S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

15 Sep, 2021

By Yannic Rack and Gaurang Dholakia

A steady flow of clean-tech startups are still going public through special purpose acquisition companies as investors looking to cash in on accelerating climate policies buck a broader slowdown in the rush for blank-check mergers.

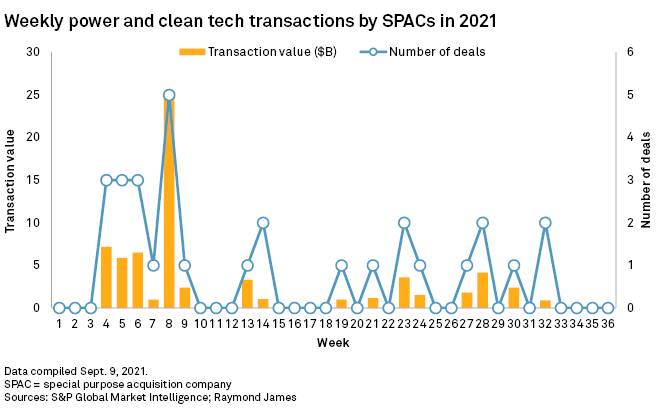

Close to three dozen SPACs have already announced deals in the clean-tech sector so far this year, according to data from S&P Global Market Intelligence and Raymond James.

Companies pursuing SPAC mergers face less stringent rules on financial projections than during traditional IPOs, making them attractive for pre-revenue businesses. But the practice has come under increasing scrutiny from the U.S. Securities and Exchange Commission, cooling SPAC mergers across sectors including clean tech, healthcare and fintech. A handful of struggling companies have also dampened an initial surge of interest in the model.

Still, more SPACs that explicitly target clean-tech companies have gone public in recent months, leading analysts and investors to predict a continued steady flow of deals for climate-friendly companies.

"Everything pertaining to energy transition and sustainability is hot," Pavel Molchanov, an analyst at Raymond James who has been tracking SPAC transactions in the space, said in an interview. "Lots of [environmental, social and governance] funds are chasing these companies."

The vast majority of clean-tech SPAC deals so far have involved electric vehicle producers, battery companies and electric charging networks, although the list also includes startups in everything from solar power to fuel cells and biogas. Market observers think SPAC sponsors could now start branching out into areas that have seen less attention to date, like green hydrogen and carbon-capture technology.

Molchanov and others welcomed the recent slowdown in deal-making, characterizing it as a healthy market correction after the initial spike in SPACs drove frothy valuations for some companies.

One director of a recently listed SPAC targeting the clean-tech sector said the readjustment put the industry in a "more rational place," although it will still "take a while to prove itself." The director, who spoke on the condition of anonymity, criticized some vehicles for missing the mark by combining with companies that are too early for public markets or, conversely, too mature.

"If they burn bright and blow up, that really doesn't help anyone," the director said in an interview. "It shouldn't be something that is a home-run or a big fat zero."

SPAC critics have particularly honed in on struggling EV makers like Nikola Corp. and Lordstown Motors Corp., which initially rallied but have seen their share prices slump to pre-listing levels or lower. Several of the EV companies are years from producing their first models, much less turn a profit. Other SPAC targets, like solar and home improvement financing company Sunlight Financial Holdings Inc., have also struggled to gain traction.

Between mid-February and early September, SPACs that have gone public have lost about $75 billion in combined value, according to an analysis of data from SPAC Research cited by The Wall Street Journal.

Room for more

Despite the slowdown in clean-tech SPAC mergers, deals have continued to close. Although a far cry from the dozen that announced business combinations in February alone, at least nine SPAC mergers in the space have been announced since June, including home charging company Wallbox Chargers SL, solar developer Altus Power Inc. and EV charging network Allego Holding BV.

So far this year, 25 SPACs targeting clean energy, utilities or ESG-related sectors have also gone public, according to Market Intelligence data. They not only involve clean energy pioneers but also the likes of Riverstone Holdings LLC, the oil financier that made big profits during the shale boom, and former BP PLC chief executive Tony Hayward.

Several others have plans to list, including a SPAC led by Gregory Beard, a former senior partner and head of natural resources at Apollo Global Management Inc., and another helmed by former NRG Energy Inc. CEO David Crane.

"This is still a very popular way for companies in clean tech, and of course other sectors too, to raise capital," Molchanov said.

That is partly because companies and investors still see a lot of potential in emerging sustainable technologies that could get a big boost from climate policies, said Johan Vermij, an analyst at 451 Research. EV charging networks in most countries are still massively underdeveloped, for example, but could grow quickly thanks to billions in planned funding.

"The market opportunity is still huge," Vermij said. That also brings risks, he added: A slew of startups are touting their pioneering battery technologies, but investors have little visibility which ones will see broad adoption and which will fall by the wayside.

Molchanov said the slower pace of the market could also help companies to differentiate themselves from the pack, and pointed to some notable successes, such as Fisker Inc., another EV maker, and ChargePoint Holdings Inc., one of the largest independent EV charging network operators.

"There's room for a lot more," he said.

451 Research is part of S&P Global Market Intelligence.