S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

23 Jun, 2021

By Jiayue Huang and Rehan Ahmad

China's rural commercial banks remain among the least profitable lenders in the country, which may increase the pressure for them to consolidate, analysts say.

The default risk of small businesses, key customers for rural banks, is still high despite the ongoing recovery in the Chinese economy. These rural banks are the key financiers for farmers and small businesses in less-developed regions, where the gains from the economy's recovery take longer to percolate.

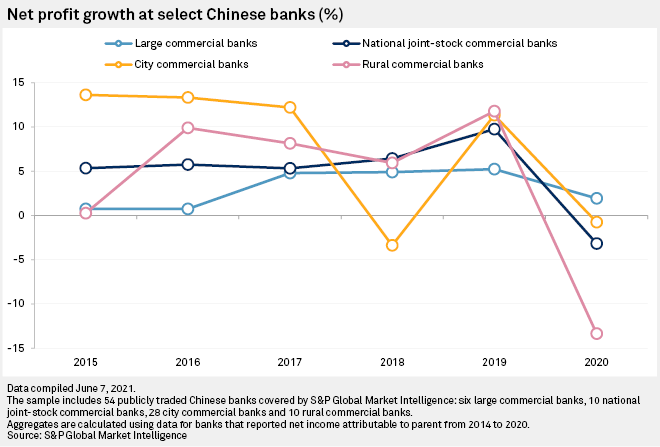

While the COVID-19 pandemic dragged on profits at most Chinese banks, rural commercial banks were hit the hardest. The aggregate profit of a sample of companies tracked by S&P Global Market Intelligence declined 14.17% in 2020, the steepest fall for the group in five years. It was also the sharpest fall among the 54 listed Chinese banks tracked by Market Intelligence.

Lagging recovery

Even when lenders' earnings started to pick up amid the recovery of China's economy, rural commercial banks stayed behind the curve. In the first quarter of 2021, aggregate earnings at rural commercial banks were almost flat at 73.4 billion yuan versus 73.7 billion yuan for the same period in 2020, according to the China Banking and Insurance Regulatory Commission, or CBIRC, which tracks all lenders in the country. Large state-backed banks posted a 2.8% year-on-year net profit growth to 316.8 billion yuan in the first quarter, while national joint stock banks' aggregate profit rose 5.3% to 138.5 billion yuan, CBIRC data shows.

"Rural banks' performance is highly correlated to the strength of small and mid-sized enterprises, which are more vulnerable during downturns. [They] are making a comeback, but remain weak as small enterprises and the rural economy continue to lag the recovery in urban centers and that of large businesses," said Rory Green, a London-based senior economist at TS Lombard. He expects rural banks to improve their performance in the fourth quarter if the vaccination rate in China passes 80% and the economy reopens fully.

Nearly 18.5% of China's small enterprises shut in 2020, compared with 6.7% in 2019, according to a study published in March by Beijing's Tsinghua University, which surveyed more than 50,000 companies.

Most rural commercial banks lend to small enterprises that may find it tough to borrow from large banks. About half of rural commercial banks' loans are to individuals and for mortgages, while 20% of their exposure is to the manufacturing sector, 10% to real estate developers and between 8% and 10% to retailers, according to Wang Zhen, a Shanghai-based analyst at UOB Kay Hian Research.

"Retail, for example, was heavily affected by the pandemic, which in turn deteriorated these lenders' asset quality, even for some leading rural commercial banks," said Chen Shujin, Hong Kong-based head of China financial institution group research at Jefferies.

Government rescue

Since mid-2019, Chinese regulators have been rescuing small, less-capitalized lenders through ad hoc bailouts and government-directed mergers, as concerns grow over possible contagion effects from a bank failure. The latest deals, all pushed by local governments, include the merger of five regional lenders in Shanxi province and the consolidation of three rural commercial banks in Jiangsu province. The northeast province of Liaoning also said earlier it had plans to consolidate 12 local banks into one mega regional lender.

"This is a long-standing goal for Beijing and the pandemic is likely accelerating the consolidation process. Performance [for rural commercial banks] will remain volatile in one-to-three years, however banking sector consolidation may reduce the cyclicality of rural bank earnings," TS Lombard's Green said.

Consolidation can enhance credit risk management at the smaller lenders, said Michael Chang, a Hong Kong-based China financial analyst at CGS-CIMB Securities.

Limits of scale

"Their relatively small size often results in investing less in credit risk management and consequently results in them having worse asset quality compared to other banks," Chang said. "If you start to merge a couple of the rural commercial banks, you get more scale."

The scale of assets and profit also limits rural commercial banks' ability to build buffers to absorb potential losses from bad loans.

According to the CBIRC data, rural commercial banks reported a nonperforming loan ratio of 3.7% in the first quarter of 2021, while all other groups reported a ratio of less than 2%. The rural commercial banks set aside loan-loss provisions equivalent to about 124% of their gross non-performing loans, the lowest among all banks. State-owned large commercial banks, the best among all, had a coverage ratio of nearly 220%.

"The consequence of less provisioning buffers on their balance sheets means a larger increase to the provisioning expenses when asset quality worsens. This makes their net profit growth more sensitive to swings in the provisioning expenses line," said Chang.

As of June 23, US$1 was equivalent to 6.47 yuan.