S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

12 Feb, 2023

By John Wu and Rehan Ahmad

China is expected to issue more green bonds in 2023 and stay a dominant global player in the green finance market as the world's biggest polluter seeks closer alignment with international standards.

The nation, in which so-called nonaligned bonds account for a substantial portion of total green financing, is seeking to adopt globally accepted norms to attract a wider pool of capital. The latest version of China's rules, updated in mid-2022, have further aligned with the standard of the International Capital Market Association's Green Bond Principles by requiring issuers to use 100% of proceeds on environment-protection projects, up from 70% previously, with state-owned enterprises exempted and remaining at 50%.

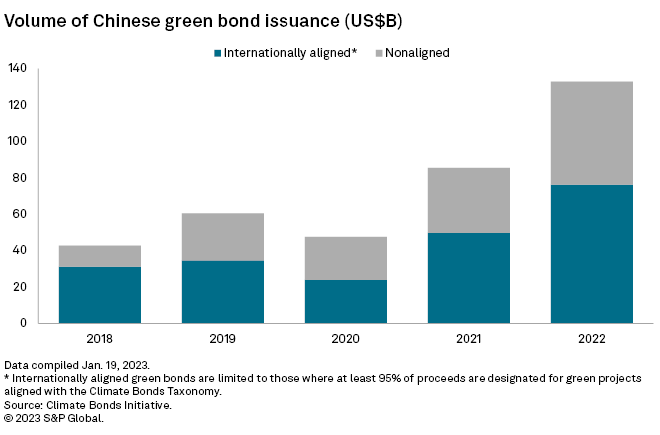

The move will "increase the pace of international alignment as new bonds are issued and existing nonaligned bonds are refinanced," said Gloria Cheung, capital markets partner at law firm Linklaters. China's nonaligned green bonds issuance totaled $56.5 billion in 2022, according to data from Climate Bonds Initiative, an international organization working to mobilize capital for climate action. "If we look at the current volume of Chinese green bond issuances that are nonaligned, the potential for conversion is immense," Cheung added.

In 2022, the nation issued the highest amount of green bonds aligned with the commonly accepted global definition, totaling $76.25 billion, according to data from Climate Bonds Initiative. Germany was second with $60.77 billion. China is expected to issue between $90 billion and $100 billion of green bonds in 2023, said Eric Luk, climate and sustainability director at Deloitte.

Policy support

China also is working with the European Union on a common taxonomy that will harmonize definitions on what constitutes green activities recognized bilaterally to facilitate cross-border issuance and investment.

"More supportive policies will be introduced and the market will be more standardized," said Jianheng Chen, an analyst at CICC Research, pointing to the regulatory changes in China.

Sectors such as renewable energy, driven by the development of the new economy, local government financing vehicles, electricity and banking will see the highest green bond issuance in 2023, Chen added.

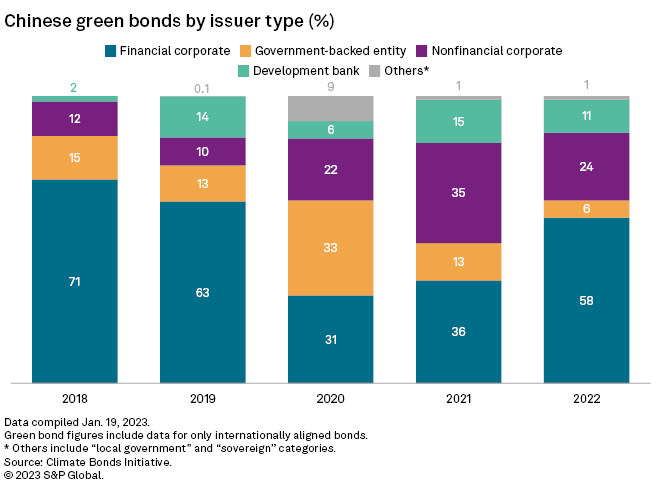

The People's Bank of China also is encouraging banks to step up their green financing by issuing or investing in more green bonds. Under the central bank's green finance evaluation system, banks will be assessed according to the proportion of green bonds to total assets, and the year-over-year change in the total value of such holdings.

Financial institutions are likely to maintain strong issuance of green bonds and such issues are expected to make up the bulk of their volumes,

Issuances across Asia Pacific

Apart from China, other economies in Asia-Pacific also are expected to step up green bond sales in 2023, Deloitte's Luk said. Japan and India are stepping up green bond sales as major economies in the region seek to address climate change.

"Supportive government policies, friendlier environment to investors and well-functioned financial markets are conducive to another year of growth in green bond issuance in China and the [Asia-Pacific] region," Luk said.

The first out of the gate in 2023 have been sovereign issuers, including a US$5.75 billion green bond issuance by the Hong Kong Special Administrative Region government and an inaugural green bond sale in India worth 80 billion rupees in January.

Japanese issuers also could rush to sell green bonds before interest rates rise, said Takahide Kiuchi, executive economist at Nomura Research Institute. Expectations are building in Japan that a change of leadership at the Bank of Japan in April will end the nation's ultraloose monetary policy.

Countries in Asia-Pacific issued $120.83 billion of green bonds in 2022, down 2.5% year over year. Still, that decline was shallower than the 32.5% drop in Europe, and the 43.2% fall in North America, as rising interest rates depressed the overall bond market. Japan and India ranked seventh and 10th, respectively, on the global league table of green bond issuance in 2022.

As of Feb. 10, US$1 was equivalent to 82.51 Indian rupees.