired in cost overruns and delays.

The burden of maintaining older plants pushed other utilities to shut them down. Entergy Corp. closed several uneconomic merchant nuclear plants, and Exelon Corp. was on the brink of shuttering a plant when Illinois lawmakers stepped in with financial support.

Other plant operators are taking the opposite approach. Duke Energy Corp., Southern and the Tennessee Valley Authority, along with companies such as Constellation Energy Corp., have requested 20-year extensions for existing reactors, including some slated to come offline in the near term. Federal and state policy decisions have made keeping those plants online more attractive, prompting operators to reconsider shutting down generation that takes years and billions of dollars to build.

Zero-emission credit programs played a key role in many of the reversed closure decisions. New York implemented the first of the state programs aimed at supporting nuclear plants in 2016. Illinois, New Jersey, Connecticut and California followed, enacting policies that have prevented closure of plants.

"These plants are, economically, not viable," Ramana said, and government incentives to keep them online are "basically keeping them on life support."

Sixteen of the 92 U.S. nuclear units in operation have been supported by state programs, Crozat said.

The federal Inflation Reduction Act, signed into law Aug. 16, included tax credits and incentives to support continued operation of the existing nuclear fleet, as well as funding to potentially develop advanced nuclear technologies, such as small modular reactors. The legislation creates a "zero-emission nuclear power production tax credit" intended to prevent decommissioning of existing plants from 2024 through 2032.

The production tax credit joins the civil nuclear credit program from the 2021 bipartisan infrastructure law, a $6 billion bailout effort to preserve the existing fleet.

This summer, the U.S. Energy Department also modified requirements to allow nuclear plants operating in regulated markets, as well as merchant units, to apply for credits, a change that may help save Diablo Canyon.

"Congress is sending a clear signal that it is a very short-sighted idea to close these nuclear plants ... at a minimum companies will appreciate the signal they're getting that long-term investment [in existing nuclear plants] is going to be economically attractive," Crozat said. "Cost-benefit analyses for capital investment are going to look different now."

Episodes of Energy Evolution are available on iTunes , Spotify and other podcast platforms.

Europe gas squeeze changes dynamic

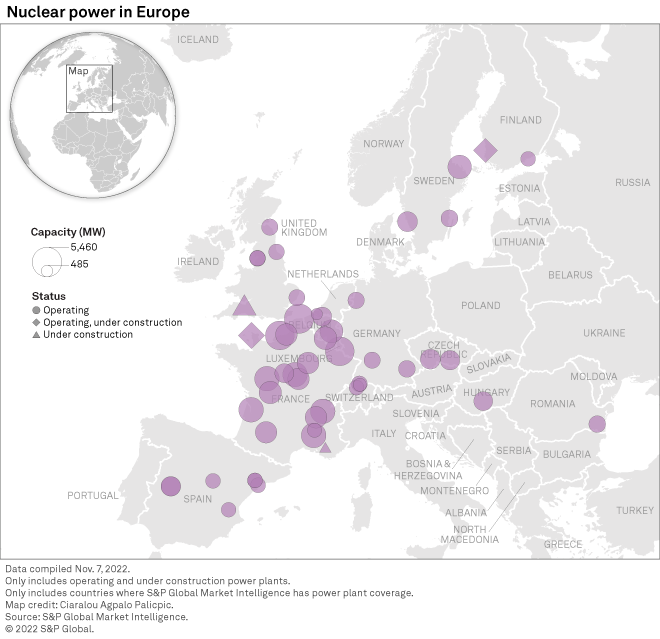

Europe is also discussing life extensions for nuclear plants to replace the loss of Russian natural gas, which sent energy prices soaring to record highs in 2022.

The geopolitical situation "changes the energy security [and] affordability dynamic," according to Antony Froggatt, senior research fellow and deputy director of think tank Chatham House's environment and society program. As a result, postponing scheduled shutdowns of aging reactors has become "attractive from a supply perspective, but also from an economic perspective," Froggatt said in an interview.

The most widely debated extension plan is in Germany, which decided to exit nuclear power completely in the aftermath of Fukushima. The country's last three plants were due to go offline at the end of 2022 but will now continue operating through mid-April 2023 to help bolster the security of supply.

