Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Feb, 2021

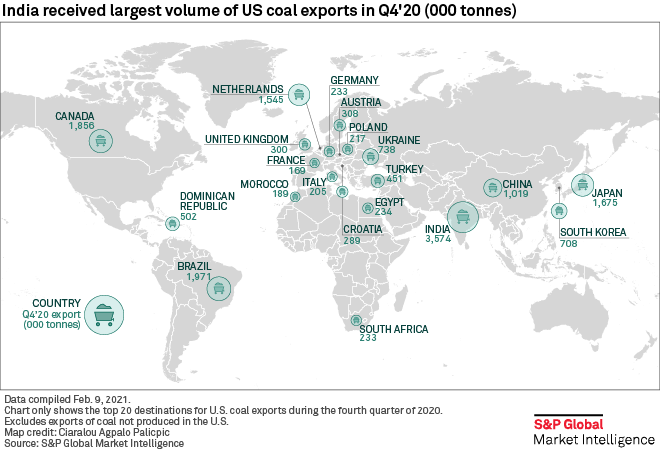

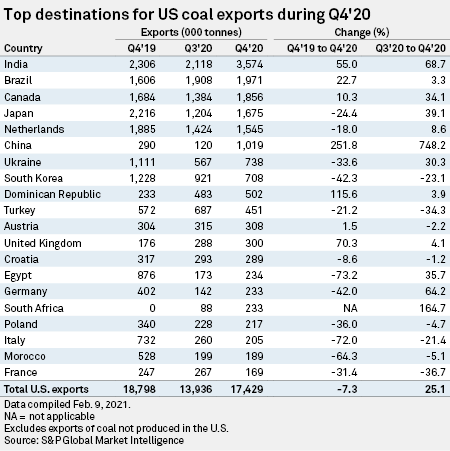

China emerged as one of the top importers of U.S. coal in the fourth quarter of 2020 as the country banned Australian coal from entering its territories amid diplomatic tensions.

U.S. coal exports in the three-month period totaled 17.4 million tonnes, down 7.3% year over year but 25.1% higher quarter over quarter, according to data compiled by S&P Global Market Intelligence.

|

China had the highest gain in coal imports from the U.S. among the top destinations in the fourth quarter of 2020. The Asian country imported 1.0 Mt of coal from the U.S. during the period, a 251.8% increase year over year and a 748.2% jump quarter over quarter.

With the unofficial ban on Australian coal in place, Chinese buyers turned to other major producers to maintain operations.

"As Chinese domestic coking coal reserves are depleted, they are experiencing a reduction in quality so need to supplement this coking coal with imported coal to maintain the correct coal quality for steelmaking," Market Intelligence mining analyst Oliver Woolard said. "Although shipments from Australia dropped, Chinese buyers are shifting the balance to other producers of high quality coking coal with the U.S., Canada and Russia benefitting."

Other countries in the region offer coking coal of good quality, but only the U.S. has comparable coking coal quality to Australia, Woolard said.

"It is simpler for Chinese buyers to import U.S. coking coal than adapt their processes to accommodate different coking coal quality, hence increasing imports," Woolard said.

The ban weighed on seaborne coking coal demand in 2020, according to industry observers including Réal Foley, senior vice president of marketing and logistics with Canadian diversified miner Teck Resources Ltd.

Foley noted that it is unclear when the restriction will be lifted. "In the meantime, what we are seeing and taking advantage of is the price premium for sales into China," Foley said during a Feb. 18 earnings call.

Ramaco Resources Inc. founder, Executive Chairman and CEO Randall Atkins recently said the ban created an arbitrage opportunity, which would "create more pricing positive dynamics" when lifted.

"China has embargoed any new Australian coals coming in. And as a result, you've got an [arbitrage] that's gone from $60 to $100, I guess, it's about $80 today," Atkins said during a Feb. 19 earnings call. "When that lifts, we believe that there will be not only, of course, a rise in the Australian benchmark, but that will find its way also into a rise on the Atlantic benchmark."

Dominican Republic was next to China with the highest growth in U.S. coal imports, comprising 502,000 tonnes in the fourth quarter of 2020 for a 115.6% year-over-year increase.

India, the most popular destination for U.S. coal, recorded deliveries of 3.6 Mt during the three-month period, increasing 55.0% year over year and nearly 70% quarter over quarter.

Executives with Pennsylvania-based producer Consol Energy Inc. recently noted that improving petroleum coke prices were a driver in the increase in coal shipments to the South Asian country.

"On the export front, we have seen several very encouraging trends as the seaborne thermal coal markets have steadily improved since the end of the third quarter of 2020," President, CEO and director James Brock said during a Feb. 9 earnings call.

Higher prices have allowed Consol to penetrate other markets in India and elsewhere, according to Robert Braithwaite, the company's vice president of marketing and sales. "With pet coke prices at four-year highs, we're now sending some coal into the cement market as well," Braithwaite said during the call.

U.S. coal shipments decreased year over year for 12 of the top 20 destinations in the final quarter of 2020, with the largest declines recorded by Egypt, Italy, Morocco, South Korea and Germany.