Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

7 Apr, 2021

By Chris Rogers

U.S. automotive sales staged a recovery in March, with exports having jumped 33.2% sequentially and by 59.7% year over year, Panjiva's analysis of official figures shows. While good news at first blush, the sales were 1.1% lower than the same period in 2019, following a 5.1% drop over the same period in February.

The decline was led by a 3.3% drop in sales of domestically produced autos in March 2021 versus March 2019. Sales of foreign vehicles climbed 6.3% over the same period.

The main challenge for the automakers, however, may not be sales but rather sourcing. As outlined in Panjiva's Q2'21 Outlook, there is an ongoing shortage of semiconductors that has led manufacturers to suspend production globally. The most recent example is Subaru Corp., which has had to shut its Yajima, Japan, manufacturing facility for two weeks due to a shortage of semiconductors, Reuters reported.

The shortages have already cut into U.S. imports of automotive products including vehicles and parts, as discussed in Panjiva's research of March 30. Panjiva's analysis of government data shows total U.S. automotive imports dipped 7.8% year over after improving by 8.2% in January. The export industry is also facing challenges, with automotive exports dropping 10.9% year over year, extending a steady downturn stretching back 14 months.

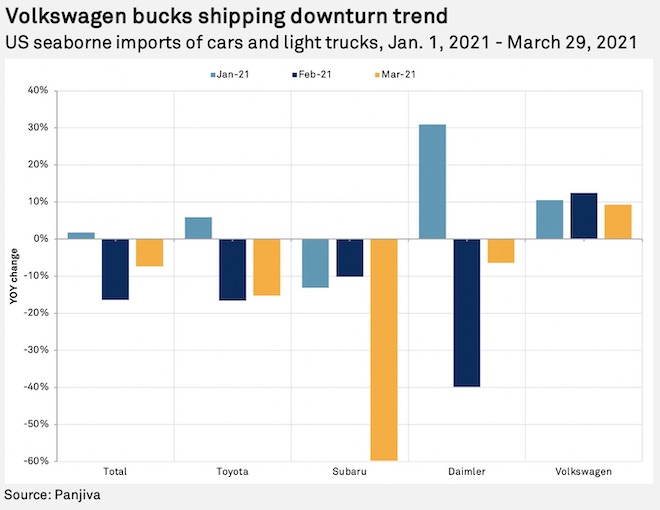

Imports of vehicles linked to the major automakers had already started to decelerate in February. U.S. seaborne imports were down 16.4% year over year during the month and declined a further 7.4% in March, Panjiva's data shows. Shipments linked to Subaru fell 59.8%, one of the fastest rates, year over year. Toyota Motor Corp. has also seen a downturn, albeit at a more modest 15.3% rate in March.

Meanwhile, European automakers have taken divergent trends, with imports linked to Daimler AG down 6.4% in March after a 39.8% slump in February. Volkswagen AG, by contrast, has been steadily increasing its shipments on a year-over-year basis, with a 9.3% increase being only slightly slower than the rate seen in the first two months of the year.

Christopher Rogers is a senior researcher at Panjiva, which is a business line of S&P Global Market Intelligence, a division of S&P Global Inc. This content does not constitute investment advice, and the views and opinions expressed in this piece are those of the author and do not necessarily represent the views of S&P Global Market Intelligence. Links are current at the time of publication. S&P Global Market Intelligence is not responsible if those links are unavailable later.