S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

14 Oct, 2021

| The Federal Energy Regulatory Commission is contemplating far-reaching changes to its electric transmission policies. Source: Vitaly Edush/Getty Creative via Getty Images |

This is the second story in a two-part series examining industry stakeholders' perspectives on the Federal Energy Regulatory Commission's advanced notice of proposed rulemaking on electric transmission.

Clean energy groups and regional grid operators gave the Federal Energy Regulatory Commission much different advice on whether the agency should terminate a long-standing funding model that critics equate to requiring one car to pay for an entire road lane expansion.

FERC fielded the comments in response to a far-reaching advance notice of proposed rulemaking launched in July (RM21-17) that seeks to clear obstacles to grid buildout at the pace and scale needed to avoid the worst effects of climate change. The rulemaking effort is one of FERC Chairman Richard Glick's top policy priorities. Given the vast scope of the proceeding, some industry experts believe the agency could break it into several final rules.

In addition to interregional transmission constraints, the notice asked industry stakeholders to weigh in on how generator interconnection policies can be reformed so that renewable energy developers no longer face years-long delays in connecting to the bulk power system. The notice also sought comment on how cost allocation methodologies can be standardized in a way that captures the full range of benefits associated with new transmission projects.

Participant funding

FERC's last major order on generator interconnection policies — Order 2003, issued in 2003 — established a default crediting policy requiring interconnection customers to fund all or most of the upgrades triggered by a new generation project. Under that approach, known as the participant funding model, the transmission owner reimburses interconnection customers those funds over a period of up to 20 years in the form of transmission credits.

The participant funding model may have once made sense for large generators, such as natural gas-fired power plants, but that is no longer the case as the U.S. moves toward a cleaner energy mix dominated by smaller and more distributed renewable energy resources, the American Clean Power Association argued in joint comments with the Energy Storage Association.

Those smaller projects are also required to foot the bill for expensive system impact studies while posting multiple financial deposits along the way.

Citing the need for "immediate reform," the trade groups argued FERC should fast-track a separate interconnection proceeding to address problems with the participant funding model.

"Even in areas where upgrade costs may not stifle all development, there remain lengthy queues and study delays as generators submit multiple interconnection requests to probe the transmission system — only to withdraw when network upgrade cost assignments are higher than expected," the groups said.

As a solution, the groups urged FERC to issue a separate rule establishing a "bright-line division" in which interconnection-related network upgrades up to and including the interconnection substation are the sole responsibility of a new generator or cluster of generators. Transmission providers should bear responsibility for upgrades downstream from the substation, the groups argued.

The Solar Energy Industries Association urged FERC to "do away with the participant funding and crediting mechanism entirely." In doing so, the group called for a fee on interconnection requests that is separate from interconnection deposits. The fee would then be applied to the cost of network upgrades if needed.

But the Midcontinent ISO argued that eliminating the participant funding model could disrupt its ongoing long-range transmission planning efforts. "Such action could delay action on the [long-range transmission planning] effort as MISO participants might be driven to reassess the broader policies of cost allocation of transmission in the region," MISO said.

The Organization of MISO States, a group of state regulators within the 15-state grid operator's footprint, argued problems with affected system studies are a bigger barrier to grid buildout.

Affected system studies are required to determine whether a new generator in one region will trigger the need for upgrades on neighboring systems. "Improvements to the ways neighboring planning regions work together could resolve generation interconnections studies more quickly," the organization insisted.

Offshore interests

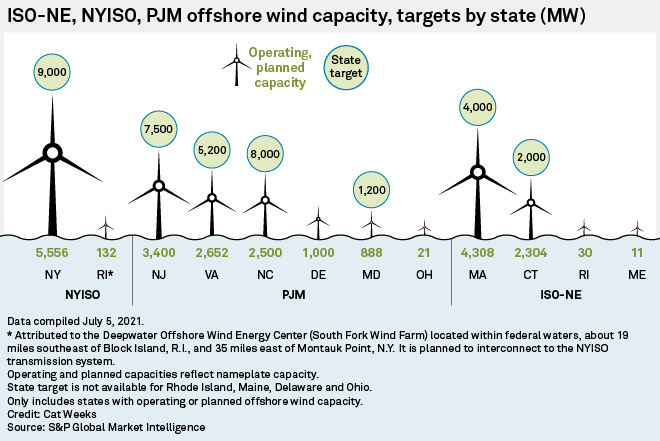

Various entities with offshore wind interests noted that the proceeding could affect offshore as well as onshore operations.

