S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

3 Jan, 2022

By Aries Poon, Rebecca Isjwara, and Mc Dowell Ramintas

Slowing loan growth, slimming margins and rising credit risk will weigh on Chinese banks entering into 2022.

Beijing's latest attempts to free up more liquidity for lending are too modest to revive credit growth, which has slowed to its lowest pace in more than 15 years, analysts said. The easing measures, which include lowering banks' required reserve ratio and a 5-basis-point cut to a benchmark interest rate late last year, will also likely keep banks' net interest margins at multiyear lows.

Meanwhile, softening economic growth, the ongoing debt problems among property developers and the end of loan repayment extensions for small businesses are set to heighten the credit risk for lenders, especially the less capitalized ones with more concentrated loan portfolios, analysts added.

"We expect China to use more policy-easing measures — such as proactive fiscal policy, prudent monetary policy as well as targeted industrial policies — to prevent a downward spiral and reverse a sharp growth slowdown," China Renaissance Securities said in a Jan. 3 report.

Banks in China are facing rising pressure on their profitability amid market and policy challenges on multiple fronts. The residential property market slump, COVID-19-related restrictions and ongoing tensions between Beijing and Washington have slowed China's factory activity, corporate investment and household consumption. Regulatory clampdowns on the financial, technology and real estate sectors have also cooled corporate expansion and fundraising activities, which are key revenue sources for banks.

Fixed asset investment during the first 11 months of 2021 rose 5.2% from a year earlier, according to China's National Bureau of Statistics. The metric, which indicates corporate loan demand, was sharply down from 35.0% year-over-year growth in the January-February period of the same year. Meanwhile, China's year-over-year GDP growth slowed to 4.9% in the September quarter in 2021, from 7.9% in the previous three months.

Slowing loan growth

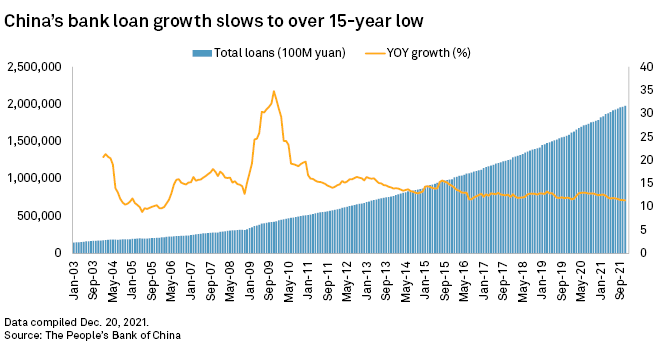

Loan growth in China is losing steam. The outstanding loan balance of Chinese financial institutions rose 11.37% in November 2021 from a year earlier, according to the China Banking and Insurance Regulatory Commission, or CBIRC. The growth rate was the lowest since March 2006.

"We will see [fewer] residential mortgage loans, given the general policy of control [for the] property market is based on houses [being] for living not speculation," said Yongmei Cai, a partner from Simmons & Simmons, a law firm. It is also much more difficult for investors to obtain loans to invest in properties, Cai said.

The outstanding mortgage balance rose 11.3% in the third quarter from a year earlier, also slowing from 13.0% growth in the second quarter, according to the CBIRC.

The outstanding loan balance for property development remained flat as of the end of the third quarter compared with a year earlier, much slower than 2.82% year-over-year growth as of the end of the second quarter, according to the CBIRC.

"The government's underlying policy to rein in leverage in the sector would persist," said Cheng Wee Tan, senior equity analyst at Morningstar.

Persistent margin pressure

The central bank cut the reserve requirement ratio, or the portion of liabilities — mainly deposits — that banks must hold with themselves, by 50 basis points to free up capital for lending on Dec. 6, 2021. Later in the month, it reduced the one-year loan prime rate, or LPR, to 3.80% from 3.85%. The cut, the first in 20 months, was a part of efforts to revive loan demand. Another benchmark, the five-year loan prime rate that is often used to price mortgage loans, remained unchanged at 4.65%.

"[The] moderate cut sent a signal of Beijing's easing bias, but its real impact will be quite limited," Nomura said in a Dec. 20 note.

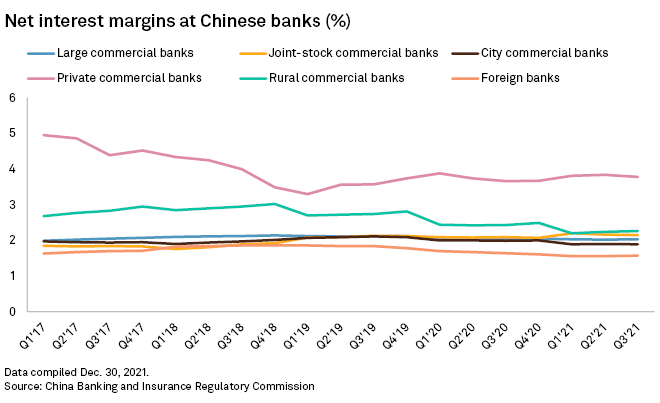

Given that China's one-year deposit rate has stayed at 1.5% since late 2015, Nomura said in the report additional cuts of the LPR will further squeeze banks' NIM and add pressures on their profitability. China Renaissance predicts the central bank to cut the one-year LPR by another 10 basis points and the reserve requirement ratio by 100 basis points this year.

The average NIM of all Chinese banks has been hovering between 2.06% and 2.07% since the beginning of 2021, down from its recent high of 2.20% in the fourth quarter of 2019, according to CBIRC data.

Return on capital, another profitability metric that shows how effective a bank is at turning capital into earnings, fell for two straight quarters. China's banking sector was generating a 10.10% return on capital in the third quarter of 2021, down from 10.39% and 11.28% in the second and first quarter of the year, respectively, according to data from the CBIRC.

Bubbling credit risk

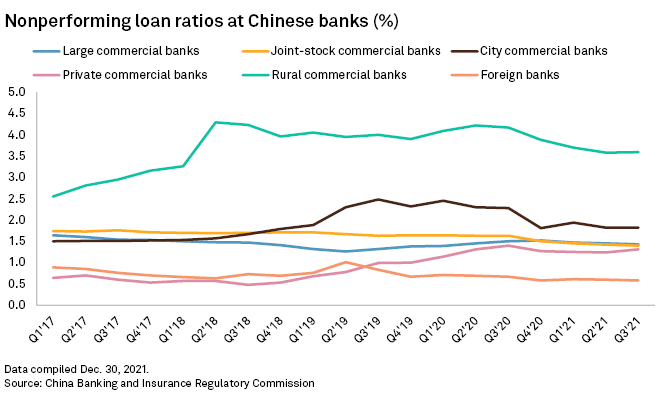

The overall nonperforming loan ratio in China's banking sector has declined due to faster loan write-offs. However, the NPL ratio for the property sector surged to 2% in the first half of 2021 from 1.2% in 2019, indicating worsening asset quality of the segment, according to Gary Ng, senior economist at investment bank Natixis.

"More risks may be seen in smaller banks with high exposure to property developers and linkages to local governments," Ng said, adding that banks with high exposure to property developers may face higher loan-write off and weaker revenue growth in the future.

While many banks hold back from lending to highly leveraged developers and set aside more provisions against loan losses, the authorities have been nudging lenders to extend more loans to small and vulnerable businesses at affordable rates, adding risk to their asset quality and earnings.

The credit risk from small businesses will likely rise after the government-mandated extension of loan repayment for those borrowers ended at the end of 2021, analysts added.

"Lending [to small businesses] presents challenges on risk control, it may not be easy to drive substantial growth on loans," Simmons' Cai said.