Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 Apr, 2021

Offshore-listed Chinese technology stocks are likely to recover gradually with less volatility despite ongoing regulatory uncertainty, analysts say.

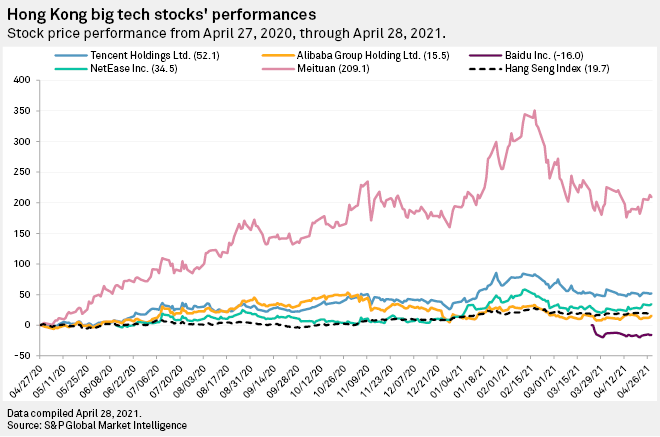

Some of the biggest tech stocks in China, including Tencent Holdings Ltd., Alibaba Group Holding Ltd., Baidu Inc., NetEase Inc. and Meituan, have tumbled in Hong Kong and the U.S. since their February highs, amid Washington's threats to delist Chinese companies, a record $2.8 billion antitrust fine on Alibaba and an unwinding of massive bets following the collapse of Archegos Capital.

"The shares of Alibaba, Tencent, Baidu and the other big Chinese tech stocks are not likely to fall further, as the regulatory risks have now been priced in," Justin Tang, head of Asian research at United First Partners, told S&P Global Market Intelligence, adding that regulators will continue to release more information and clarify antitrust practices.

In the latest wave of clampdown on China's internet players, the State Administration for Market Regulation, the State Taxation Administration and the Cyberspace Administration of China have asked 34 internet companies to self-evaluate their own practices to ensure they are not violating the Anti-Monopoly Law.

Alibaba was also recently fined $2.8 billion by antitrust regulators in China. Following the fine, the e-commerce company's executives said it would rectify its problems and step up efforts to retain its merchants. Alibaba's Hong Kong-listed shares rose as much as 9% in morning trade two days after the fine, after losing almost a third of its value since Beijing's series of investigations into the company from last November.

For Tencent, gaming regulations, rather than antitrust, will impact its stock the most, given its main source of revenue is its gaming business, said Tam Tsz Wang, TMT equity research analyst at DBS Vickers Securities.

"We saw how the batch of gaming regulations in China two years ago impacted Tencent and how the company recovered. Now that has been priced in too, it all depends on whether China will release any more rules or bans that impact the gaming sector," Tam said.

The company's market capitalization fell from a record high of $573 billion to $394.9 billion in April 2018 following a crackdown on the gaming sector in China, citing games' addictive nature and threat to children. Chinese authorities had withheld the approval of several gaming titles including Tencent's mega-hit "PlayerUnknown's Battlegrounds" and "Honor of Kings."

'Relatively safe' bet

Even so, Tam said Baidu's stock is the "relatively safe" bet among the Chinese internet stocks partly because it has fewer regulatory concerns.

"The company operates the largest search engine in China and has not behaved in a way that violates antitrust laws to grab market share," he said.

Baidu's electric vehicle announcements in the first quarter have also helped bolster the company's stock, Tam added. On the Feb. 18 earnings call, CEO Robin Li outlined a three-year plan to manufacture intelligent electric vehicles in partnership with Zhejiang Geely Automobile Co. Ltd.

Baidu said it is the first Chinese company to receive driverless licenses both in California and China.

Not out of woods

Among the technology behemoths, the only company that may be impacted most by ongoing antitrust regulation is food delivery service Meituan, said Ke Yan, equity analyst at DZT Research.

"Meituan has a 10-year history of fighting the offline market. It also deals with delivery and logistics companies, smaller restaurants and therefore their services have become an essential part of everyday life. Antitrust regulators will be more inclined to look at its business model over Tencent or Baidu," he said.

China's State Administration for Market Regulation launched an antitrust investigation into the food delivery player April 26, focusing on its exclusivity arrangement with vendors. It did not mention a fine or penalty. Tencent-backed Meituan said it would cooperate with the regulators.

The company's shares rose following the announcement from the regulator, indicating that investors expect limited impact from the second antitrust probe, analysts said.

Delisting concern

Fears that some Chinese tech companies could be delisted from the U.S. have also created stock volatility. However, analysts said these companies are now preparing themselves for "potential risks" by actively looking at secondary listings in Hong Kong.

"In the case of further delistings of Chinese tech companies trading in the U.S., they cannot be delisted so quickly. This will give them time to switch their shares from the U.S. to Hong Kong as we have already seen," Yan said.

On March 24, the U.S. Securities and Exchange Commission adopted the Holding Foreign Companies Accountable Act, which would remove Chinese companies from U.S. exchanges if they do not comply to American auditing standards. This sent Hong Kong shares of the U.S.-listed Chinese tech stocks down the following day, with Alibaba slipping 4.2%, gaming developer NetEase down 3% and Baidu dropping 8.85%.

Unwound trades

Analysts also said the recent sell-off triggered by the fall of Archegos Capital was a "one-off" and will not likely impact the tech stocks in the future.

"The Archegos incident only spotlights unhealthy practices and is unlikely to happen again," United First Partners' Tang said.

Chinese stocks listed in the U.S. took a dive after a series of margin calls by the family office of Tiger Asia Management founder Bill Hwang. The fund was forced by its lenders to sell more than $20 billion in shares, including Baidu and Tencent Music Entertainment Group.