"The commission should consider policies critical to offshore wind development, as different states are pursuing offshore wind initiatives to implement critical parts of their integrated resource planning," according to two Royal Dutch Shell PLC subsidiaries.

Current interconnection approaches could limit US East Coast wind installation to between 4 GW and 5 GW and hinder installations on the West Coast, the entities said. Given the limited number of potential interconnection points, FERC should encourage grid operators to better coordinate and make the interconnection process more efficient for large increases in generation, they added.

Additionally, the subsidiaries claimed the current cost allocation practices do not recognize the offshore wind's potential to increase reliability both onshore and offshore. "Moreover, offshore wind transmission-related costs will aggregate into the billions, and such costs cannot simply be socialized around a market unless the commission establishes meaningful measurable benefits," the companies said.

Ørsted A/S called on the commission to "align the costs of interconnection-related network upgrades with the current policy and economic drivers that are bringing more and more renewable energy resources to the grid." The company also said it prefers a "robust crediting policy" rather than participant funding, which would help relieve issues pertaining to "speculative queue positions."

FERC should require all grid operators to use the same inputs and assumptions for their transmission system impact studies and operate on the same planning schedule, Orsted added. Doing so may help to avoid "dramatically escalating and unpredictable associated network upgrade costs that in many instances are nearly impossible for interconnection customers to anticipate," the company said.

As part of its rulemaking, FERC must promote transmission planning reforms to more equitably allocate costs, according to the New England Offshore Wind Coalition. The coalition also called cluster studies "inadequate," arguing that "they fail to address and plan for important future needs as well as broader benefits to the system as a whole that can be provided by such upgrades."

Cost allocation

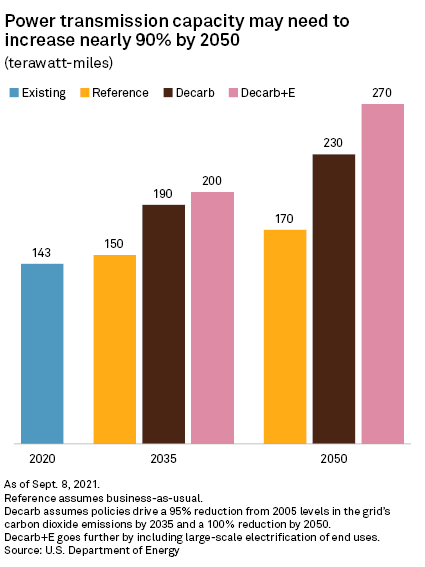

The U.S. Department of Energy recommended that FERC establish cost allocation guidelines for large interregional transition lines meeting certain criteria, such as minimum voltage levels, as well as a timeline for affected regions to issue a tariff agreement pertaining to cost allocations for the lines. Such a move could help planning authorities address differences between regions, DOE said.

Overall, FERC needs to improve its cost allocation methods and reduce "undue burdens" on interconnection entities to more quickly deploy transmission facilities, the department said.

A coalition of environmental and renewable energy advocates led by the National Audubon Society asserted regulators should not limit projects' cost allocation only to incumbent transmission owners, saying that doing so is "unjust and reasonable and is unduly discriminatory."

"This significantly shrinks the pool of available alternatives and arbitrarily sets the threshold for selecting the best solutions at whatever transmission owners decide is best for their bottom line," the coalition said.

The National Association of State Utility Consumer Advocates said cost allocation "must support principles of consumer protection, equity and justice and just and reasonable costs." To do so, it said FERC should promote the development of specific metrics to help calculate and assign benefits.

"General societal good is not a sufficient basis to allocate costs to consumers," according to the consumer advocate group. "Rather, proper cost allocation must reflect the distribution of costs and benefits associated with particular projects."

Ellie Potter is a reporter with S&P Global Platts. S&P Global Market Intelligence and S&P Global Platts are owned by S&P Global Inc.