S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

19 Dec, 2022

By Aries Poon, John Wu, and Rehan Ahmad

Risks to China's US$53 trillion banking system are rising as the nation's property downturn and economic slowdown stretch into 2023.

More real estate developers may be unable to service their loans amid weak homebuying sentiment and high leverage, despite interest rate cuts, policy support for the property sector and Beijing's more relaxed stance on the pandemic, analysts said. Small businesses are another group of vulnerable borrowers, as there are signs exports and domestic consumption are likely to slow further.

"One of the biggest uncertainties to China's economy is the pandemic policy.

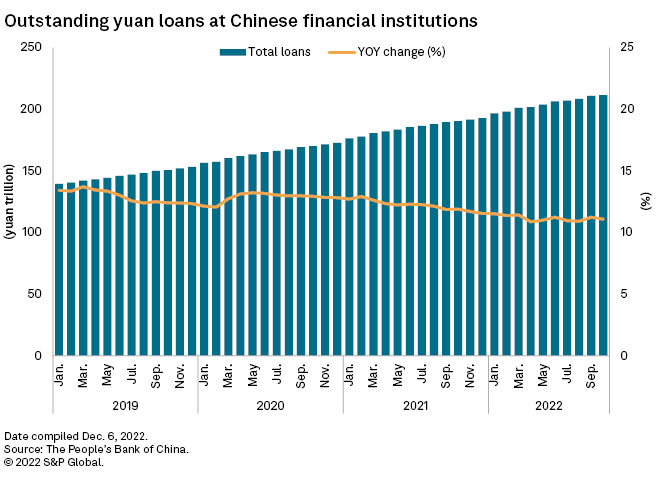

Bank profitability may remain under pressure too, analysts said. Chinese lenders are set to see further declines in net interest margins in 2023. Loan demand from households and the private sector will likely remain weak amid a murky economic outlook, although total bank lending in China will still grow next year, albeit at a slower pace, as Beijing nudges large lenders to extend new credit to infrastructure and unfinished property projects.

Banks in China are the primary financiers of the nation's economic growth as well as the much-needed lifeline for struggling businesses and local governments to prevent risk from spreading. Under Beijing's directive, many banks have been lending more but at lower interest rates, sometimes to weaker borrowers that would otherwise have not been lent to, while setting aside billions of yuan as provisions for troubled loans.

Underperformance to continue

While all banks in the world face a growth slowdown, Chinese lenders are entering 2023 in worse shape than most of their global peers. Banks in many country saw their profits improve in 2022 on the back of rising interest rates and a post-pandemic reopening.

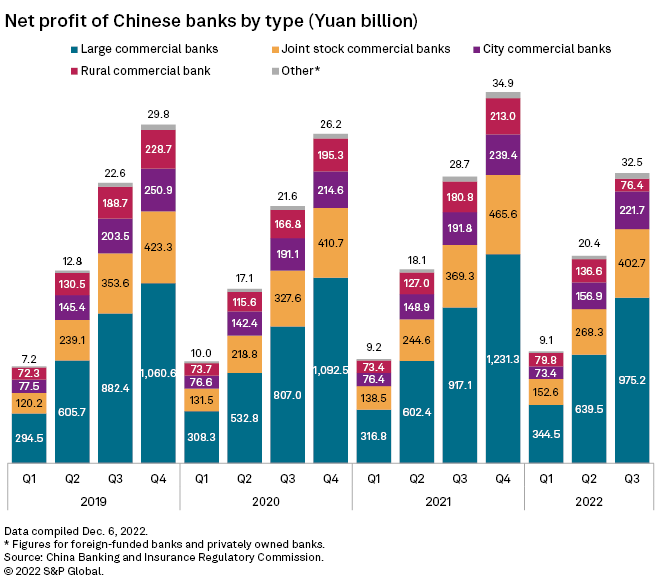

Chinese banks' return on equity dropped to 9.32% as of Sept. 30, its lowest level in more than 10 years, according to data from the China Banking and Insurance Regulatory Commission. Total net profit of banks also fell 11% in the third quarter from a year ago, the first year-over-year decline in two years. Meanwhile, the sector's common equity Tier 1 ratio, a key metric to indicate loss-absorbing capacity, has been steady between 10.50% and 11.00% since the beginning of 2021.

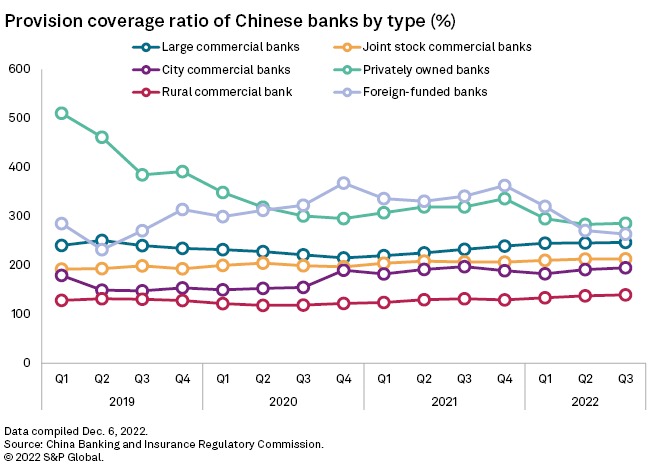

Systemic risk is not an imminent concern for now, analysts said, as most lenders are comfortably capitalized. Pockets of risk may arise among smaller lenders with less buffers to withstand shocks, but Beijing has a track record of containing risks from spreading, analysts said.

