Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Mar, 2023

By Bill Holland

Climate change issues will continue to dominate the hundreds of shareholder resolutions proposed at US companies in 2023, according to the Proxy Preview report released March 22 by advocacy groups As You Sow, Sustainable Investments Institute and Proxy Impact.

Advocacy groups have increasingly used shareholder resolutions to push US companies to publicly disclose their greenhouse gas emissions and their plans for emissions reductions. In many cases, companies will negotiate a compromise to avoid a vote and the resolution will be withdrawn.

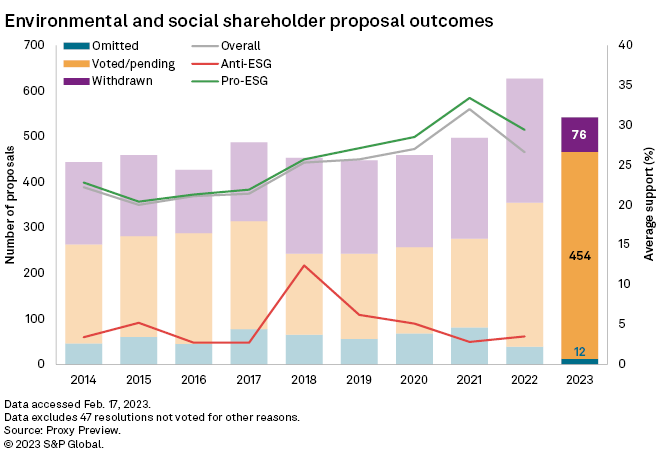

Shareholders had filed at least 542 resolutions on environmental, social and governance issues by Feb. 17, on track to match or exceed 2022's record of 627 resolutions, the Proxy Preview report said. Over 450 resolutions were scheduled for a vote, but that number will drop as activist shareholders and companies reach agreements.

In 2022, 266 ESG-related shareholder resolutions were withdrawn after negotiations, compared to 223 in 2021. A higher number of withdrawals suggests that shareholders are getting more successful at pressuring companies to act, Proxy Preview has said.

Conservative groups have borrowed the playbook of the more liberally oriented shareholder advocates and introduced their own motions. Almost all the "anti-ESG" proposals avoid climate change issues and focus on social policy, the Proxy Preview said.

The number of anti-ESG resolutions in 2023 was at 40 through Feb. 17, compared to 27 through the same period in 2022, Proxy Preview said. Heidi Welsh, executive director of the Sustainable Investments Institute and report co-author, expects the number of anti-ESG resolutions to increase to 70 this year, despite a tepid reception in 2022.

"There is no indication that attacks on ESG investing are going to dampen investor appetite for facts and disclosure, which make the capital markets work better," Welsh said in a statement that accompanied the report.

Climate resolutions

Oil and gas companies and electric utilities face 59 different shareholder resolutions so far in 2023, almost all related to the environment and carbon emissions, according to the report's tabulation of SEC filings. Climate change was the topic for 33 of those resolutions, according to the report.

The other 80 out of a total of 113 climate-related resolutions were addressed to companies across various industries, including Lockheed Martin Corp. and Amazon.com Inc.

"Shareholders in 2023 are tightly focused on resolutions asking companies to establish science-based greenhouse gas reduction targets that cover the full value chain of emissions — and to report on them," As You Sow climate initiative manager David Shugar said in the report.

New resolutions in 2023

Exxon Mobil Corp.

In a proposal that is new this year, As You Sow and its CEO, Andrew Behar, asked ExxonMobil and Chevron Corp. to recalculate their emissions data to include assets divested since 2016, the baseline year each company uses to measure emission progress.

"When polluting assets are transferred from one company to another but continue operating, [the absence of] their emissions should not be counted toward the selling company's emission reduction goals," Michael Passoff, CEO of shareholder advocacy group Proxy Impact, said on a webinar that introduced the report. "To do so is to take credit for climate progress where none has really, actually occurred."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.