"It turned out that even in Germany, it wasn't politically impossible," said Mark Hibbs, nonresident senior fellow in the nuclear policy program at the Carnegie Endowment for International Peace, a think tank.

The decision prolongs the operation of about 4 GW of capacity, strengthening Germany's grid through the winter and making up for reduced imports from France's underproducing nuclear fleet.

"What we've seen unfolding in Germany in the last several months is a situation that could happen elsewhere in Europe ... and probably will happen in places where there's not a fundamental, built-in opposition to nuclear power," Hibbs said.

After Russia invaded Ukraine on Feb. 24, the Belgian government agreed to extend the life of two of its newest reactors by 10 years to 2035, despite pledging only three months earlier to phase out nuclear by 2025. The government attributed the extensions to the "chaotic geopolitical context."

Belgium's extensions will force Engie SA to invest in upgrades and safety updates for the plants. Engie, which operates the facilities, had long opposed extending operation.

"Extending for six months is one thing; extending for two or three years is another," Froggatt said, adding that it is "much less certain" that the favorable economics for life extensions will continue in the medium term.

Technical issues with Europe's aging nuclear plants — many of which were built in the 1980s and are nearing the end of their licensed operation — complicate the picture for governments that see extensions as a viable way to plug power shortages.

Nowhere is that predicament clearer than in France — Europe's leading nuclear generator — where multiple gigawatts of nuclear capacity have been offline in 2022, partly due to a backlog of scheduled maintenance but also after investigations found stress corrosion in several reactors. Any life extensions in France will require "very rigorous" safety inspections, Hibbs said.

Still, reactor extensions could become "fairly routine" this decade as European nations realize their short-term options are limited, Hibbs added.

That is also driven by the "growing awareness that we are not going to be able to build any new reactors in the very short term," said Yves Desbazeille, director general of nucleareurope, which represents the European nuclear industry.

European nations do not have clear strategies to replace their aging reactors with new ones. "It's not tomorrow that this should be prepared, it's now," Desbazeille said.

Japan's reemergence

Japan idled its nuclear operations in 2011 after an earthquake and subsequent tsunami caused a partial meltdown at the Fukushima Dai-ichi coastal nuclear plant. The disaster chilled global interest in nuclear power and prompted expensive new safety reviews internationally.

Shutting down the reactors took about 30% of the country's electric resources offline, though, and Japan began restarting reactors in 2015. As of May, 10 of 33 operating reactors had been restarted, and nuclear now makes up about 10% of Japan's generating capacity, according to the

In August, Japanese Prime Minister Fumio Kishida called for restarting more nuclear plants and extensions for existing plants. Kishida also asked the government to consider whether it should recommend constructing additional nuclear plants, citing Russia's invasion of Ukraine and Japan's need for carbon-free generation.

Japan's strategic energy outlook calls for nuclear to represent 20% of its overall generation by 2030 as part of a plan to reach carbon neutrality by 2050, but the plan says Japan will approach nuclear cautiously.

The energy plan calls for Japan to increase the share of renewables in its energy mix to 36% by 2030, up from about 22% currently. The plan recognizes, however, that while Japan will work to add significant renewable generation, a "necessary amount of nuclear will be continuously utilized on the major premise of ensuring safety and public trust."

Kishida and U.S. President Joe Biden agreed May 23 to explore an initiative to reduce Asian countries' dependence on Russian energy that includes a nuclear power partnership.

Kishida and Biden committed to accelerated development and global deployment of advanced and small modular reactors by jointly using export promotion and capacity-building tools, according to a joint statement. The leaders said their countries would work together to create more resilient nuclear supply chains, including uranium fuel, for existing and new reactors.

As world leaders and company executives reconsider the value of nuclear, the fate of nuclear plants worldwide hangs in the balance. Geopolitical turmoil, government incentives, climate change pressures and market conditions could be the difference between plants saved from imminent retirement and those that close for good. But after years of chilly sentiment, nuclear may be poised to come out of the cold as the world continues to warm.

"It's completely conceivable that over the next decade we have more plant closures," said Matt Bowen, research scholar at the Center on Global Energy Policy at Columbia University SIPA, focusing on nuclear energy. "On the other hand, we have these new measures and moves to keep the existing fleet afloat. We're building policy momentum."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.