Collateral risk

Despite a slump in home prices and sales, Chinese banks have heeded Beijing's call and are increasing their exposures to the property sector, which accounted for about a quarter of all outstanding bank loans at the end of September.

Lenders are extending forbearance in addition to more than 1.8 trillion yuan in fresh loans to struggling developers despite their declining creditworthiness, as part of the government’s efforts to contain the sector's debt problems and restart construction of unfinished homes that sparked mortgage boycotts in some cities in mid-2022.

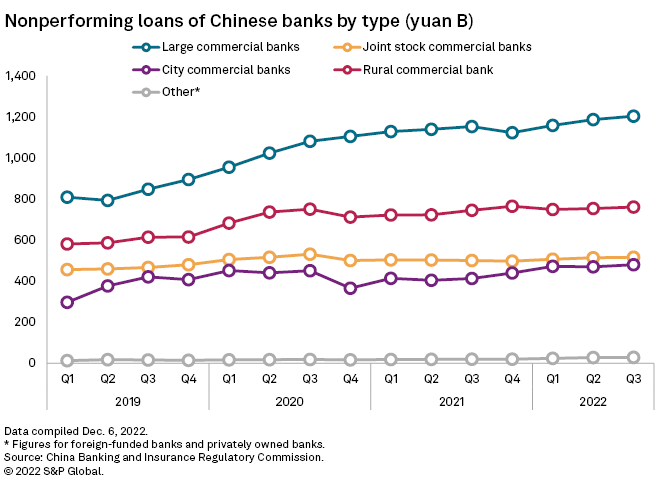

Credit losses for Chinese banks will average around 2.2 trillion yuan a year between 2022 and 2024, in which real estate nonperforming loans will stay elevated in 2023 after doubling in 2022, according to a Dec. 14 report from S&P Global Ratings.

"The chance of a hard landing for banks is remote at this stage, though pockets of regional sensitivities could chip the banking sector's health at the fringes," the report said.

There were 38.91 trillion yuan of outstanding mortgages and another 12.67 trillion yuan of loans to developers as of Sept. 30, according to data from the People's Bank of China. The system’s total outstanding loan balance stood at 210.76 trillion yuan.

Property troubles

China's home prices will likely decline by up to 8% in 2023, after falling 6% this year, according to the rating agency’s estimate. Lower-tier cities may see sharper drops in prices due to weaker economic growth and higher inventory levels, posing higher credit risk on banks servicing those regions, it said.

"We expected about 40% of Chinese developers would have financial troubles in 2022. This figure will likely rise further in 2023, but the increase won't likely be a lot," Ratings' Hu said. "We may be a step closer to the property market bottom, but it will yet be some time before a turnaround."

The property sector downturn will cost the banking system up to 1.5 trillion yuan over the next few years, mainly from potential losses in banks' unsecured property development loans, bonds, and nonstandard assets, said May Yan, head of Greater China financials equity research at UBS.

Nonstandard assets, such as trust loans, are assets that are not traded on the interbank market. Once a major funding source for developers, these shadow banking channels have cut exposures to developers as directed by the government. Repayment pressure on developers will grow next year as some of those trust loans expire, according to media reports.

"Our estimate shows that such direct impact on the banking system is still manageable, particularly when banks recognize such losses over more than a year," Yan said.

Supply chain disruptions

Banks have also been increasing their exposure to small businesses in recent years under Beijing's plan to boost investment in the real economy and achieve common prosperity. This loan type has become another source of credit risk for banks, as the country's supply chain is hit by slowing exports and domestic consumption alongside business disruptions due to the pandemic, analysts said.

Loans to small businesses, or so-called inclusive lending, totaled 23.16 trillion yuan as of Sept. 30, up 24.6% from a year ago, according to the People's Bank of China. It was about 11% of the system’s total loans.

"From the macro side, at risk currently are the balance sheets of smaller banks," said Kaspar Hense, senior portfolio manager at BlueBay Asset Management. The economic downturn will expose the poor risk management and disclosure practices among small lenders, many of which are not listed companies, Hense said.

Margin, volume pressure

In addition to asset quality risk, Chinese banks also face "significant" pressures on net interest margins in 2023, said Iris Tan, senior equity analyst at Morningstar.

"The government has introduced policies to support both supply side and demand side of the market, but we expect retail loan demands to remain under pressure in coming quarters," Tan said.

China's central bank is likely to further cut the five-year loan prime rate, a reference interest rate for mortgages, to encourage home purchases in the coming quarters, Tan said. The central bank cut the proxy mortgage rate twice in 2022, in addition to multiple cuts of the reserve requirement ratio for banks and the one-year loan prime rate.

People's Bank of China Governor Yi Gang told a conference in Bangkok Dec. 2 that the central bank's focus is now on economic growth, according to a Bloomberg report. "We have a pretty accommodative monetary policy in place to help with economic recovery and maximize employment," Yi was quoted as saying.

As of Dec. 19, US$1 was equivalent to 6.98 Chinese yuan.