Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 Sep, 2022

|

|

The recent price hikes by major Western wind turbine-makers have spawned renewed chatter about increased competition from China, where local manufacturers sell turbines at consistently cheaper rates but have yet to replicate their domestic success overseas.

Gaining significant footholds in the mature U.S. or Western European markets — and dethroning the incumbent manufacturers like Vestas Wind Systems A/S, Siemens Gamesa Renewable Energy SA and General Electric Co. — continues to be a difficult prospect for Chinese suppliers, analysts said.

The U.S. and Western Europe have "well-established local players and local manufacturing," said Indra Mukherjee, senior analyst on clean energy technology and renewables at S&P Global Commodity Insights. "Relationships between [turbine-makers] and large clients have also been established for years."

However, the fact that Chinese turbines today cost less than half the global average positions the suppliers for expansion in less established wind markets such as Latin America and Eastern Europe.

The likes of Xinjiang Goldwind Science & Technology Co. Ltd. and Mingyang Smart Energy Group Ltd. will likely grow their international portfolios in these regions in the coming years, analysts said, typically partnering with smaller developers or supplying turbines to projects where Chinese investors are involved.

'Racing to the bottom'

Goldwind, Mingyang and Envision Energy Ltd. — China's three biggest suppliers — received over 23 GW of orders for new turbines in the first half of 2022, according to analysis by Commodity Insights. That compares to 8.7 GW by Western vendors.

Chinese manufacturers seem to be "completely decoupled [from] the global commodity inflation," Shashi Barla, director and head of research at consultancy Brinckmann, said in an email. Chinese turbine prices "continue to plummet," Barla said. "These companies are racing to the bottom."

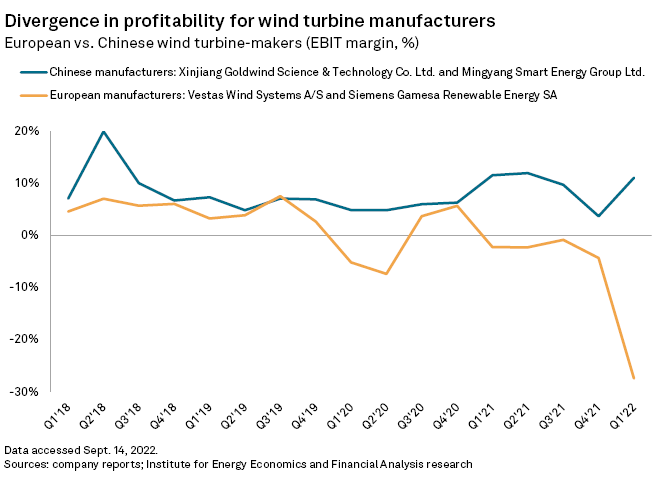

In contrast, Western manufacturers have raised their prices to long-term highs in 2022, driven by inflated raw materials costs and supply chain bottlenecks that have pushed the companies into the red.

Analysts point out that Chinese margins have held up far better than their Western peers, caveating that their ability to reproduce these margins in foreign markets remains a significant unknown.

"China has the most efficient, concentrated, and low-cost supply chain for turbine [manufacturers] in the world, and many Western companies source parts from Chinese suppliers," said Norman Waite, energy finance analyst at the Institute for Energy Economics and Financial Analysis.

That supply chain is fed by the world's largest steel industry, where prices have "barely moved" compared to those in the U.S. or Europe, Waite said in an email. The price of resin, used in turbine blades, has also "dropped significantly" in China, coming in far below Western prices, the analyst added.

Mingyang and Envision did not reply to emailed questions, while a Goldwind spokesperson simply referred to the company's investor reports and presentation materials.

Expansion challenges

Goldwind, Mingyang and Envision have accumulated nearly 10 GW of installations outside of China, according to Aaron Barr, global head of onshore wind energy research at consultancy Wood Mackenzie.

"Our analysis shows that Western Europe and the U.S. are not as attractive for overseas expansion as other parts of Asia, Middle East, Africa and Latin America," Barr said in an email.

Data from Goldwind backs up this assertion. The company's overseas order backlog stood at more than 2.7 GW by the end of June, including 1.1 GW in Asian markets outside of China, 628 MW in South America and 450 MW in Australia. The company already has 452 MW in operation outside China, along with 581 MW under construction.

In contrast, the company's European order backlog amounted to 168 MW, with just 4 MW in the U.S.

"In the short term, we do not see that the EU wind market will be [seeing] much activity [from] Chinese manufacturers," a spokesperson for German turbine-maker Nordex SE said in an email, adding that the same applies to the U.S.

Wind developers in Europe pointed to several reasons why Chinese suppliers have struggled to be relevant in mature wind markets.

A spokesperson for ABO Wind AG pointed to Europe's high standards around technology, quality specifications and grid compatibility. Meanwhile, a PNE AG spokesperson said Chinese turbines are "usually one to two development cycles older" than those from Western manufacturers.

In certain cases, however, Chinese companies are ahead technologically. Mingyang, for example, will soon bring the world's largest offshore wind turbine to market — a 16-MW giant that puts it ahead of European and U.S. rivals in terms of product scale.

'Plenty of business' at home

Analysts point to another reason for Chinese manufacturers' lack of activity overseas: They simply have not needed to look beyond their home market, which has been the world's largest for onshore wind since 2011 and is the largest for offshore wind as of 2021, according to Waite.

The country added 16.9 GW of new offshore wind capacity in 2021, Bloomberg News reported in January — more than is installed in the entire EU.

"There has been plenty of business for them to do at home so I don't think overseas expansion was prioritized," Waite said.

While China's big three suppliers have historically dominated the local wind market, an installation rush in 2020 has "reinvigorated" second- and third-tier manufacturers, who now account for about 50% of installations, according to Mukherjee.

"This has altered competitive dynamics within the mainland Chinese market and could potentially force more established local players to be more aggressive in their international expansion," the analyst added.

Mingyang already signed a memorandum of understanding with the U.K. government to build a blade manufacturing factory in the country. The company previously became the first Chinese manufacturer to supply turbines to a European offshore wind farm, delivering 10 3-MW machines to a project in Italy.

The conditions in the Chinese market, combined with their Western peers' well-documented financial and organizational difficulties, could eventually lead to greater levels of activity by Chinese turbine-makers overseas, according to Waite, especially if Chinese companies invest in local manufacturing capabilities.

"If there were ever a time for [them] to push into global markets, it is now," Waite said.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.